Equipment Financing Restaurant: Your Complete Guide to Kitchen Growth

Equipment financing is a smart move for getting the kitchen gear you need without draining your bank account. It’s not just another loan; think of it as a tool that lets you grab that state-of-the-art oven or walk-in cooler now by making simple monthly payments. This keeps your cash free for the daily grind, like making payroll and stocking up on ingredients.

The Smart Way to Fund Your Dream Kitchen

Outfitting a restaurant is easily one of the biggest checks you'll write. Sinking thousands of dollars into equipment that starts losing value the moment it's installed is an old-school strategy that can starve your business of the cash it needs to actually grow. Smart restaurant equipment financing completely flips that script, turning a massive one-time expense into a predictable, manageable operating cost.

Think of it as your competitive edge. Instead of waiting months or years to save up, you can get efficient, modern equipment right now. That means you can start improving your menu, speeding up service, and cutting down on energy costs immediately. It leaves your cash on hand for what really matters day-to-day: buying top-notch ingredients, paying your talented crew, and running marketing that gets more people in the door.

Financing as a Growth Engine

Financing isn’t just a lifeline for startups or a fix for emergencies—it’s a core part of any smart growth plan. While getting the funds is one piece of the puzzle, it's just as important to see how this fits into your larger comprehensive small business growth strategies to make sure you're set up for the long haul.

The market has shifted to support this. The global equipment finance industry is expected to hit a staggering $3.1 trillion by 2032, with options specifically built for the unique cycles of the restaurant business. Lenders now structure financing around replacing key equipment every 3–7 years, a much more realistic timeline than the old 10–15 year model.

Your Restaurant Financing Options at a Glance

So, how do you actually do it? Your two main paths are getting a loan or signing a lease, and each has its own perks. A loan helps you build equity and eventually own the equipment free and clear, making it a true asset. A lease, on the other hand, usually means lower monthly payments and gives you the flexibility to upgrade to newer tech down the road.

Getting a handle on these differences is the first step. You can dig deeper into the core benefits of restaurant equipment financing in our detailed guide to see which approach feels right for you.

To help you get started, we put together a simple table that breaks down the most common financing options at a high level. Use this to quickly compare solutions and see which one aligns with your business goals.

Your Restaurant Financing Options at a Glance

| Financing Type | Best For | Typical Term |

|---|---|---|

| Equipment Loan | Building long-term equity and owning core assets like walk-in coolers. | 3–7 Years |

| Equipment Lease | Lower monthly payments and upgrading technology like POS systems. | 2–5 Years |

| Lease-to-Own | Testing equipment before committing or for owners with lower credit. | 1–3 Years |

| SBA Loan | Established restaurants seeking favorable rates for major expansions. | 7–10 Years |

Choosing the right option really depends on your long-term vision. Do you want to own your workhorse equipment for the next decade, or do you need the flexibility to swap out your point-of-sale system every few years? Thinking through these goals will point you toward the best financial tool for the job.

Choosing the Right Financing Path for Your Restaurant

Stepping into the world of restaurant equipment financing can feel a bit like staring at a menu with way too many options. You’ve got loans, leases, lines of credit… what’s the difference?

Each one serves a different purpose, kind of like how a six-burner range and a combi oven both cook food but in totally different ways. The real key isn’t just knowing the definitions; it’s about understanding which path aligns with your restaurant’s unique goals. Are you trying to build long-term value, or do you need maximum flexibility to adapt on the fly?

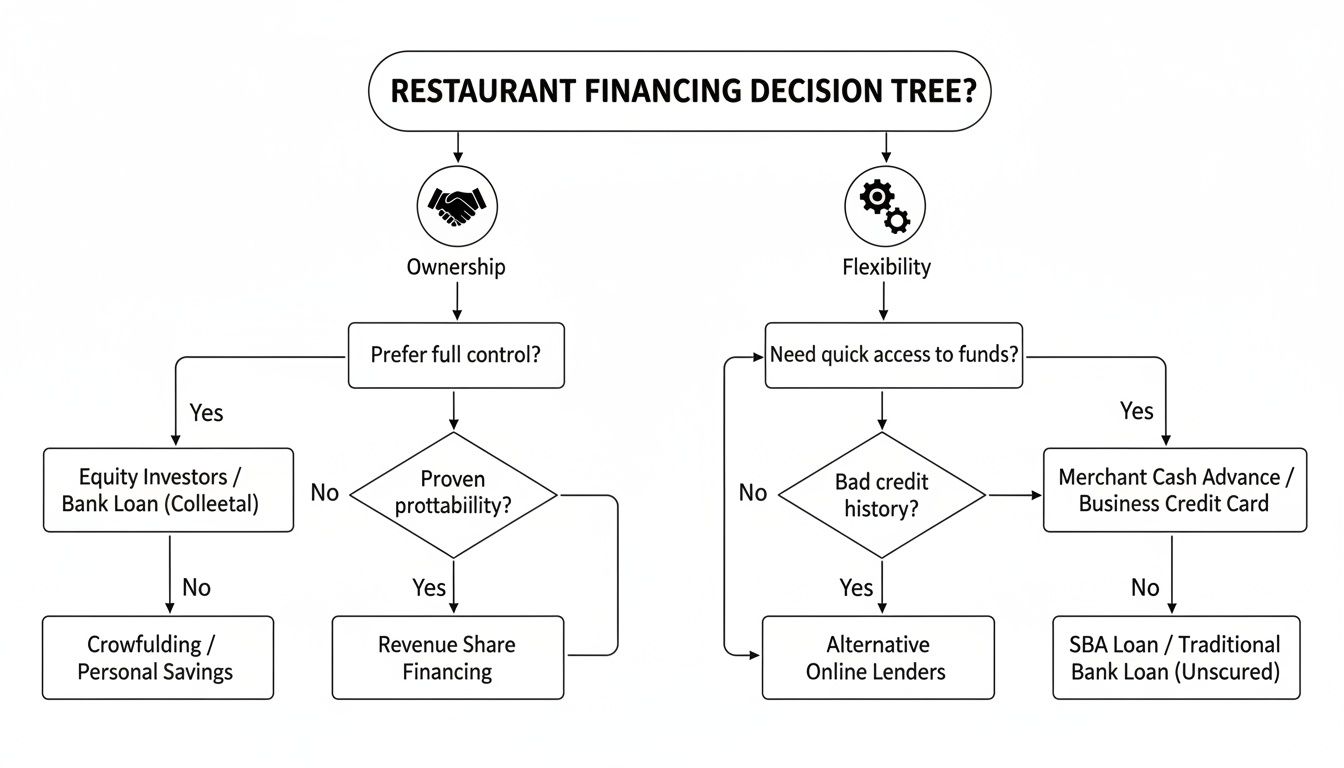

To help you figure it out, this chart breaks down the core choice between ownership and flexibility.

As you can see, your main goal—either owning the asset for the long haul or staying nimble—is the biggest factor guiding you to the right type of financing.

The Ownership Route: Equipment Loans and SBA Loans

If your goal is to own your gear outright, these are your go-to options.

Equipment Loans are the most traditional path. Think of it like a mortgage for your kitchen; you make regular payments, and at the end of the term, that walk-in cooler or six-burner range is 100% yours. This is the perfect route for foundational, long-lasting equipment that forms the backbone of your kitchen.

- Who is this for? Established restaurants with steady cash flow that want to build equity in their assets. It’s ideal for the workhorse equipment you plan on using for the next 7-10 years.

- What to expect: You’ll probably need a decent credit score (often 650+) and some time in business. The good news? The equipment itself acts as collateral, which can make these loans a bit easier to get than other types of business funding.

SBA Loans, which are backed by the U.S. Small Business Administration, are another powerful choice for ownership. The application process is definitely more intensive, but they offer some of the best interest rates and longest repayment terms you can find. This makes them a fantastic option for large-scale equipment purchases or a full kitchen build-out.

The Flexibility Route: Equipment Leases and Lease-to-Own

Sometimes, owning isn't the goal. Maybe you want the latest tech without the long-term commitment.

An Equipment Lease is a lot like renting an apartment instead of buying a house. You get to use top-of-the-line equipment for a set period, and your monthly payments are usually lower than a loan. When the lease is up, you often have the choice to upgrade to the newest model, buy out the equipment, or just return it.

Leases are a secret weapon for technology-driven equipment like combi ovens or advanced POS systems that become outdated quickly. It keeps you from getting stuck with aging assets and preserves your cash for payroll, inventory, and other day-to-day needs.

A Lease-to-Own agreement is the hybrid model—the best of both worlds. It gives you the low entry cost of a lease but with a clear path to owning the equipment at the end of the term. This is a great choice for startups or businesses with less-than-perfect credit who want to try out equipment before committing to a full purchase. For a closer look, check out our guide on restaurant equipment leasing for start-ups.

Options for Immediate or Ongoing Needs

What if your financing needs aren't tied to one specific piece of equipment? That’s where these more versatile tools come into play.

A Business Line of Credit acts like a credit card for your business. It’s a revolving fund you can draw from whenever you need it. This is perfect for covering a string of smaller purchases, handling unexpected repairs, or stocking up for a seasonal rush. You only pay interest on what you actually use, making it a super cost-effective safety net.

A Merchant Cash Advance (MCA) is another option that provides a lump sum of cash in exchange for a slice of your future credit card sales. While it’s one of the fastest ways to get funding, it's also the most expensive by a long shot. An MCA is best saved for true emergencies when you need cash yesterday and have already exhausted all the more affordable routes.

Breaking Down the True Cost of Your Equipment

When you’re looking at financing new equipment for your restaurant, it’s all too easy to fixate on the price tag of that shiny new oven or walk-in cooler. But the real story—the number that truly matters for your business—is the total cost of the financing itself. Nailing this down is the key to making a smart financial move that will support your restaurant for years to come.

Think of it like a customer's check at your restaurant. The equipment price is the main course, but the interest rate is the bar tab, extra fees are the service charge, and the term length is how long they linger over dessert. Each element changes the final bill.

The Key Ingredients of Your Financing Cost

Your total financing cost is really a blend of a few critical factors. Getting a handle on how they work together will help you see the bigger picture, moving beyond just the monthly payment.

- Interest Rate: This is simply the percentage the lender charges for loaning you the money. The lower the rate, the less you'll pay in the long run.

- Term Length: This is how long you have to pay back the loan or lease, usually somewhere between 24 to 84 months. A longer term means a smaller monthly payment, but you'll end up paying more in total interest over the life of the agreement.

- Down Payment: This is the cash you put down upfront. A larger down payment reduces the total amount you need to borrow, which can lower both your monthly bill and your overall interest charges.

These pieces of the puzzle directly shape your short-term cash flow and your long-term expenses. The goal is always to find a balance that your restaurant can manage comfortably. Understanding your potential kitchen costs, like the average cost of a kitchen renovation, can also give you a broader financial perspective as you plan your equipment investment.

Real-World Repayment Examples

Let's make this real. Say you need a $15,000 commercial refrigerator. Here’s a look at how two different financing paths could play out, highlighting that classic trade-off between monthly affordability and total cost.

This simplified comparison shows how different financing structures impact your monthly payment and total cost for the same piece of essential equipment.

Financing a $15,000 Commercial Refrigerator Two Ways

| Financing Option | Interest Rate / Factor | Term Length | Estimated Monthly Payment | Total Cost |

|---|---|---|---|---|

| Short-Term Loan | 8% APR | 36 Months | ~$470 | $16,920 |

| Long-Term Lease | 12% APR | 60 Months | ~$334 | $20,040 |

Key Takeaway: A shorter-term loan often saves you a good chunk of money in the long run, even with the higher monthly payments. On the flip side, a longer-term lease frees up more cash month-to-month but ultimately costs more. There's no single "right" answer—it all comes down to your business's immediate cash flow needs and your long-term financial goals.

As the table shows, the long-term lease has a much lower monthly payment, which might be the perfect fit for a new restaurant trying to protect its cash flow. However, it ends up costing over $3,000 more over the life of the agreement. The short-term loan requires a bigger monthly commitment but saves you money overall, making it a great choice for an established business with stable revenue.

Want a more personalized look at your own numbers? You can easily calculate your costs before cooking with a restaurant equipment finance calculator to play with different scenarios and find what works best for your situation.

Navigating the Financing Application Process

Applying for restaurant equipment financing can feel a bit like prepping for a surprise health inspection—a little intense, a little stressful. But just like a perfectly organized kitchen, a well-prepared application makes everything run smoother and seriously boosts your chances of getting a "yes."

Think of it like your financial mise en place. The more you prep all your documents and information upfront, the faster and cleaner the final funding process will be. Let's break it down into a clear, step-by-step game plan so you can walk into any lender's office (virtual or otherwise) with total confidence.

Stage 1: Gather Your Essential Documents

Before you even think about filling out a single form, your first move is to get all your paperwork in order. Lenders need a clear snapshot of your restaurant's financial health to feel good about funding you. Having everything ready to go shows them you’re a serious, organized operator.

Honestly, this is the most important part of the whole process. Getting your documents together now means you can respond to requests instantly and avoid delays that could cost you a great deal on a piece of equipment.

An organized application package does more than just provide data; it builds trust. It tells a lender you’re a detail-oriented owner who knows their business inside and out, which immediately lowers their perceived risk.

Here’s a look at the core items pretty much every lender is going to ask for.

The Financing Application Checklist

Think of this as your prep list. Make sure you have these items ready to go when you're seeking equipment financing restaurant funding.

- A Solid Business Plan: This is your restaurant's story. It needs to cover your concept, your target customers, and most importantly, exactly how this new equipment is going to help you make more money.

- Recent Financial Statements: Lenders will typically want to see 2-3 years of your profit and loss (P&L) statements, balance sheets, and cash flow statements. This is how they gauge your financial stability.

- Bank Statements: Have 3-6 months of your most recent business bank statements handy. This helps them verify your monthly revenue and see your cash flow in action.

- Business and Personal Tax Returns: Be ready to share at least two years of returns to paint a complete financial picture.

- Equipment Quote: You'll need an official quote from your supplier that details the make, model, and total cost of the equipment you want to buy.

Stage 2: Submit and Await Review

Once your documents are all lined up, you’re ready to submit your application. With most modern lenders that specialize in equipment financing, this is a pretty straightforward online form.

After you hit "submit," the lender starts their underwriting process. They’ll dig into your financials, check your credit history, and assess the value of the equipment itself. A huge plus here is that the equipment you’re financing usually serves as its own collateral. This asset-backed approach makes the deal less risky for the lender, which often translates to a faster approval with less paperwork than a traditional bank loan.

Stage 3: Get Your Offer and Get Funded

If your application gets the green light, the lender will send over a formal offer. This document will clearly lay out the loan amount, interest rate, term length, and what your monthly payment will be.

Take your time reviewing the terms. Once you accept, the lender typically handles the rest. They'll coordinate directly with your equipment supplier, release the funds, and you’ll get your new gear delivered. The whole thing, from application to funding, can often happen in just a few business days.

How to Secure Better Terms and Lower Rates

Getting approved for restaurant equipment financing is one thing. Getting a great deal is another.

At the end of the day, lenders are in the business of managing risk. The less of a risk you look like on paper, the better your interest rate and repayment terms are going to be. Plain and simple. Your secret weapon here is to start thinking like a lender. If you can understand what they're looking for and get ahead of their concerns, you can position your restaurant as a prime candidate for funding. This isn't just about filling out forms; it's about building a rock-solid case for your restaurant's success.

The push for reliable, high-efficiency equipment is getting more intense. A recent report pointed out that over 50% of U.S. restaurant operators planned to bump up their equipment budgets, with a massive 67% looking to replace existing kitchen gear. As the industry keeps evolving, a strong financing application becomes more critical than ever. You can dig into more of these industry trends over at the Equipment Leasing & Finance Foundation.

Strengthen Your Financial Foundation

The first place any lender is going to look is at your financial health. A solid credit score and a clean history of managing your money aren't just nice-to-haves; they're non-negotiable for getting the best rates.

- Boost Your Credit Score: Your personal and business credit scores are a direct reflection of your reliability. You'll want to aim for a score of 680 or higher to get access to the really competitive loan products. You can nudge that score up by paying bills on time, keeping your credit card balances low, and fixing any errors you find on your credit reports.

- Maintain Clean Bank Records: Lenders are going to ask for at least 3-6 months of your business bank statements. They're scanning for consistent cash flow, a healthy average daily balance, and zero overdrafts. Clean records are proof that you manage your money well.

Craft a Compelling Business Narrative

Your numbers tell one part of the story, but your business plan fills in all the crucial details. This is your chance to show lenders not just what you've done, but where you're headed.

A detailed plan that clearly lays out your restaurant's concept, target market, and growth strategy can be a surprisingly powerful negotiation tool. Most importantly, it needs to connect the dots between the equipment you want to finance and your projected revenue boost. For example, show them exactly how a new combi oven will let you expand your catering menu and increase profits by 25%.

Pro Tip: Don't just list your experience—quantify it. Instead of saying you have "many years in the industry," state that you have "15 years of experience managing high-volume kitchens, including reducing food costs by 10%." Specifics build credibility and make you look like a much safer bet.

Reduce Lender Risk and Increase Your Leverage

Finally, there are a few direct actions you can take that make a lender's decision a whole lot easier and give you more bargaining power. These steps show you've got skin in the game and are confident in your venture.

- Make a Larger Down Payment: Offering a significant down payment (usually 10-20%) dramatically lowers the amount you need to borrow. This reduces the lender's exposure to risk and almost always results in a lower interest rate and a better repayment schedule for you.

- Highlight Your Industry Experience: Lenders love experienced operators. Your track record of success in the restaurant world is a huge asset. Be sure to highlight your years of management experience, any previously successful ventures, or specialized culinary training you have.

- Choose the Right Equipment: Financing equipment from reputable, well-known brands can also give you a leg up. Lenders are much more comfortable financing assets that have a strong resale value, as this provides them with better collateral if things go south.

How We Make Your Restaurant Financing Simple

Let’s be honest, hunting for equipment financing can feel like a full-time job, pulling you away from what you actually do—running your restaurant. We've designed our entire process to get rid of that hassle. Instead of you spending days shopping for lenders, we bring the best financing options right to you. It's all built directly into your equipment purchasing experience.

Think of it this way: you wouldn’t source your produce from a dozen different farms when you can get everything from one trusted supplier. We apply the same simple logic to the equipment financing restaurant owners need. We've built solid partnerships with specialized lenders who get the unique cash flow of the foodservice industry, so you see competitive offers without drowning in paperwork.

Streamlined From Checkout to Kitchen

Our goal is to make financing a seamless part of outfitting your kitchen. The process is built for speed and simplicity, making sure you get the tools you need without costly delays holding you back.

Here’s what makes our approach different:

- Ultimate Convenience: You can apply for financing or a lease-to-own plan right at checkout. No need to fill out separate, lengthy applications with a bunch of different lenders.

- Rapid Approvals: Time is money in this business. Our streamlined system often delivers financing decisions in just minutes, not weeks, letting you move forward fast.

- Flexible Options for All: We work with partners who cater to a wide range of credit profiles. Whether you’re a brand-new startup or an established multi-unit operation, we have a solution that fits.

A Real-World Scenario

Imagine you’re launching a new café. You’ve picked out the perfect commercial espresso machine, a convection oven, and a refrigerated display case—a pretty significant upfront investment. Instead of draining your operating capital or navigating a complicated bank loan, you just add everything to your cart on our site.

At checkout, you choose a financing option. A simple, one-page application is all it takes. Within a few hours, you get an approval with clear, easy-to-understand terms. The funds are sent directly to us, your equipment ships, and you’re ready to open your doors.

This is how modern restaurant financing should work. It shouldn't be a barrier to growth but an accelerator. By embedding financing directly into the purchasing process, we turn a major operational hurdle into a simple, strategic step forward.

We’re more than just an equipment supplier; we’re your partner in growth. Our integrated financing solutions are designed to get you the equipment you need faster so you can get back to focusing on building your dream kitchen and delighting your customers.

Common Questions About Equipment Financing

Navigating the world of restaurant equipment financing always brings up a few final, practical questions. Getting clear, straightforward answers is the key to moving forward with confidence and making a decision that’s actually good for your business. Think of this as your quick-reference guide for those last few uncertainties.

Can I Finance Used Restaurant Equipment?

Yes, absolutely. Many lenders are happy to offer financing for used or refurbished equipment. Honestly, this can be a brilliant strategy to slash your initial investment while still getting the high-quality gear your kitchen needs to perform.

The terms might differ slightly from what you’d see for brand-new items. For instance, a lender might prefer a shorter repayment term or ask for a simple inspection to verify the equipment's condition and value. It's a common and incredibly smart way to build out a kitchen on a tighter budget.

What Credit Score Do I Need for Equipment Financing?

There isn't one single "magic number" that applies everywhere, as each lender sets its own criteria. While traditional banks often look for credit scores of 680 or higher, the world of specialized equipment financing is much more flexible.

Many alternative lenders and lease-to-own programs are designed to work with a broader range of credit profiles, often approving applicants with scores in the low 600s. They frequently place more emphasis on your restaurant's cash flow, time in business, and overall financial health rather than relying solely on a personal credit score. That said, a higher score will always help you lock in a better interest rate.

The most important takeaway is that your credit score is just one piece of the puzzle. A strong business plan and consistent revenue can often make up for a less-than-perfect credit history, especially when the equipment itself acts as collateral for the loan.

Should I Choose a Loan or a Lease?

This is one of the most common questions out there, and the right answer depends entirely on your long-term business goals. It's the classic "ownership vs. flexibility" trade-off.

- Choose a loan if: Your main goal is to own the asset and build equity. This is the perfect path for foundational, long-lasting equipment you plan to use for years, like a walk-in cooler or a heavy-duty range.

- Choose a lease if: You want lower monthly payments, need to conserve cash, and value the ability to upgrade to newer technology every few years. Leasing is ideal for items that evolve quickly, such as POS systems or combi ovens.

Think about the specific piece of equipment. For a workhorse that will be the heart of your kitchen for a decade, a loan makes sense. For tech that might be outdated in three years, a lease offers a smarter, more flexible path.

How Fast Can I Get My Equipment Funded?

The speed of funding varies dramatically depending on the financing type you choose. A traditional loan from a major bank can be a slow, drawn-out process, often taking several weeks from application to approval.

However, specialized equipment financing restaurant lenders are built for speed because they understand that you can't afford to wait. For most applications, especially those for amounts under $100,000, you can often receive an approval decision in just a few hours. The entire process—from submitting your application to having the funds sent to your supplier—can frequently be completed in just 1-3 business days. This rapid turnaround means you can get your kitchen equipped and operational that much faster.

Ready to get the equipment you need without the wait? At The Restaurant Warehouse, we make financing simple and fast. Explore our flexible options and get an approval decision in minutes. https://therestaurantwarehouse.com

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment