How to Lease Used Restaurant Equipment Without Getting Served a Lemon

Why Lease Used Equipment? The Smart Alternative to Buying New

Used restaurant equipment leasing is a financing option to acquire pre-owned commercial kitchen equipment through affordable monthly payments. Instead of paying the full price upfront, you can preserve cash flow while getting the tools needed for success.

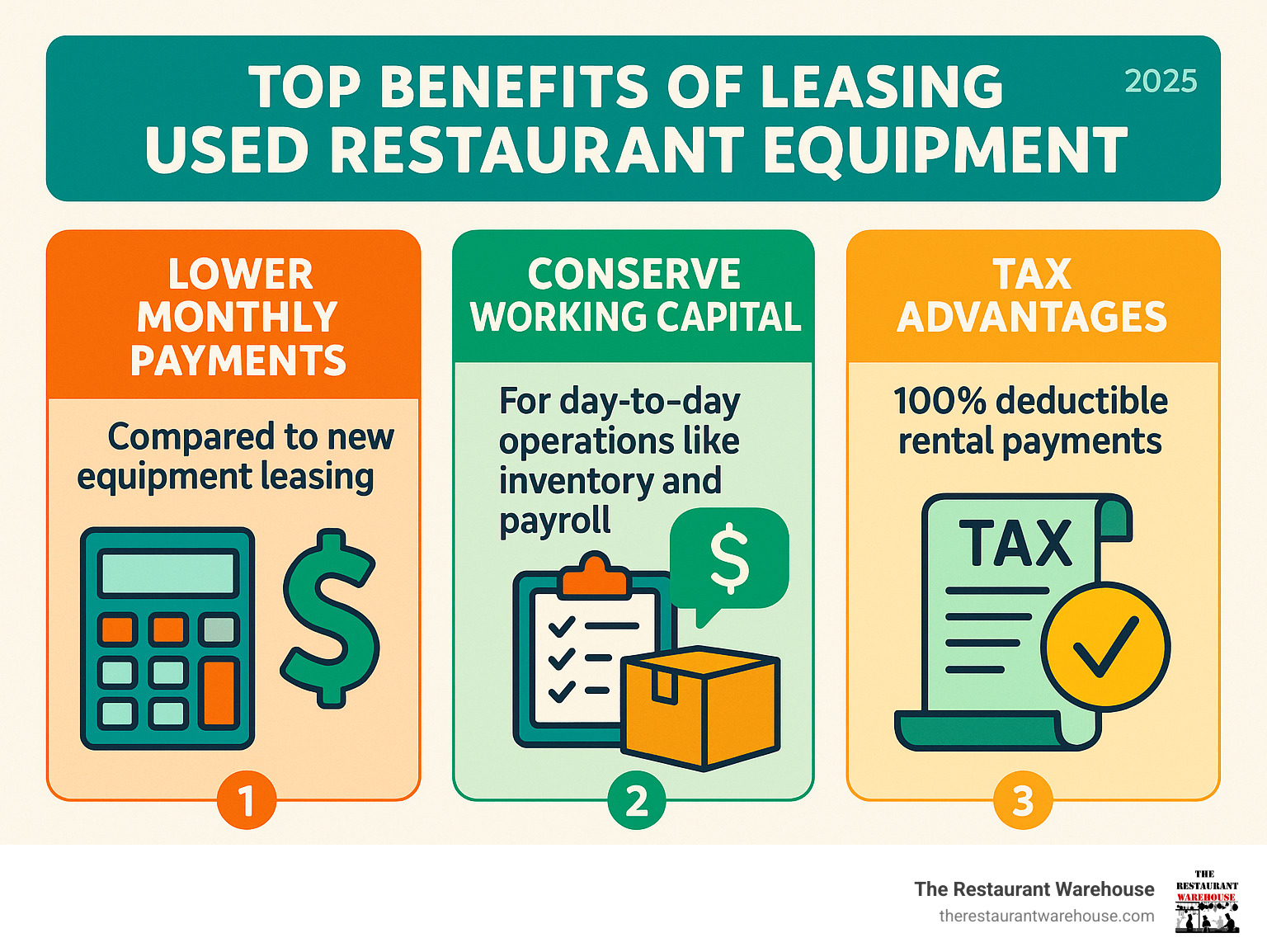

Key Benefits of Used Equipment Leasing:

- Lower monthly payments - Used equipment costs 30-50% less than new

- Preserve working capital - Keep cash available for inventory, payroll, and marketing

- 100% tax deductible rental payments

- Fast approval - Often within 24 hours for amounts up to $50,000

- Flexible terms - 12 to 60 month payment plans available

- End-of-lease options - Purchase, return, or upgrade your equipment

The math is simple: certified used equipment allows you to bank the same 70% to 80% gross profit margins as new equipment, but at a fraction of the acquisition cost. This means more money stays in your pocket for other critical business needs.

Whether launching, expanding, or replacing equipment, leasing used gear is a smart path forward. You get quality equipment, often less than 2.5 years old and with warranties, without the massive upfront cost of buying new. The process is straightforward, with most lease-to-own approvals arriving in 24 hours or less and equipment delivery within 2 to 12 business days.

Used restaurant equipment leasing terms at a glance:

Who Benefits Most from Leasing Pre-Owned Equipment?

While any restaurant can benefit, leasing pre-owned equipment is a game-changer in certain situations:

- Startups: Leasing used equipment lets you open with professional-grade gear without draining startup capital. Use that cash for inventory or payroll instead of a large equipment purchase. It's a key strategy for managing initial costs.

- Expanding Restaurants: When it's time to add a new griddle or a second fryer, leasing used equipment lets you scale up quickly without disrupting cash flow, maintaining financial agility as you grow.

- Budget-Conscious Owners: Run a lean operation by acquiring premium equipment at a fraction of the cost of new, allowing you to stay on budget while offering top-notch service.

- Businesses Testing New Concepts: A 'Rent-Try-Buy' program is perfect for testing a new menu item or pop-up that requires specialized equipment. Rent for a flexible period, try the equipment, and then decide whether to buy, continue renting, or return it. This versatility lets you adapt without a long-term commitment.

If you're looking to protect your cash flow, reduce risk, and increase flexibility, then used restaurant equipment leasing is likely your ideal partner. For more insights, check out our guide on Restaurant Equipment Leasing For Startups.

The Financial Recipe for Success: Key Benefits

Beyond cost savings, used restaurant equipment leasing offers a smorgasbord of financial benefits:

- Tax Deductions: Rental payments are often 100% tax deductible as an operating expense, which can lower your taxable income. This offers a significant advantage over purchasing, where you depreciate the asset over many years. Always consult a tax advisor for your specific situation. Learn more about how Rental payments are 100% tax deductible.

- Fixed Monthly Payments: With leasing, your payments are typically fixed for the entire term. This predictability makes budgeting and cash flow projections much simpler.

- Easier Upgrades: The restaurant industry moves fast. Leasing offers inherent flexibility, with many agreements allowing for easy upgrades so you're never stuck with outdated machinery.

- Faster Acquisition: When you need equipment fast, waiting for traditional financing isn't an option. Lease approvals often arrive in 24 hours or less, with some programs offering instant approval for up to $50,000. Used equipment can be delivered in just 2 to 12 business days.

- Building Business Credit: Consistent, on-time lease payments demonstrate financial responsibility and can help build your business's credit score over time. This can open doors to better financing opportunities in the future.

From Application to Ownership: Navigating the Used Restaurant Equipment Leasing Process

The used restaurant equipment leasing process is simpler than you might think, designed to get you the equipment you need quickly. Let's walk through the steps. For a complete overview, check out The Ultimate Guide To Restaurant Equipment Financing.

Step 1: Preparing Your Application and Documentation

Getting your paperwork ready beforehand makes the process go smoothly. Lenders will want to see that you have a well-thought-out plan.

Your business plan should clearly explain your concept, customers, and how the leased equipment fits into your strategy. Provide realistic financial projections that show where your business is headed. For guidance, see this guide on Financial projections.

Recent bank statements give lenders a look at your cash flow, showing consistency and stability. Your credit score also matters, but many lenders work with businesses that have less-than-perfect credit. For more insights, see How Hard Is It To Get A Restaurant Equipment Loan.

The typical document checklist includes an application form, financial statements, tax returns, bank statements, equipment quotes, and business registration documents. Once submitted, approvals often arrive within 24 hours.

Step 2: Understanding Lease Terms and End-of-Term Options

Used restaurant equipment leasing offers several paths, and picking the right one depends on your goals.

Lease-to-own is a popular, straightforward option. You make monthly payments for a set term (12-60 months) and own the equipment at the end for a small fee, like $1. It's ideal if you plan to keep the equipment long-term. Learn more at Restaurant Equipment Lease To Own.

Fair Market Value (FMV) leases offer end-of-term flexibility: buy the equipment at its market value, return it, or renew the lease. This is great if you anticipate needing upgrades.

$1 buyout leases are lease-to-own agreements where you pay a dollar at the end and the equipment is yours.

Lease duration typically ranges from 12 to 60 months. Longer terms mean lower monthly payments but potentially more total interest.

Many programs include upgrade options, allowing you to swap equipment during your lease if your needs change, providing a safety net for your decisions. If your lease includes a return option, the leasing company typically arranges pickup.

Step 3: Finding and Selecting Your Equipment

You can lease more than just big-ticket items. Common choices include:

- Refrigerators and freezers: Get quality commercial refrigeration at a fraction of the cost.

- Fryers and dishwashers: Lease these essential, hard-working machines to avoid tying up capital.

- Ice machines and mixers: These can be surprisingly expensive to buy new, making leasing a smart choice.

- Prep tables: Quality stainless steel surfaces are crucial for safety and efficiency.

- Bundled items: Many programs let you bundle tables and chairs, signage, and even POS systems into one lease for a single monthly payment.

The key is to prioritize the equipment that is most critical to your daily operations. For more ideas on what's available, explore options to Buy Used Restaurant Equipment.

Avoiding the 'Lemon': The Importance of Certified Used and Warranties

A common concern with used equipment is getting a "lemon." That's why choosing Certified Used equipment backed by a solid warranty is so important. It turns a potential gamble into a smart investment. For more details, see our Used Commercial Kitchen Equipment Guide.

What "Certified Used" Really Means

"Certified Used" is a promise of quality. It means equipment has undergone a rigorous process to ensure it's in excellent working condition.

Here's what the "Certified Used" process typically involves:

- Multi-Point Inspection: Technicians thoroughly inspect every component to identify wear and potential issues.

- Restoration Process: Equipment undergoes a detailed cleaning, servicing, and repair process. Worn-out parts are replaced, settings are calibrated, and the unit is tested to ensure it meets operational standards.

- Age of Equipment: Certified used equipment is often surprisingly young, typically less than 2.5 years old. Given that commercial equipment has a 5- to 10-year lifespan, this offers tremendous value.

This meticulous process ensures that when you choose used restaurant equipment leasing for certified gear, you're cutting costs without sacrificing quality. For more on this, check out Kitchen Gear On A Budget Finding Quality Used Food Equipment.

The Power of a Warranty on Pre-Owned Gear

A warranty on used equipment is a safety net for your investment, providing peace of mind that you're covered if something goes wrong.

- Meaningful Coverage: Look for warranties that last from 90 days to a full year. This is a significant benefit that protects you from unforeseen issues that might arise after you begin using the equipment.

- Parts and Labor Coverage: A good warranty covers both the replacement parts and the labor for installation, saving you from hundreds or thousands in unexpected repair costs.

- Protection Against Initial Defects: A warranty protects you against latent defects that only appear after the equipment is put to use.

- Service Response: Reputable providers with warranties have a clear process for handling service requests promptly, minimizing kitchen downtime.

Choosing used restaurant equipment leasing for certified equipment with a warranty lowers your financial risk and ensures your focus remains on serving delicious food. To keep your equipment running smoothly, check out our guide on Warm Up Your Kitchen Savings With Used Food Warmers.

Lease vs. Buy: A Head-to-Head Comparison for Your Kitchen

Choosing between leasing and buying equipment depends on your capital, cash flow, and long-term strategy. Leasing converts a large upfront expense into manageable monthly payments, preserving cash. Buying requires significant capital but provides immediate ownership. Understanding the difference is key to your restaurant's financial health.

For more context, see Should Your Restaurant Get A Restaurant Equipment Loan.

The Financial Breakdown

Here's how used restaurant equipment leasing compares to buying:

- Upfront costs: Leasing requires little to no down payment, often just the first month's payment. Buying, whether used or new, demands significant upfront capital.

- Monthly payments: Leasing involves predictable, fixed monthly payments. Buying outright has no monthly payments, but your working capital is depleted from the start.

- Total cost over time: While leasing might have a higher total cost over the full term, buying used can come with unexpected repair costs that eat into any initial savings.

- Tax benefits: Lease payments are often 100% tax deductible as an operating expense. When you buy, you typically depreciate the asset over several years, offering a less immediate tax benefit.

- Flexibility: Leasing allows you to upgrade, return, or buy the equipment at the end of the term. If you own it, you're responsible for selling or disposing of it.

- Cash flow preservation: This is leasing's biggest advantage. It keeps your working capital free for daily expenses. Understanding your capital expenses shows how leasing turns a large purchase into a manageable operating cost.

Making the Right Choice for Your Business Model

The "perfect" choice doesn't exist – only the right choice for your specific situation. Here's when each approach makes the most sense.

When to choose used restaurant equipment leasing:

- Startups and expansions: Preserve working capital for inventory, staff, and marketing.

- Testing new concepts: Use 'Rent-Try-Buy' programs to try specialized equipment without a long-term commitment.

- Valuing flexibility: Easily upgrade to newer, more efficient technology as the industry evolves.

When to buy used equipment outright:

- If you have substantial cash reserves and the purchase won't impact your liquidity.

- When you're confident you'll use the equipment for its entire lifespan and don't anticipate needing upgrades.

When to buy new equipment:

- If you have significant capital and want the latest technology with full manufacturer warranties.

For most restaurants, especially those growing or managing tight budgets, used restaurant equipment leasing offers the best balance of affordability, quality, and flexibility. For more insights, explore Obtaining Restaurant Equipment Through A Lease Agreement.

Frequently Asked Questions About Used Equipment Leases

Let's clear up some of the most common questions about used restaurant equipment leasing so you can make informed decisions with confidence.

What types of businesses might not be eligible for used equipment leasing?

While leasing is accessible, some factors can make approval challenging:

- Poor credit history: A low business or personal credit score is a primary hurdle, though some providers specialize in financing for those with credit challenges. See our guide on Restaurant Equipment Financing Bad Credit.

- Lack of a solid business plan: Lenders need to see a clear path to profitability to ensure you can make payments.

- Very new businesses: Some lenders may require a minimum operating history or substantial initial funding.

Working with a company that specializes in the restaurant industry is key, as they understand your unique challenges.

How quickly can I get approved and receive my equipment?

Approval times are impressively quick. Many lease-to-own approvals arrive in 24 hours or less, and some 'Rent-Try-Buy' programs offer instant approval for up to $50,000. This gives you immediate insight into your potential costs.

Delivery times are equally speedy. Once you're approved and the paperwork is complete, used equipment can typically be delivered within 2 to 12 business days. This means minimal downtime for your kitchen.

This efficiency is a game-changer for restaurant owners. For more details, check out our Lease Commercial Kitchen Equipment Guide.

Can I lease smallwares and furniture, or only large appliances?

The scope of leasing is broader than most people realize. Beyond large appliances, you can often include digital menu boards, tables and chairs, signage, exhaust systems, and POS systems.

Lease bundling is a convenient feature that allows you to combine equipment, furniture, and even installation costs into one manageable monthly payment. This simplifies your accounting and is especially valuable for new restaurants or renovations.

The ability to bundle everything from major equipment to smaller essentials makes used restaurant equipment leasing a comprehensive solution. Explore more options for Used Restaurant Equipment to see what's available.

Equip Your Kitchen for Less and Start Cooking Up Profits

Choosing used restaurant equipment leasing is a smart financial strategy that offers real advantages. You preserve precious cash flow, benefit from tax-deductible payments, and gain the flexibility to upgrade as your business evolves. This isn't about settling. With certified used equipment, often less than 2.5 years old and backed by warranties, you get reliable, professionally serviced gear at a fraction of the cost of new.

At The Restaurant Warehouse, we cut out high commissions and retail overhead to bring you wholesale pricing on quality equipment. We believe every restaurant owner deserves access to affordable, reliable solutions.

Don't let budget constraints hold you back. With used restaurant equipment leasing, you can equip your kitchen with professional-grade gear, maintain healthy cash flow, and focus on what you do best: creating amazing food.

Ready to take the next step? Explore your financing options and get the equipment you need to start cooking up profits today.

About The Author

Sean Kearney

Sean Kearney is the Founder of The Restaurant Warehouse, with 15 years of experience in the restaurant equipment industry and more than 30 years in ecommerce, beginning with Amazon.com. As an equipment distributor and supplier, Sean helps restaurant owners make confident purchasing decisions through clear pricing, practical guidance, and a more transparent online buying experience.

Connect with Sean on LinkedIn, Instagram, YouTube, or Facebook.

Leave a comment