The Dish on Food Equipment Financing: Options for Every Business

Why Food Equipment Financing is a Game-Changer for Restaurant Success

Food equipment financing allows restaurant owners to acquire essential commercial kitchen equipment through loans or leases instead of paying the full cost upfront. This strategic move helps preserve working capital, offers significant tax advantages, and provides fast access to the tools you need. Options range from equipment loans that build equity to flexible leases with lower monthly payments.

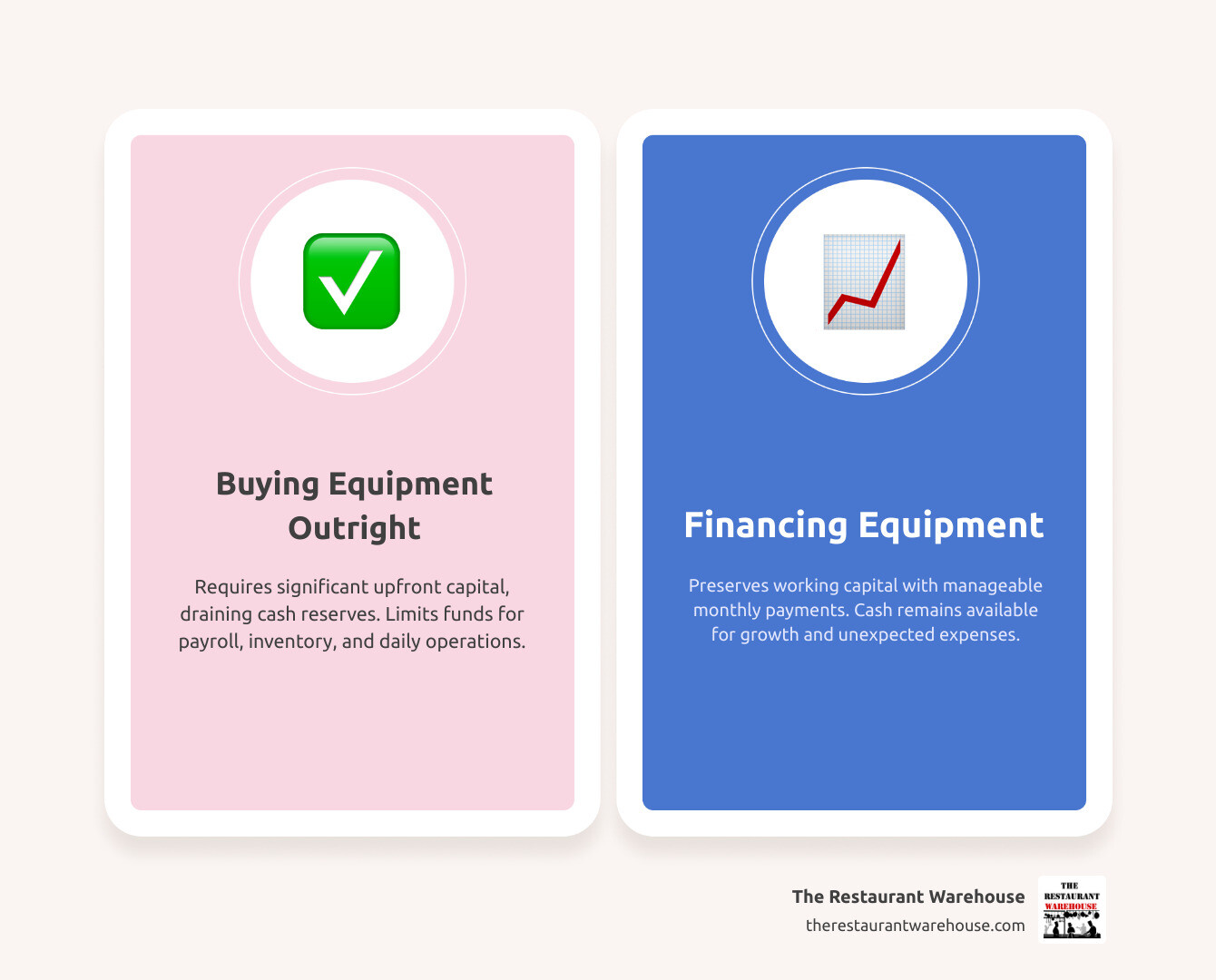

Commercial kitchen equipment is expensive, with single items often costing thousands of dollars. A full setup can require a massive capital outlay before you even open your doors. Instead of draining their bank accounts, smart restaurant owners use financing to preserve their working capital. This keeps cash free for daily operations like payroll, inventory, and marketing.

By financing, the equipment you acquire can start generating revenue immediately, effectively paying for itself through improved efficiency and service. It's a crucial strategy for managing cash flow and ensuring long-term stability and growth.

Simple food equipment financing word guide:

What is Food Equipment Financing and How Does It Work?

Food equipment financing is a specialized financial solution that helps businesses acquire necessary tools and machinery without a large upfront payment. It's a form of asset-based lending where the equipment itself often serves as collateral. This structure is a key reason why the approval process is typically much simpler and faster compared to traditional bank loans, which often require a broader look at your business's overall financial health and may require other business or personal assets as security.

The Basic Mechanism

The process is designed for efficiency. It begins when you select the equipment you need and get a detailed quote from a vendor. Next, you submit a simple application to a financing provider. Upon approval—which can happen in hours—the lender pays the vendor directly on your behalf. You then enter into an agreement to make regular, fixed payments to the lender over a predetermined term, which can range from 12 to 84 months. Depending on the structure of your agreement, you either gain immediate ownership (an equipment loan) or the right to use the equipment with an option to purchase it later (an equipment lease). This inherent flexibility allows you to precisely align your equipment acquisition strategy with your business's operational needs and cash flow projections.

For a deeper dive into how this all works, check out our guide: Restaurant Equipment Financing: What You Need to Know.

What Types of Equipment Can You Finance?

The range of equipment you can finance is incredibly broad, covering nearly everything a foodservice business needs to operate efficiently, from the back of the house to the front.

You can typically finance major cooking appliances like commercial griddles, fryers, and steamers; refrigeration units like commercial refrigerators (such as True Refrigerators or Atosa Refrigerators) and freezers (like True Freezers or Atosa Freezers); and food preparation equipment like Atosa Sandwich Prep Tables, Pizza Prep Tables, and commercial mixers. The financing also extends to warewashing equipment like dishwashers, front-of-house technology like Point of Sale (POS) systems, and even essential furnishings like tables, chairs, and delivery vehicles. A significant advantage is that many providers allow you to bundle multiple smaller items and even soft costs (like installation and shipping) into a single financing agreement, enabling you to acquire a full kitchen setup with one simple monthly payment.

For catering businesses specifically, leasing equipment can be a game-changer. Learn more here: Catering Equipment Lease Made Easy: Cook Without Breaking the Bank.

Who Provides Food Equipment Financing?

The landscape of food equipment financing providers is diverse, offering options for nearly every business profile and need. Key providers include:

- Traditional Banks: Often provide the most competitive interest rates, but they are best suited for established businesses with strong credit and a lengthy operating history. The application process can be slow and documentation-heavy.

- Online Lenders: These lenders are known for their speed and streamlined digital applications. They offer quick decisions and funding, often in 24-48 hours, and are typically more flexible with credit scores and time-in-business requirements, making them a great option for startups and those needing equipment quickly.

- Credit Unions: As member-owned institutions, credit unions can sometimes offer more personalized service and favorable terms than large banks, making them a good option for small, community-focused businesses.

- Equipment Suppliers and Manufacturers: Many vendors, like The Restaurant Warehouse, partner with a network of financing companies. This offers immense convenience, as you can select your equipment and arrange financing in one seamless process, often right at the point of sale.

- Specialized Finance Companies: These firms focus exclusively on equipment financing and possess deep industry knowledge. This expertise allows them to create highly flexible and customized financing packages that a traditional bank might not offer.

Exploring these different provider types will help you find the best fit for your business's financial situation and equipment needs.

Comparing Your Financing Options: Loans vs. Leases

Choosing the right food equipment financing option is a critical decision that hinges on your long-term business goals. Key factors to consider include whether you prioritize eventual ownership or the flexibility to upgrade technology, and how you want to manage your monthly cash flow and tax liabilities. There's no single best choice; the ideal solution is the one that aligns perfectly with your restaurant's financial strategy.

To help you dish out the right choice, check out our comprehensive guide: A Comprehensive Guide to Restaurant Equipment Financing Options.

Equipment Loans (Capital Leases)

An equipment loan functions much like a traditional auto loan. You are purchasing the equipment, and a lender provides the funds, which you then repay in installments over a set term. From day one, the equipment is considered your asset, allowing you to build equity on your balance sheet. This path is ideal for businesses that plan to use the equipment for its entire lifespan and value long-term ownership. Loans typically feature fixed monthly payments, which makes budgeting predictable and straightforward. A significant advantage lies in the tax benefits: you can often deduct the interest paid on the loan and claim depreciation on the asset each year. This includes the powerful Section 179 deduction, which can provide a substantial tax write-off. Because the equipment itself serves as collateral, the approval process can be less stringent than for other types of business loans. The primary consideration is that monthly payments are generally higher than lease payments because you are financing the full purchase price of the asset.

If you're leaning towards owning your equipment, dive deeper here: Should Your Restaurant Get a Restaurant Equipment Loan?.

Equipment Leases (Operating Leases)

An equipment lease is functionally similar to renting an apartment. You pay for the right to use the equipment for a set period without taking on ownership. This structure provides incredible flexibility and cash flow benefits. The primary advantage is lower monthly payments, as your payments are calculated based on the equipment's depreciation during the lease term, not its full value. This can free up a significant amount of cash for other operational needs. Leasing is also the perfect strategy for avoiding technological obsolescence; at the end of the term, you can simply return the equipment and upgrade to the latest model. This is especially valuable for tech-heavy items like POS systems. From a tax perspective, lease payments are typically 100% tax-deductible as a direct operating expense. Furthermore, operating leases often don't appear as a long-term liability on your balance sheet, which can make it easier to secure other types of financing. While you don't automatically own the equipment, most leases provide buyout options at the end of the term, such as purchasing it for its Fair Market Value (FMV) or for a nominal amount, like a $1 buyout.

Want to learn more about leasing? Check this out: Restaurant Equipment Leasing.

[TABLE] Comparing Key Features of Equipment Loans vs. Operating Leases

To help you visualize the differences, here's a quick comparison of the key features of equipment loans and operating leases:

| Feature | Equipment Loan (Capital Lease) | Operating Lease |

|---|---|---|

| Ownership | You own the equipment from day one; build equity. | Lender retains ownership; you have usage rights. |

| Monthly Cost | Generally higher, as you're paying for full purchase price. | Generally lower, as you're paying for usage/depreciation. |

| Upfront Cost | May require a down payment, though 100% financing is often available. | Often requires minimal or no money down. |

| Tax Benefits | Deduct interest; claim depreciation (including Section 179). | Payments are typically 100% tax-deductible as an operating expense. |

| End-of-Term Options | You own the equipment outright. | Return equipment, renew lease, or purchase via buyout (e.g., FMV, $1). |

| Flexibility | Less flexible; tied to the asset until paid off. | High flexibility; easy to upgrade or change equipment. |

Other Popular Choices

Beyond standard loans and leases, consider these versatile options:

Lease-to-Own: This is a hybrid agreement, often structured as a $1 buyout lease. It combines the lower monthly payments and minimal upfront cost of a lease with a clear, predetermined path to ownership. At the end of the term, you purchase the equipment for a nominal amount (e.g., $1). It's a popular choice for businesses that want the cash flow benefits of leasing but ultimately intend to own the equipment. Learn more about this smart choice here: Lease to Own Restaurant Equipment.

Business Line of Credit: This is a revolving pool of funds that your business can draw from as needed and repay over time, similar to a credit card. You only pay interest on the amount you use. While not specific to equipment, it offers maximum flexibility for purchasing equipment, covering unexpected repairs, or managing other business expenses. It's best for businesses with strong credit and a need for ongoing, flexible access to capital.

Food equipment financing offers many flavors. We're here to help you find the perfect recipe for your business!

The Strategic Advantages of Financing

Financing your food equipment is a strategic business decision that fuels growth, innovation, and competitiveness. It empowers your restaurant to acquire the best tools without draining financial reserves, impacting everything from your balance sheet and operational efficiency to staff morale and customer satisfaction.

Learn more about the general benefits here: Benefits of Restaurant Equipment Financing.

Preserve Your Cash Flow

This is the single most significant benefit of food equipment financing. Cash flow is the lifeblood of any business, especially in the foodservice industry where margins can be tight. By financing, you preserve your working capital instead of making a large, depleting upfront expenditure. For example, instead of spending $40,000 in cash on a new kitchen line, you could finance it for a predictable monthly payment of around $900. This keeps nearly $40,000 in your bank account, available for daily operations like purchasing inventory, paying staff, marketing, or handling unexpected emergencies. Many programs offer 100% financing options, requiring no down payment. You can also bundle soft costs like shipping, taxes, and installation into your monthly payments, preventing hidden expenses from disrupting your budget. This financial flexibility is crucial for navigating the day-to-day challenges of the restaurant business with confidence.

For insights into managing costs when opening a restaurant, see: Cost to Open Restaurant.

Open up Significant Tax Benefits

Food equipment financing offers substantial tax advantages that can dramatically lower the effective cost of your equipment. The most notable of these is the Section 179 deduction. This IRS tax code allows businesses to deduct the full purchase price of qualifying new or used equipment in the year it is placed into service, rather than depreciating it over several years. For instance, if you finance a $20,000 ice machine and are in a 35% tax bracket, the Section 179 deduction could result in a direct tax saving of $7,000 for that year. While there are annual deduction limits (currently over $1 million), they are high enough that most restaurants can deduct all their equipment purchases. In addition to Section 179, businesses may be able to use bonus depreciation, which allows for an additional first-year deduction on qualified assets. To ensure you are maximizing these powerful benefits for your specific financial situation, it is always best to consult with a tax professional.

For the most current information, you can always refer to the IRS directly: Learn more about business tax deductions.

Get Better Equipment Sooner

Financing provides immediate access to top-tier technology without the long wait required to save up enough cash. This means you can get that more efficient commercial griddle, high-capacity ice machine, or advanced POS system now, not next year. Better equipment directly translates to increased productivity and a stronger bottom line. For example, a modern, energy-efficient refrigerator lowers utility bills, while a programmable deep fryer ensures product consistency and reduces food waste. This, in turn, improves the customer experience through better quality food and faster service times. Flexible financing, especially leasing, also helps you avoid obsolescence. You can regularly upgrade your equipment to stay competitive and efficient. Finally, providing your staff with modern, reliable tools can significantly improve staff morale and job satisfaction. A happy, well-equipped team is more productive and provides better service, creating a healthier and more profitable work environment.

Navigating the Application and Approval Process

One of the best parts of food equipment financing is the fast and simple application process. Unlike traditional bank loans, equipment financing is designed for speed. Approvals can be granted in minutes, with funding often available in as little as 24 hours. This means less waiting and more time focusing on your business.

What are the Typical Qualification Requirements?

While requirements vary, lenders generally look at a few key factors. A FICO® score of 600 or above is often preferred, but many lenders work with "all credit scores" because the equipment itself acts as collateral, reducing their risk. Most providers prefer to see a business has been operating for at least 6 months, though many "startup-friendly" lenders exist. Some may require a minimum annual business income (e.g., $40,000+). For financing up to $250,000, many providers don't even need your financial statements; a simple one-page application is often sufficient.

A Step-by-Step Guide to Applying for Food Equipment Financing

The application process is incredibly simple:

- Choose your equipment: Decide on the specific items you need.

- Get a vendor quote: Obtain a detailed quote for the equipment and any soft costs.

- Complete the application: Fill out a short online form, which often takes just a few minutes.

- Review and sign documents: Once approved, review and sign the financing agreement, usually via secure eDocs.

- Receive funding: The lender pays your vendor directly, and your equipment is shipped. Funding can happen in as little as 24 hours.

Can Startups or Businesses with Bad Credit Get Approved?

Yes, it's often possible. The equipment itself acts as collateral, which significantly reduces the lender's risk and makes them more flexible. Many food equipment financing providers specialize in working with startups and businesses with less-than-perfect credit. They understand new businesses lack extensive financial history and may look at your business plan or personal credit instead. Lenders may also focus more on your current revenue and cash flow than just a credit score. While terms like interest rates might be slightly less favorable to offset the risk, the benefit of getting essential equipment to generate revenue often outweighs this cost.

We have specific resources to help:

Solutions are often available for your unique situation, so it's always worth exploring your options.

Key Considerations and Potential Pitfalls

While food equipment financing offers incredible benefits, it's wise to approach it with a clear understanding of the details to ensure the agreement truly serves your business. The most important factor is the total cost of financing, which includes not just the interest but also any associated fees over the life of the agreement. Being aware of common terms and potential missteps can save you a significant amount of money and help you make a fully informed decision.

We've compiled some helpful insights on this topic here: Restaurant Equipment Financing Mistakes.

Understanding Common Terms and Conditions

Familiarize yourself with these common terms to compare offers effectively:

- Payment Terms: This is the length of your agreement, typically ranging from 12 to 84 months. Shorter terms mean higher monthly payments but lower overall interest costs. Longer terms offer more manageable lower payments but result in paying more interest over time.

- Interest Rate vs. APR: The interest rate is the cost of borrowing the principal amount. The Annual Percentage Rate (APR) is a broader measure that includes the interest rate plus any lender fees, giving you a more accurate picture of the total annual cost.

- Factor Rate: Some lenders, particularly in short-term financing, use a factor rate instead of an interest rate. This is a decimal figure (e.g., 1.2) that you multiply by the loan amount to determine the total repayment amount. It's simple to calculate but can sometimes obscure the true cost compared to an APR.

- Deferred Payments: Some programs allow you to delay your first payment for 30, 60, or 90 days. This is a great feature that allows your new equipment to start generating revenue before you have to make your first payment.

- Buyout Options: At the end of a lease, your options are key. A $1 Buyout is a lease-to-own plan where you purchase the equipment for a symbolic $1. A Fair Market Value (FMV) Buyout lets you buy the equipment at its current appraised value, renew the lease, or return it, offering maximum flexibility.

- Prepayment Penalties: Be sure to ask if there is a penalty for paying off the loan or lease early. Some agreements require you to pay all the originally planned interest, even if you pay it off ahead of schedule.

Choosing the Right Financing Partner

Selecting the right financing partner is as crucial as choosing the right equipment. A great partner is transparent, supportive, and acts as a true consultant for your business.

Look for Transparency in all fees and terms, with no hidden costs or confusing language. Industry Expertise is also vital; a partner who knows the foodservice industry can offer more favorable, customized terms and understand your unique challenges. Prioritize excellent Customer Service with responsive and helpful specialists who can guide you through the process. Finally, Check Reviews and Credibility by looking for providers with a solid reputation and positive customer feedback from other restaurant owners. A partner with a large Network of Funding Sources is also a plus, as they can shop for the best rates and terms on your behalf, saving you time and money.

Finding a trustworthy business partner is crucial. We offer some helpful tips here: Tips for Finding a Trustworthy Business Partner.

By considering these factors, you can secure financing that supports your immediate needs and long-term growth.

Frequently Asked Questions about Food Equipment Financing

Making the right financing decision is a big deal. Here are answers to the most common questions we receive from restaurant owners about food equipment financing.

How quickly can I get funded for my equipment?

Speed is a major advantage of equipment financing. The process is remarkably fast:

- Application: Most online applications take just 5-10 minutes to complete.

- Approval: Decisions for financing amounts under $250,000 can be instant or take just a few hours. Larger, more complex requests may take a couple of days.

- Funding: Once you are approved and the financing documents are signed (usually electronically), funding can occur in as little as 24 hours. The lender pays your equipment vendor directly.

Faster funding is typical for smaller amounts, complete applications, and stronger credit profiles.

Can I finance used restaurant equipment?

Yes, absolutely. Many lenders are happy to finance used or refurbished equipment, provided it is in good working condition and has a reasonable service life remaining. Financing used equipment is a smart financial move, as the lower initial cost translates directly to smaller monthly payments and a faster return on your investment. For higher-value used items, the lender may require a simple inspection or appraisal to verify its condition and value before finalizing the agreement.

We have a guide to help you steer this process: How to Lease Used Restaurant Equipment Without Getting Served a Lemon.

Does applying for equipment financing hurt my credit score?

This is a common concern with a reassuring answer. Most initial applications to get a quote or pre-approval use a soft credit inquiry, which has zero impact on your credit score. This allows you to shop around and compare offers from multiple lenders without any negative effect. A hard credit pull, which can cause a small, temporary dip in your score, typically only occurs once you have chosen a lender and decided to move forward with a formal application. Furthermore, credit scoring models often group multiple hard inquiries for the same type of financing within a short period (e.g., 14-30 days) as a single event, minimizing the impact. The benefit of acquiring revenue-generating equipment almost always outweighs the minor, temporary effect of a hard inquiry.

What happens if I want to pay off my financing agreement early?

This depends entirely on the terms of your specific agreement. Some equipment loans have no prepayment penalties, allowing you to pay off the remaining balance at any time to save on future interest. However, other agreements, especially some leases or loans with factor rates, may have prepayment penalties or require you to pay a significant portion of the total interest you would have paid over the full term. It is crucial to ask about the prepayment policy before signing any documents.

What happens if the equipment breaks down during the financing term?

Your financing agreement is separate from the equipment's performance and warranty. You are still responsible for making your monthly payments to the lender even if the equipment malfunctions. This is why purchase equipment from a reputable vendor that offers a solid manufacturer's warranty. Before you buy, understand the warranty's length and what it covers (parts, labor, etc.). If a breakdown occurs, you will work with the vendor or manufacturer for repairs under the warranty, while continuing to make your regular payments to the finance company.

Conclusion

Food equipment financing is more than a payment method; it's a powerful strategy for growth, efficiency, and financial stability in the competitive foodservice industry. It empowers businesses of all sizes—from startups to established chains—to acquire essential equipment without the burden of massive upfront costs.

By financing, you preserve working capital for daily operations, open up significant tax advantages like the Section 179 deduction, and access top-tier equipment sooner to boost productivity and improve the customer experience. Whether you choose an equipment loan, a flexible operating lease, or a hybrid lease-to-own option, there is a solution custom to your business goals.

At The Restaurant Warehouse, we are committed to your success. We supply commercial restaurant equipment at lower prices by cutting out high commissions and retail overhead. We believe every business deserves the tools to thrive, which is why we champion smart food equipment financing as a vital resource.

Don't let budget constraints limit your potential. Let us help you steer your options and find the perfect path forward.

Explore your financing options with us today and get equipped to shine!

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment