How to Use a Restaurant Equipment Finance Calculator

In the restaurant industry, cash is king. Preserving your working capital is essential for handling payroll, buying inventory, and managing the day-to-day costs of running your business. That’s why financing equipment is often a smarter move than paying with cash, even if you have the funds available. It turns a massive one-time expense into a predictable monthly payment. But how can you be sure that payment will fit comfortably within your budget? By using a Restaurant Equipment Finance Calculator, you can model different scenarios to find the sweet spot. This guide will show you how to use this tool to protect your cash flow while still getting the high-quality equipment your kitchen deserves.

Smart Ways to Finance Your Restaurant Kitchen

A restaurant equipment finance calculator is a digital tool that helps restaurant owners estimate monthly payments and total costs before purchasing commercial kitchen equipment. By inputting the equipment cost, loan amount, interest rate, and loan term, you can get clear payment estimates to budget effectively.

Key information a restaurant equipment finance calculator provides:

- Monthly payment estimates

- Total repayment amount over the loan term

- Total interest costs

- Payment scenarios for different terms and rates

Starting a restaurant or upgrading equipment requires serious financial planning. With costs ranging from thousands to hundreds of thousands of dollars, most owners need financing. The good news is that equipment financing is often easier to qualify for than other business loans because the equipment itself serves as collateral. Lenders typically finance 80% to 100% of the equipment's value, with terms from 2 to 7 years and interest rates between 7% and 20%.

Before you sign any agreement, you need to understand exactly what you'll pay. A finance calculator is your best friend in this process, helping you compare options and make informed decisions for your kitchen's future.

Similar topics to restaurant equipment finance calculator:

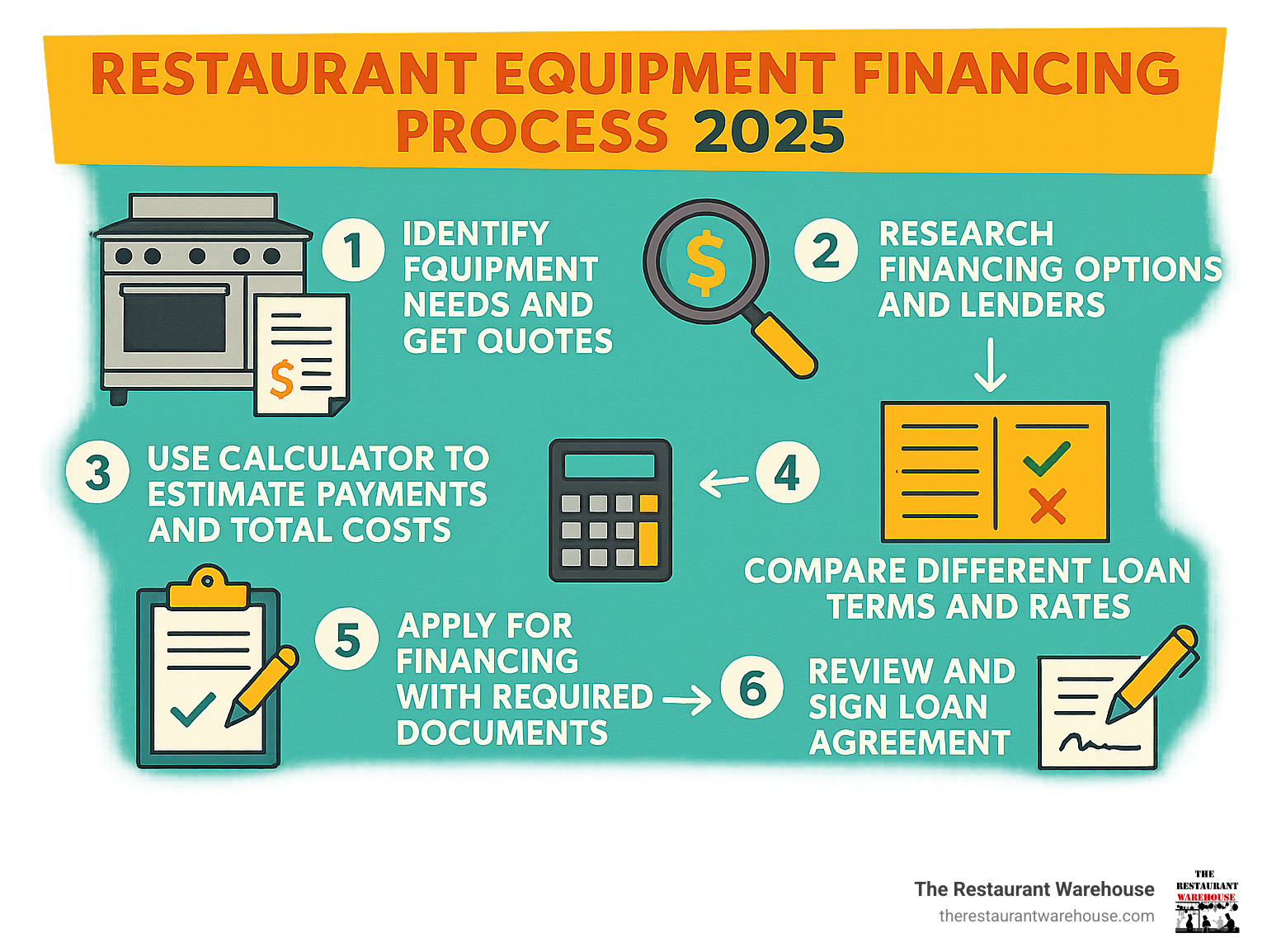

How to Use a Restaurant Equipment Finance Calculator

A restaurant equipment finance calculator is your secret weapon for smart budgeting. Its purpose is to give you a clear, preliminary picture of your financing options, helping you estimate monthly payments and plan your cash flow. Using one is simple:

- Find a reputable calculator: Many financing providers, like The Restaurant Warehouse, offer these tools on their websites.

- Enter your information: Input the equipment cost, your estimated interest rate, the desired loan term, and any down payment.

- Click "Calculate": The tool will instantly process your inputs and display the estimated results.

This initial estimate is crucial for financial planning, allowing you to see if the payments fit your restaurant's budget. For more comprehensive planning, check out our insights on More info about restaurant startup costs.

What Information Will You Need?

To get the most accurate estimate from a restaurant equipment finance calculator, you’ll need a few key pieces of information. The better the inputs, the better the result.

Here are the common inputs you’ll need:

- Equipment Cost: The total purchase price of the commercial kitchen equipment.

- Loan Amount: The specific amount you intend to borrow after any down payment. Lenders often finance 80% to 100% of the equipment's value.

- Down Payment: The portion of the cost you plan to pay upfront. A larger down payment can reduce your loan amount and total interest.

- Estimated Interest Rate: The percentage charged on the loan. If you don't know your rate, you can use an industry average (typically 7-20%) to get a general idea. Your credit score is the biggest factor here.

- Loan Term: The repayment period, usually 2 to 7 years. A longer term lowers monthly payments but increases the total interest paid.

What Do Your Calculator Results Mean?

Once you've entered the numbers into your restaurant equipment finance calculator, it's time to analyze the results. The information gives you a clear financial snapshot to help you make informed decisions.

Here's what you'll typically see:

- Estimated Monthly Payment: The most important number for your daily budget. It shows what you'll need to set aside each month.

- Total Repayment Amount: The grand total you will pay over the entire loan term, including principal and interest.

- Total Interest Paid: This breaks down how much extra you'll pay in interest, showing the true cost of financing.

- Amortization Schedule (sometimes): Advanced calculators may show a table detailing how each payment reduces your principal balance over time.

For example, let's calculate the financing for a new $10,000 commercial refrigerator:

- Equipment Cost: $10,000

- Down Payment: $0

- Estimated Interest Rate: 8%

- Loan Term: 60 months (5 years)

A calculator would show:

- Estimated Monthly Payment: Approximately $202.76

- Total Repayment Amount: Approximately $12,165.60

- Total Interest Paid: Approximately $2,165.60

These estimates let you compare scenarios quickly. A shorter term would mean higher monthly payments but less total interest. This immediate feedback is invaluable. For more tools, see our restaurant startup cost calculators.

Beyond Monthly Payments: Advanced Calculator Features

While getting a quick monthly payment estimate is a great start, the best finance calculators offer more advanced features to give you the full picture. Some tools provide an amortization schedule, which is a detailed breakdown of each payment you’ll make. It shows you exactly how much of your money goes toward the actual equipment cost (the principal) versus how much goes to interest. This schedule is incredibly useful because it lets you watch your loan balance shrink over time and see precisely how your payments are working for you. It takes the guesswork out of understanding where your money is going over the life of the loan.

Advanced calculators also let you play with different payment scenarios. You can easily see how changing the loan term or interest rate affects your payments and total cost. This flexibility is key to finding a plan that fits your restaurant's cash flow. By comparing different setups, you can make a truly informed decision. Many calculators also highlight the total interest you'll pay, revealing the true cost of borrowing. Understanding these details helps you explore different financing options confidently, ensuring you secure the best possible terms for essential equipment like new refrigerators or deep fryers.

What a Calculator Won't Tell You

While a restaurant equipment finance calculator is helpful, it has limitations. Think of it as a starting point, not the final word.

Here’s what a calculator won't tell you:

- They are estimates only: The results are for illustrative purposes and are not a binding loan offer. Actual rates and terms depend on a full credit review.

- They exclude extra fees: Many calculators don't include additional costs like documentation or origination fees, which are one-time charges for processing your loan. These can add a few hundred dollars to your total cost.

- They can't predict your exact rate: Your business and personal credit scores are the most significant factors in determining your interest rate. A calculator can't assess your creditworthiness. Lenders also consider your time in business and annual revenue.

A calculator is a fantastic tool for preliminary budgeting. However, always remember to factor in potential additional costs and understand that the final terms will come after a formal application. To help you decide if a loan is right for you, read our guide to help you decide if you should get a loan.

Decoding Equipment Financing Terms and Rates

Navigating equipment financing can feel a bit like reading a menu in a foreign language, but understanding the typical financing landscape is crucial to securing the best deal. It helps you speak the same language as lenders and confidently evaluate offers.

This chart illustrates a fundamental truth in financing: even small differences in interest rates can lead to significant savings. This is why using a restaurant equipment finance calculator to compare scenarios is so powerful. For a deeper dive into financing strategies, check out The Ultimate Guide to Restaurant Equipment Financing.

What Are Typical Interest Rates and Loan Terms?

When shopping for equipment financing, it helps to know the typical rates and terms. While your specific offer will vary, industry standards provide a good baseline.

- Interest rates for restaurant equipment loans typically fall between 7% and 20%. Excellent credit and an established business can secure rates on the lower end, while newer businesses or those with credit challenges may see higher rates.

- Loan terms generally range from 2 to 7 years, though some lenders offer longer terms for larger purchases. Most terms align with the equipment's useful life.

Your specific rate is influenced by your credit score, business history (time in business and revenue), and the type of equipment being financed. A strong track record tells lenders you're a reliable investment, resulting in better rates. For more details on your options, explore our guide on restaurant equipment financing options.

Where to Find Equipment Financing

Once you have a solid estimate from a finance calculator, the next step is figuring out where to actually get the money. You have a few different paths to choose from, and each comes with its own set of benefits and considerations. The right choice for your restaurant will depend on your specific situation—things like your financial health, your personal and business credit history, and how quickly you need to get that new equipment into your kitchen. Understanding your options ahead of time will help you find a lender and a loan that fits your budget and your timeline perfectly.

Traditional Banks vs. Online Lenders

Your local bank is a classic choice for a reason. Traditional bank loans often come with the lowest interest rates and the most favorable repayment terms. However, they're also known for having strict qualification standards and a much longer, more involved application process. If you have a stellar credit score, a solid business history, and aren't in a major rush to get your equipment, this can be a great route to save on interest over the long haul. It requires patience, but the potential savings can be significant for your bottom line.

On the other hand, online lenders have become a popular and powerful alternative. They typically offer a streamlined, digital application process and tend to have more flexible requirements for approval. This makes them a solid option if you need funding quickly or don't quite meet the strict criteria of a traditional bank. While their interest rates might be slightly higher to account for the added risk and convenience, the speed and accessibility can be a major advantage when you need to get your kitchen up and running without delay.

Direct Financing from Equipment Suppliers

Another fantastic option is getting financing directly from your equipment supplier. Many vendors, including us at The Restaurant Warehouse, offer in-house financing programs to help you get the tools you need. This approach simplifies the entire process because you handle the purchase and the loan all in one place. The equipment you're buying serves as its own collateral, which often makes qualifying easier and helps you avoid the lengthy paperwork that can come with traditional loans. It’s a straightforward and efficient way to get high-quality restaurant equipment without the extra hassle of involving a third-party lender.

How to Qualify for Restaurant Equipment Financing

Getting approved for restaurant equipment financing is often easier than for other business loans because the equipment serves as collateral, reducing the lender's risk. This means even restaurants with less-than-perfect credit have options.

Lenders will still evaluate your business's health. To apply, you will generally need:

- Business Bank Statements: Typically the last 3-6 months to verify cash flow.

- Time in Business: Most lenders prefer at least 6 months to 2 years of operating history, though some work with startups.

- Credit Score: Both personal and business scores are considered. Better credit leads to better terms.

- Equipment Invoice or Quote: A detailed quote, like those from The Restaurant Warehouse, establishes the equipment's value for the lender.

- Business Plan: For new restaurants or large loans, a plan outlining your financial projections may be required.

The straightforward process and lower risk mean approval rates are generally high. To learn more about the process, check out our guide on how hard it is to get a restaurant equipment loan.

Setting Up Your Business for Success

Qualifying for a loan is just one piece of the puzzle; setting your business up for long-term success is the real goal. A solid financial plan for acquiring essential equipment is the foundation of any thriving restaurant. It’s about making smart investments that will pay off for years, freeing you up to focus on creating amazing food and memorable experiences for your guests. This proactive approach is crucial, since the costs for starting or upgrading a kitchen can be substantial. With expenses ranging from thousands to hundreds of thousands of dollars, most owners will need some form of financing to get their vision off the ground.

The good news is that securing restaurant equipment financing is often more straightforward than getting other types of business loans. Because the equipment itself—whether it's a new freezer or a high-capacity deep fryer—serves as collateral, the risk for lenders is lower, making it an accessible path for many owners. This is why it's so important to have a clear plan. Before you commit to any agreement, use a finance calculator to compare different loan terms and interest rates. This simple but powerful step helps you understand the true cost of your investment and choose a payment plan that supports your restaurant's financial health from day one.

Key Financing Terms You Should Know

Understanding key financial terms will help you steer conversations with lenders. Here are the essential definitions:

- Loan vs. Lease: A loan is money you borrow to buy equipment, which you own from day one. A lease is a long-term rental where you pay to use the equipment, with an option to buy it later.

- APR (Annual Percentage Rate): The true annual cost of your loan. It includes the interest rate plus any associated fees, making it the best metric for comparing offers.

- Factor Rate: Often used in leases instead of an interest rate. It's a decimal (e.g., 1.25) that you multiply by the loan amount to find the total repayment.

- Principal: The original amount you borrow, before interest.

- Term: The length of time you have to repay the loan.

- Down Payment: Money you pay upfront, which reduces your loan amount.

- Collateral: The equipment itself, which the lender can claim if you fail to make payments.

Here is a simple comparison of a loan and a lease:

| Feature | Equipment Loan | Equipment Lease |

|---|---|---|

| Ownership | You own the equipment from the start. | The lender owns the equipment. |

| End of Term | You own the equipment free and clear. | You can buy, return, or upgrade. |

| Payments | Builds equity in an asset. | Treated as an operating expense. |

Understanding these terms empowers you to compare offers effectively. For a deep dive into leasing, explore our guide to leasing commercial kitchen equipment.

Smart Strategies for Financing Your Equipment

Financing new equipment is more than just a purchase; it's a strategic investment in your restaurant's future success. It's a financial strategy that savvy restaurant owners use to maintain flexibility, manage cash flow, and position their businesses for growth.

When you use a restaurant equipment finance calculator to plan these investments, you're taking control of your restaurant's financial future. Financing transforms a large expense into a manageable monthly payment, preserving the cash you need for daily operations. For more detailed insights, explore More info on the benefits of financing.

Why Finance Equipment Instead of Buying Outright?

Financing equipment is often a smarter move than paying cash, even if you have the funds. Savvy owners choose financing because cash is king in the restaurant business, and preserving it is critical.

- Preserve Working Capital: Financing keeps cash in your pocket for payroll, marketing, or emergencies instead of tying it up in a single large purchase.

- Manage Cash Flow: It converts a large, unpredictable expense into a fixed, predictable monthly payment, making budgeting easier.

- Get Tax Deductions: The Section 179 deduction may allow you to deduct the full purchase price of financed equipment in the year it's put into service, offering significant tax savings. (Consult a tax professional.)

- Access Better Equipment: Finance the high-quality, efficient equipment you need now, rather than settling for a cheaper model that might cost more in the long run.

- Scale Your Business: Financing provides the flexibility to upgrade and expand your kitchen as your restaurant grows.

To weigh your options, check out this helpful lease vs. buy resource from The Restaurant Warehouse.

Exploring Equipment Leasing as an Alternative

While financing a purchase is a common path to ownership, it’s not your only option. Equipment leasing is another popular route that functions more like a long-term rental. Instead of borrowing money to buy an asset, you pay a monthly fee to use it for a set period. At the end of the lease term, you typically have the choice to return the equipment, renew the lease, or purchase it. This flexibility can be a major advantage, especially in an industry where technology and needs can change quickly. Leasing offers a different set of financial benefits and is worth considering alongside a traditional loan.

When Leasing Makes Sense

Leasing might be the perfect fit if you need equipment for a short time, want to keep upfront costs as low as possible, or are having trouble qualifying for a loan. For instance, if you're testing a new menu item that requires a specialty oven, leasing allows you to try it out without committing to a full purchase. It's also a great option for new restaurants that need to preserve cash for operations. Since you aren't buying the asset, monthly lease payments are often lower than loan payments, freeing up your budget for other critical expenses like inventory and staffing.

Understanding Lease Agreements and Potential Pitfalls

Before you sign a lease, it’s essential to read the fine print carefully. Pay close attention to clauses like "Fair Market Value" (FMV), which determines the buyout price at the end of your term. An FMV buyout can be unpredictable, potentially costing more than you expect if you decide to keep the equipment. Also, be wary of "blanket liens," which give the leasing company rights to your other business assets—not just the leased equipment—if you default on payments. Understanding these terms helps you avoid surprises and protect your business from unnecessary risk.

Aligning Your Loan with Equipment Lifespan

One of the smartest financial moves you can make is to match your loan term to the useful life of your equipment. It’s tempting to choose a longer term to get a lower monthly payment, but this can backfire. You don't want to be making payments on a deep fryer for two years after it has been replaced. This creates negative equity, where you owe more than the asset is worth. A good rule of thumb is to ensure the loan is paid off before the equipment needs major repairs or becomes obsolete, keeping your finances clean and your kitchen running efficiently.

Considering Depreciation and Trade-In Value

All kitchen equipment loses value over time—a process called depreciation. A brand-new commercial refrigerator is worth less the moment it's installed in your kitchen. When planning your financing, it's wise to be realistic about this. While you might hope to get a decent trade-in value for your old equipment when it's time to upgrade, these values are often lower than expected. You should structure your loan so you aren't relying on a high trade-in value to pay off the remaining balance. Think of any trade-in cash as a bonus, not a core part of your financial plan.

Refinancing Existing Equipment Loans

Your financial situation isn't static, and neither is your equipment loan. Refinancing is an option that many restaurant owners overlook. If your business's credit score has improved significantly since you took out the loan, or if market interest rates have dropped, you may be able to secure a new loan with better terms. Refinancing can lower your monthly payment, reduce the total interest you pay, or both. It’s worth checking in on your existing restaurant equipment financing every year or so to see if a better deal is available.

How to Lower Your Restaurant Equipment Loan Costs

Once you decide to finance, your goal is to get the best deal possible. A lower interest rate can save you thousands over the life of the loan. Here are some strategies to reduce your costs:

- Improve Your Credit: Higher personal and business credit scores lead to lower interest rates. Pay bills on time and reduce existing debt.

- Increase Your Down Payment: Putting more money down upfront reduces your loan amount, monthly payments, and total interest paid.

- Shop for Competitive Rates: Don't take the first offer. Compare rates from different lenders to find the best deal.

- Choose a Shorter Loan Term: A shorter term means higher monthly payments but significantly less total interest. Choose the shortest term your cash flow can comfortably handle.

- Negotiate the Equipment Price: A lower purchase price means a smaller loan. We are committed to wholesale pricing to help you save from the start.

- Ask About Prepayment Penalties: Understand if there are fees for paying off your loan early.

- Make Timely Payments: This avoids late fees and helps build your credit for the future.

For flexible ownership paths, explore More info on lease-to-own options.

Frequently Asked Questions about Restaurant Equipment Financing

Financing can feel overwhelming, but the most common questions have encouraging answers. Here are the top concerns restaurant owners have about equipment financing.

Is it difficult to get financing for restaurant equipment?

No, restaurant equipment financing is often much easier to get than other business loans. The equipment itself acts as collateral, which reduces the lender's risk. This means that even businesses with fair credit or a short operating history can often get approved. Lenders will review your credit, time in business, and revenue, but options are available for a wide range of business profiles, including startups. The application process is typically fast, with approvals often granted within a day or two.

How much of the equipment cost can I finance?

Most lenders will finance between 80% and 100% of the equipment's value. This means you may be able to acquire new equipment with little to no down payment. The exact amount depends on your business's financial health, credit history, and the type of equipment. New equipment from a reputable supplier like The Restaurant Warehouse often qualifies for 100% financing because it holds its value well.

What's the difference between an equipment loan and a lease?

This is a key distinction. With an equipment loan, you borrow money to buy the equipment. You own it from day one and it's yours free and clear after you make all the payments. With an equipment lease, you are essentially renting the equipment for a set period. At the end of the term, you usually have the option to buy it, return it, or upgrade. Loans use traditional interest rates (APR), while leases often use factor rates. They also have different tax implications—loan interest is deductible while lease payments are often fully deductible as an operating expense. Consult an accountant to see which is best for your business.

Ready to Finance Your Kitchen Equipment?

You now have the knowledge to make confident decisions about your kitchen's future. You understand that financing isn't just a loan; it's a strategic tool for preserving capital, managing cash flow, and growing your business.

Financial planning is critical in the restaurant industry. By using a restaurant equipment finance calculator, you empower your business to make smart investments that will pay off for years. Equipment financing is highly accessible because the equipment itself serves as collateral.

At The Restaurant Warehouse, we're committed to making quality equipment accessible through affordable, wholesale pricing that works with your budget. Your dream kitchen is closer than you think.

Ready to take the next step? Explore your restaurant equipment financing options and equip your kitchen for success.

Key Takeaways

- Plan your payments before you commit: Use a restaurant equipment finance calculator to model different loan scenarios. This helps you find a comfortable monthly payment that protects your cash flow while still getting the equipment you need.

- Treat financing as a strategic tool: Paying with cash isn't always the best move. Financing preserves your working capital for daily operations and turns a massive purchase into a predictable, manageable monthly expense.

- Secure the best deal by being prepared: Your credit score, down payment, and loan term directly affect your costs. Improve your credit and compare offers from different lenders to get the most favorable interest rate and save money over the life of the loan.

Related Articles

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment