Guide to restaurant equipment financing for startups: A Startup's Path

That state-of-the-art oven and walk-in cooler are within reach, but the initial price tag can feel like an impossible roadblock for a new venture. This is the core challenge every restaurant startup faces when dreaming big. Smart restaurant equipment financing is the key to unlocking your culinary vision without exhausting your precious startup capital before you even open your doors.

Launching Your Dream Kitchen Without Draining Your Capital

Think of your startup capital as the fuel for your restaurant's engine. You need enough to cover not just the initial build-out but also the long journey ahead—payroll, inventory, marketing, and those inevitable unexpected repairs. Paying cash upfront for every single piece of equipment is like burning most of your fuel while you're still on the launchpad. It’s a risky move that can leave you vulnerable.

This is where restaurant equipment financing for startups completely changes the game. It lets you get all the essential, high-quality gear you need with predictable monthly payments. Instead of one massive, crippling expense, you have a manageable operational cost. This simple shift in strategy preserves your cash reserves for the daily costs that actually keep your business humming.

Protecting Your Most Vital Resource

For any startup, cash flow isn't just important—it's everything. Financing transforms a huge, capital-intensive purchase into a regular operating expense, and that strategic move gives you a few immediate advantages that are crucial for survival and growth.

- Preserves Liquidity: Keep your cash on hand for inventory, payroll, and those big marketing pushes.

- Enables Quality: You can get top-tier, reliable equipment from day one instead of settling for less.

- Builds Business Credit: Making on-time payments helps establish a positive credit history for your new venture.

Beyond just the equipment itself, launching your kitchen also means navigating the legalities of securing your commercial kitchen space through a lease agreement. Both financing and smart leasing are tools that protect your capital for what matters most: running your business.

Financing empowers you to equip your kitchen for success, not just for survival. It's the difference between starting your business on a solid financial foundation versus scrambling from day one.

Imagine launching your dream café without draining your savings on that essential commercial refrigeration unit—financing makes that possible. Startups can often qualify even with a limited track record, though they should be prepared for rates in the 12-20% range and may need a down payment of 20-30%. Lenders will lean heavily on your personal credit score and a solid business plan to gauge the risk. You can take a deeper dive into the benefits of restaurant equipment financing to see how it could fit into your own strategy.

Choosing Your Best Financing Path

Think of financing options like a menu designed to fit your startup's specific appetite for growth, risk, and ownership. Navigating the world of restaurant equipment financing for startups means matching the right funding "dish" to your unique business goals. Just as you wouldn't serve a steak to a vegetarian, you shouldn't pick a financing option that doesn't align with your financial reality and long-term vision.

We'll walk through the most common choices on the table, explaining who they're best for and why. This isn't about finding a one-size-fits-all solution; it's about making a smart, informed decision that strengthens your new restaurant right from the get-go.

The Classic Entrée: Equipment Loans

An equipment loan is the most traditional path to ownership. It's incredibly straightforward: a lender gives you a lump sum to buy your equipment, and you pay it back in fixed monthly installments over a set term. Once you make that final payment, the equipment is yours, free and clear.

This option is perfect for the foundational, long-lasting workhorses of your kitchen—the pieces you know you'll be using for a decade or more.

- Best for: Stainless steel worktables, walk-in coolers, and heavy-duty commercial ovens.

- Key Advantage: You build equity with every single payment and can take advantage of tax deductions like Section 179.

- Consideration: This route usually requires a higher down payment and a stronger credit profile, which can sometimes be a hurdle for brand-new startups.

The Flexible Tasting Menu: Equipment Leases

If an equipment loan is all about ownership, an equipment lease is all about access and flexibility. With a lease, you pay a monthly fee to use the equipment for a specific period. At the end of the term, you usually have the choice to return it, upgrade to a newer model, or purchase it.

Leasing is basically the "tasting menu" for startups. It offers lower upfront costs and smaller monthly payments, which preserves your precious cash for everything else—payroll, marketing, inventory, you name it. This makes it an excellent strategy for acquiring technology that evolves quickly or for testing a concept without a massive capital commitment. For startups, a comprehensive guide to relevant topics like “Capital Raising for Small Businesses” can provide broader context on securing funds.

For a startup, leasing is a strategic move to conserve capital. It allows you to get a fully functional, high-end kitchen running while keeping your cash reserves liquid for payroll, marketing, and inventory.

The Prix Fixe Meal: SBA Loans

SBA loans, backed by the U.S. Small Business Administration, are like a gourmet prix fixe meal: they offer fantastic value with favorable terms and low interest rates, but you have to be patient. These loans are highly sought after because they reduce the lender's risk, making them more willing to work with new businesses.

The application process is notoriously thorough and can take weeks, or even months, to get through. But for a startup with a rock-solid business plan and the time to wait, the long-term savings can be substantial. For an even more detailed breakdown of this option, our guide on restaurant equipment leasing for startups offers valuable perspectives.

The Chef's Special: Vendor Financing

Vendor financing is the "chef's special" offered directly from the equipment supplier. Companies like The Restaurant Warehouse provide in-house financing and lease-to-own programs, creating a seamless one-stop-shop experience. You select your equipment and arrange the funding all in the same place.

This is often the fastest and most convenient path for a startup. Because the vendor understands both the equipment and the industry, the approval process can be much quicker and more straightforward than with a traditional bank. It's designed for speed, helping you get your kitchen up and running without delay.

Comparing Financing Options: Lease vs. Loan

Deciding between leasing and buying can feel tricky, so let's break it down side-by-side. Seeing the key differences laid out clearly can help you quickly pinpoint which path aligns better with your startup's financial situation and long-term goals.

| Feature | Equipment Lease | Equipment Loan |

|---|---|---|

| Upfront Cost | Typically low, often just the first and last month's payment. | Requires a significant down payment, usually 10-20% of the cost. |

| Ownership | You don't own the equipment. Options to buy at term end. | You own the equipment from day one and build equity. |

| Monthly Payments | Generally lower than loan payments. | Higher payments, as you're paying off the full asset value. |

| Flexibility | High. Easy to upgrade to new models at the end of the lease. | Lower. You're committed to the equipment you purchased. |

| Tax Implications | Lease payments are often fully deductible as operating expenses. | You can deduct interest and depreciate the asset (e.g., Section 179). |

| Best For... | Startups preserving cash, tech that becomes obsolete quickly. | Established businesses, long-lasting foundational equipment. |

Ultimately, neither option is universally "better"—it's all about what's better for you. If conserving cash is your top priority and you want the flexibility to upgrade, a lease is a fantastic tool. But if you're buying a piece of equipment that will be the heart of your kitchen for the next 15 years, building equity through a loan makes a lot of sense.

What Lenders Are Really Looking For

Trying to get equipment financing for a new restaurant can feel like you're solving a puzzle with half the pieces missing. You don't have a business history to show, so what can you possibly give a lender? Here's the secret: they aren't looking for a perfect track record. They're looking for a believable story. They just need to feel confident that you can handle the payments and run a successful restaurant.

For a brand-new concept, the main character in that story is you. Without years of sales data or business tax returns to look at, lenders lean heavily on your personal financial health to gauge how reliable you are. Your personal credit score is the first and most important clue they have about how you manage your financial commitments.

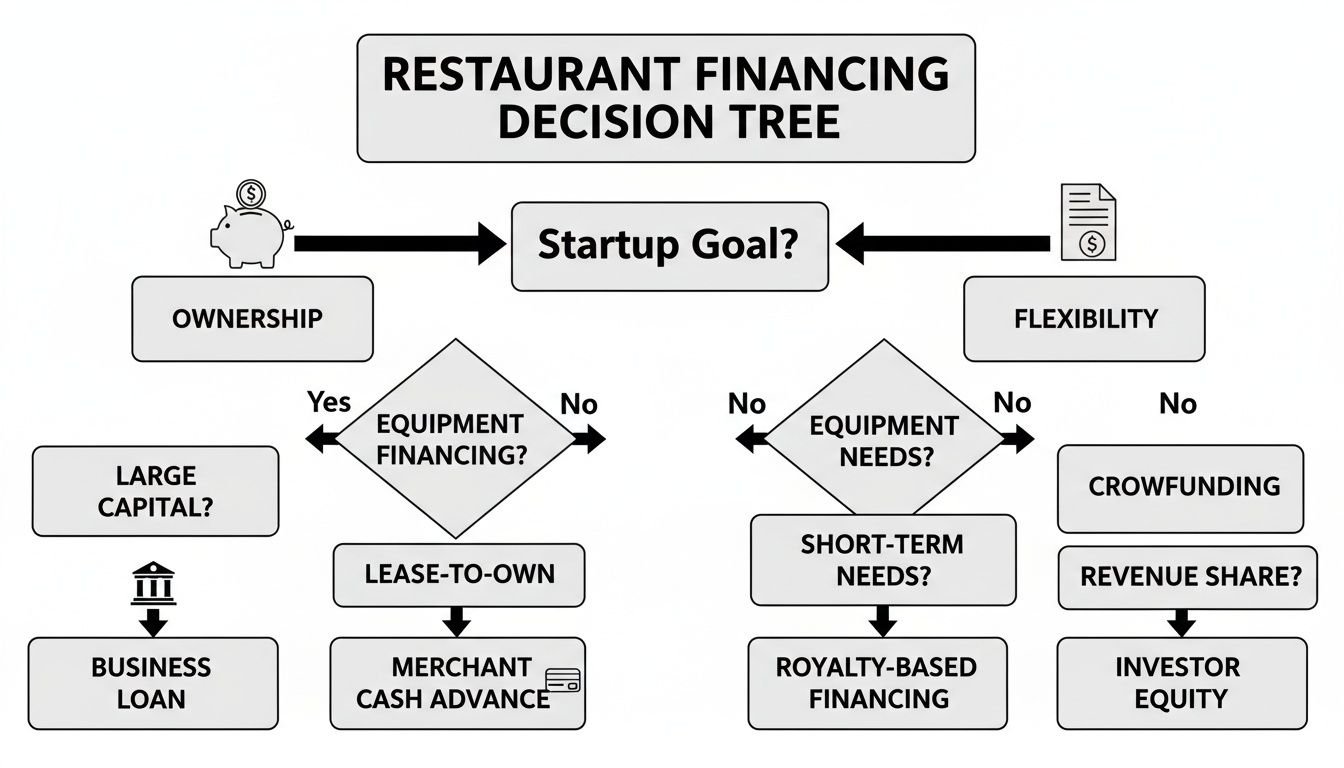

This decision tree helps visualize the big choice you'll face: do you want to own the equipment for the long haul, or do you need the flexibility of a lease?

As you can see, the path of a loan leads straight to ownership, while leasing prioritizes lower initial costs and the freedom to adapt your kitchen down the road.

Building a Case Beyond Your Credit Score

A solid personal credit score—ideally 650 or higher—is your ticket in the door, but it doesn't automatically get you the loan. Lenders also need to believe in your vision and your ability to actually pull it off. This is where a killer business plan becomes your most powerful tool.

Your business plan is the script that lays out your restaurant's future success. It has to be more than just a great idea; it needs to be a detailed roadmap showing exactly how you'll make money. Lenders will zoom in on your financial projections, hunting for realistic revenue forecasts and a clear grasp of your costs. If you're not sure where to start, our detailed guide on how to write a restaurant business plan that lenders love is a great resource.

On top of the numbers, your personal experience in the restaurant industry adds a massive layer of credibility. Have you worked as a chef, a manager, or even a server? This hands-on experience proves you get the unique grind of the foodservice world, which seriously lowers the lender's perceived risk.

The Essential Document Checklist

When you're ready to make your move, lenders will ask for a specific set of documents to back up your story. Getting these papers in order ahead of time shows you're serious and professional, which can speed up the whole approval process.

- Personal Financial Statement: This is just a snapshot of your personal assets and liabilities.

- Recent Bank Statements: Lenders typically want to see the last 3-6 months to check for consistent deposits and responsible cash flow.

- Equipment Quote or Invoice: You'll need a detailed list of the equipment you want to finance, including the total cost from a supplier like The Restaurant Warehouse.

- Business Plan Summary: A quick, one-page overview of your restaurant concept, target market, and financial projections.

Having this packet ready to go helps the underwriter see the full picture, moving your application from a "maybe" to a "yes."

A lender's decision boils down to a simple formula: Trust + Viability = Approval. Your credit score builds their trust, and your business plan proves your viability. Nail both, and you’re in a great position to get funded.

Why Your Bank Account Tells a Story

For startups, consistent bank deposits, clear equipment invoices, and minimal overdrafts are often enough to get an approval. Unstable cash flow is an approval-killer, so a clean bank history is huge. The equipment finance world is booming, with projections showing it'll grow to $3.1 trillion by 2032. This is partly thanks to flexible, short-term leases that are perfect for seasonal businesses like coffee shops or food trucks.

Finally, showing you have some skin in the game with a down payment can dramatically improve your odds. It proves your personal commitment to the venture and lowers the lender's overall risk, making your application that much more appealing.

Decoding the Fine Print of Your Financing Deal

The monthly payment is what everyone focuses on, but it’s only one part of the story. To really get a handle on the deal you’re being offered, you need to look past that single number and translate the financial jargon into the real-world cost. The true cost of restaurant equipment financing for startups is a mix of the interest rate, how long you have to pay it back, and any fees tucked into the agreement.

Think of it like choosing ingredients for a recipe. The interest rate is the cost of your main ingredient, but other factors—like the length of time you cook it (the term)—can completely change the final dish. A low monthly payment spread over a really long term might look tempting, but it could end up costing you thousands more in total interest.

The global equipment financing market is booming, which is great news for new restaurants. Savvy startups are using this trend to bypass cash crunches for everything from kitchen shelving to chef wear. For food truck owners or caterers, this means getting that essential reach-in freezer with a lease-to-own plan is more accessible than ever, even if it requires a 20-30% upfront payment. You can find more details on these equipment financing trends and their impact.

Putting the Numbers into Practice

Let's make this real with a tangible example. Imagine you need a $50,000 kitchen package—an oven, a walk-in cooler, prep tables, and a commercial mixer. The terms you get can vary dramatically based on your startup’s financial profile.

- Scenario A (Strong Profile): You’ve got a 720 personal credit score and a solid, well-thought-out business plan. A lender offers you a 5-year (60-month) loan at an 8% interest rate.

- Scenario B (Weaker Profile): Your credit score is sitting at 640, and your business plan has a few holes. The best offer you can find is a 5-year (60-month) loan at a 15% interest rate.

Here's how those numbers actually play out:

| Metric | Scenario A (Strong Profile) | Scenario B (Weaker Profile) |

|---|---|---|

| Loan Amount | $50,000 | $50,000 |

| Interest Rate | 8% | 15% |

| Monthly Payment | ~$1,014 | ~$1,190 |

| Total Interest Paid | ~$10,820 | ~$21,370 |

| Total Cost | $60,820 | $71,370 |

In this case, a stronger credit profile saves you over $10,500 in interest alone. It’s a powerful reminder of why preparing your application and strengthening your financial standing beforehand pays off big time.

The Power of Tax Incentives

Beyond the loan terms, there are powerful tools that can dramatically lower the net cost of your equipment. The most important one for restaurant owners is Section 179 of the IRS tax code.

Section 179 allows you to deduct the full purchase price of qualifying new or used equipment from your gross income in the year it was placed into service. This is a massive tax advantage designed to encourage small businesses to invest in themselves.

Instead of depreciating the asset over several years, you get the entire tax benefit upfront. For our $50,000 equipment package, you could potentially deduct the full amount from your taxable income. Depending on your tax bracket, this could result in thousands of dollars in tax savings, effectively knocking down the true cost of your financing deal.

Of course, you should always consult a tax professional to see exactly how this applies to your specific situation.

How We Make Funding Your Restaurant Simple

Trying to get a loan from a traditional bank can feel like a slow, painful process for any business. For a restaurant startup with no sales history? It can be downright impossible. That's exactly why we shifted from being just another equipment supplier to being your dedicated launch partner. We built our restaurant equipment financing for startups programs to cut right through all that red tape because we know that what you need most is speed and simplicity.

Our whole approach is designed for the real-world demands of opening a restaurant. We’ve created a single, unified experience where you can pick out every piece of equipment for your dream kitchen and get the funding for it at the same time. This gets rid of the frustrating back-and-forth between suppliers and third-party lenders, saving you precious time that’s better spent perfecting your menu, not drowning in paperwork.

One-Stop Sourcing and Funding

Imagine this: you select your perfect commercial oven, walk-in cooler, and prep stations, and then move straight to a simple funding application—all in the same day. That’s the core of what we do.

- Simple Application: Our process is straightforward and built for speed. We often require far less documentation than a traditional bank.

- Quick Approvals: We get that you need to open your doors yesterday. Approvals can often be secured in as little as 24 hours, which means your equipment gets shipped out faster.

- Industry Expertise: Because we know this equipment inside and out, our financing decisions are more practical and built around what your specific restaurant actually needs.

This integrated system means you're not just buying equipment; you're investing in a process designed to get your kitchen up and running with as little friction as possible.

Your Path to Ownership with Lease-to-Own

For most startups, hanging onto cash is the number one priority. Our very popular lease-to-own program is the perfect answer. It lets you get all the equipment you need with very little money down while still giving you a clear, direct path to owning it all outright.

Our lease-to-own option is a strategic tool for managing startup capital. It combines the low upfront cost of a lease with the long-term benefit of ownership, giving new restaurants the best of both worlds.

This structure helps you manage your budget with predictable monthly payments. When you finance top-tier brands like Atosa and True through us, you’re investing in reliability and efficiency from day one. We’ve even designed industry-specific programs, like bundling financing with discounted True freezers or Atosa ovens, to help you scale quickly.

High-performing hospitality groups often use a hybrid strategy—they’ll buy passive assets like prep tables outright while leasing tech-heavy gear to maximize their ROI. You can find more insights on smart equipment sourcing over at rongroupglobal.com.

Common Questions About Startup Equipment Financing

Jumping into equipment financing for the first time? It's totally normal to have a ton of questions. Getting straight answers is the only way to move forward with confidence, so let's tackle some of the most common things new restaurant owners ask.

Think of this as a quick-fire round to clear up the hurdles you're probably facing right now.

Can I Get Financing with a Poor Credit Score?

A less-than-perfect credit score is a common roadblock, but it’s definitely not a dealbreaker. While a score below 650 will make things tougher with traditional banks, you absolutely still have options.

Alternative lenders and vendor financing programs are usually more flexible. They tend to look at the bigger picture, not just a single number. One of the best ways to boost your chances is to bring in a co-signer who has a strong credit profile. For a lender, this adds an extra layer of security and can seriously improve your odds of getting that approval.

What Is the Difference Between a Lease Buyout?

When your lease term is up, you’ll have a decision to make about what happens to the equipment. This is your "buyout," and the terms you agree to at the start will make a big difference in your total cost.

- Fair Market Value (FMV) Lease: This is your flexible option. You get lower monthly payments, and at the end of the term, you can buy the equipment for whatever it’s worth at that time. It's a great choice if you think you might want to upgrade to newer tech in a few years.

- $1 Buyout Lease: This is pretty much a lease-to-own plan. The monthly payments are a bit higher, but once the term is over, you own the equipment for a single dollar. This makes a ton of sense for foundational pieces you know you'll need for years to come, like a walk-in cooler or a range.

How Long Does Approval Take?

The waiting game for approval can vary wildly, and for a startup, every day counts.

A traditional loan from a bank or an SBA loan can feel like it takes forever—we’re talking weeks or even months of underwriting. On the other hand, vendor financing or working with an online lender can get you an answer in just 24 to 48 hours. That means you can get your kitchen gear ordered and on its way much, much faster.

Is Financing Used Equipment a Good Idea?

Absolutely. Financing isn’t just for brand-new equipment still in the plastic wrap. Lots of lenders are perfectly happy to finance used equipment, which can be a brilliant move for a startup trying to make every dollar count.

The key is to source your used equipment from a reputable dealer who can vouch for its condition. The financing terms might be a little different—maybe a shorter repayment period—but the thousands you save on the initial purchase can be redirected to other critical startup costs, like marketing or your first big inventory order.

At The Restaurant Warehouse, we know exactly what startups are up against. Our financing and lease-to-own programs are built to be fast and simple, getting you the quality equipment you need to bring your dream kitchen to life. Ready to get started? Explore our funding options at https://therestaurantwarehouse.com.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment