A Comprehensive Guide to Restaurant Equipment Financing Options

Why Restaurant Equipment Financing Is Essential for Success

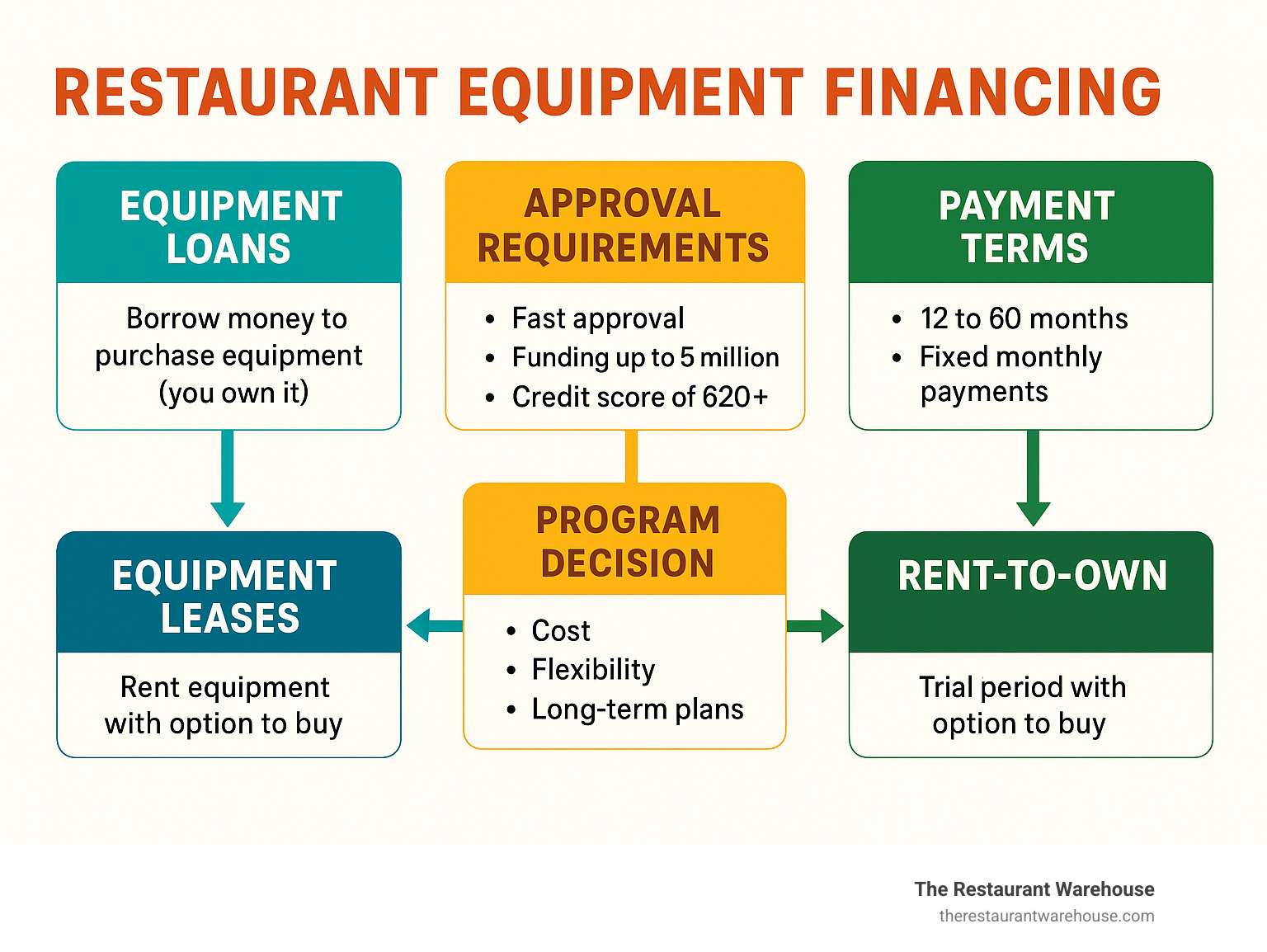

Restaurant equipment financing allows you to acquire commercial kitchen equipment through loans, leases, or rent-to-own programs without paying the full cost upfront. Here's what you need to know:

Key Financing Options: - Equipment Loans - Borrow money to buy equipment (you own it) - Equipment Leases - Rent equipment with option to buy later - Rent-to-Own - Trial period with flexible end options

Quick Facts: - Approval in 24 hours or less - Funding from $3,000 to $5,000,000 - Credit scores as low as 620 accepted - New and used equipment eligible - Startups can qualify

Running a successful restaurant requires more than great recipes and service. You need reliable, efficient equipment that can handle daily demands without breaking your budget or cash flow.

With over 97,000 restaurants operating in Canada alone, competition is fierce. Traditional suppliers often burden you with high markups and hidden costs, making equipment purchases feel impossible when you're already managing thin margins.

The reality is simple: most restaurants can't afford to buy commercial equipment outright. A single commercial oven can cost $15,000-$50,000. Add refrigeration, prep equipment, and POS systems, and you're looking at $100,000+ just to get started.

Equipment financing solves this problem by spreading costs over 12-60 months while preserving your working capital for daily operations, marketing, and growth opportunities.

Whether you're opening your first location or upgrading existing equipment, financing gives you access to the tools you need without the devastating upfront costs that kill restaurant dreams.

Restaurant Equipment Financing 101: What It Is & How It Works

Restaurant equipment financing works like getting a car loan, but for your kitchen. The equipment itself becomes the collateral, which means lenders feel more comfortable saying yes to your application.

Here's the beautiful part: instead of watching $30,000 disappear from your bank account for that new walk-in cooler, you might pay just $600-800 per month. Your cash stays put for the daily stuff that keeps your doors open - payroll, ingredients, and those surprise repairs that always seem to happen at the worst possible time.

The equipment secures the loan throughout your payment term. Once you make that final payment, it's yours completely. No strings attached.

This collateral-based lending approach makes qualification much easier than traditional business loans. Lenders know they can recover their investment if things go sideways, so they're willing to work with restaurant owners who might not qualify for other types of financing.

Lease agreements offer another path forward. You can rent equipment with the option to buy it later, while rent-to-own basics let you try before you commit. Both options help manage your cash flow while getting the equipment you need today.

What Can You Finance?

Nearly everything in your restaurant can be financed. Walk-in coolers and freezers that keep your ingredients fresh? Absolutely. Those commercial ovens that are the heart of your kitchen? You bet.

Your POS systems that handle every transaction can be financed too. Even your dining room furniture - tables, chairs, and that perfect lighting that creates the right atmosphere.

The rule is simple: if it's used for business and has resale value, you can probably finance it. This includes everything from prep tables and dishwashers to ice machines and even food trucks.

Restaurant Equipment Financing Step-by-Step Process

The process is refreshingly straightforward. You'll start with an online application that takes about 15-30 minutes to complete. Just basic business information - nothing too complicated.

Most lenders give you a decision within 24 hours. Some even approve applications in just one hour. Compare that to traditional bank loans that can leave you waiting for weeks.

Once approved, you'll submit your bank statements and tax returns. The funding typically happens within 24-48 hours, with money going directly to your equipment supplier.

Then comes the best part - equipment delivery. Your new gear arrives ready to help you serve customers better and make more money.

How Restaurant Equipment Financing Supports Growth

Smart financing creates immediate efficiency gains. That new dishwasher might cut your dish time in half while using 30% less water and electricity. The monthly savings on utilities can cover a chunk of your payment right there.

Menu expansion becomes possible without emptying your bank account. Want to add wood-fired pizzas to your menu? Finance that oven and start generating new revenue streams while keeping your cash for marketing and ingredients.

Modern equipment delivers serious energy savings. Newer models typically use 20-40% less electricity than older ones. Your utility bills drop while your equipment payments stay predictable.

While your competitors deal with broken equipment and constant repairs, you're serving customers faster with consistent quality. That's how financing gives you a real competitive edge.

More info about Restaurant Equipment Financing: What You Need to Know

Financing Structures Compared: Loans, Leases & Rent-To-Own

Choosing the right restaurant equipment financing structure can make or break your restaurant's financial health. Each option has its sweet spot, and understanding these differences will help you make the smartest choice for your situation.

Think of it this way: buying equipment is like choosing between renting an apartment, getting a mortgage, or doing a rent-to-own deal. Each serves different needs and life situations.

| Factor | Equipment Loans | Equipment Leases | Rent-to-Own |

|---|---|---|---|

| Ownership | Immediate | End of term | Flexible |

| Tax Benefits | Depreciation | Payment deduction | Payment deduction |

| Down Payment | 10-20% typical | Often $0 | Usually $0 |

| Total Cost | Lowest | Medium | Highest |

| Flexibility | Low | Medium | High |

| Credit Requirements | Moderate | Lower | Lowest |

The reality is that most restaurant owners don't need just one type of financing. You might use a loan for your main kitchen equipment, lease your POS system, and try rent-to-own for that specialty pizza oven you're not sure about yet.

Here's how each structure works in the real world of restaurant operations.

Equipment Loans

Equipment loans are the most straightforward option - you borrow money, buy the equipment, and own it from day one. The equipment itself secures the loan, which makes approval easier than unsecured business loans.

This is like getting a car loan for your restaurant. You make monthly payments, but the equipment is yours to modify, sell, or keep forever.

The biggest advantage? You're building equity with every payment. That $20,000 commercial oven doesn't just cook food - it becomes an asset on your balance sheet that you can depreciate for tax benefits.

Equipment loans work best when you have decent credit, can handle a down payment of 10-20%, and plan to keep the equipment for years. The total cost is usually lowest with loans, making them perfect for core kitchen equipment that won't become obsolete quickly.

Typical terms run 12-84 months with interest rates from 6-25%. The longer the term, the lower your monthly payments, but you'll pay more interest overall. Fixed monthly payments make budgeting predictable, which every restaurant owner appreciates.

Depreciation benefits under Section 179 can be substantial. You might deduct the full purchase price in the first year, creating significant tax savings that help offset your financing costs.

Equipment Leases

Leasing is like renting equipment with benefits. You get lower monthly payments than loans, easier qualification, and flexibility at the end of your term.

There are two main types, and the difference matters for your taxes and cash flow.

Operating leases are true rentals. You use the equipment, make payments, and return it at the end. Your entire monthly payment is typically tax-deductible as a business expense, which can create better cash flow than loan depreciation.

Capital leases (also called lease-to-own) are structured more like loans. You'll have a buyout option at the end - usually $1 or 10% of the original price. You're essentially buying the equipment over time, just with different paperwork.

The sweet spot for leasing is when you want lower monthly payments, have limited cash for down payments, or prefer the flexibility to upgrade equipment as your restaurant evolves.

Seasonal restaurants especially benefit from leasing because payments can sometimes be structured around your busy and slow periods. Ice cream shops don't need the same cash flow in January as they do in July.

Early buyout options are common, giving you the chance to purchase equipment for less than the remaining payments if your cash flow improves or you get a great deal.

Rent-to-Own Programs

Rent-to-own offers maximum flexibility for restaurants that need to stay nimble. These programs are designed for the "try before you commit" approach that many successful restaurant owners prefer.

The typical structure involves 52 weekly payments with five end-of-term options that give you incredible flexibility. You can purchase immediately for the remaining balance, upgrade to newer equipment, or return everything penalty-free after 12 months.

Instant approval up to $50,000 is common, making this perfect for new restaurants or owners with credit challenges. The qualification process focuses more on your ability to make payments than your credit history.

The trade-off is higher total cost. You're paying for flexibility and easier qualification, which means more money over time. But for many restaurants, this flexibility is worth every penny.

Equipment obsolescence becomes less of a worry with rent-to-own. That new POS system or kitchen display technology that might be outdated in two years? No problem - just upgrade at the end of your term.

Trial periods let you test equipment in your actual restaurant environment. If that new prep table doesn't fit your workflow or that specialty oven doesn't deliver the results you expected, you have options.

The key is matching your financing structure to your restaurant's stage of development, cash flow patterns, and growth plans. There's no universal "best" option - only the best option for your specific situation.

Benefits of Restaurant Equipment Financing

Qualification & Application: Requirements, Documents, Approval Speed

Getting approved for restaurant equipment financing is surprisingly straightforward compared to traditional business loans. The equipment itself acts as your collateral, which makes lenders much more comfortable working with restaurant owners.

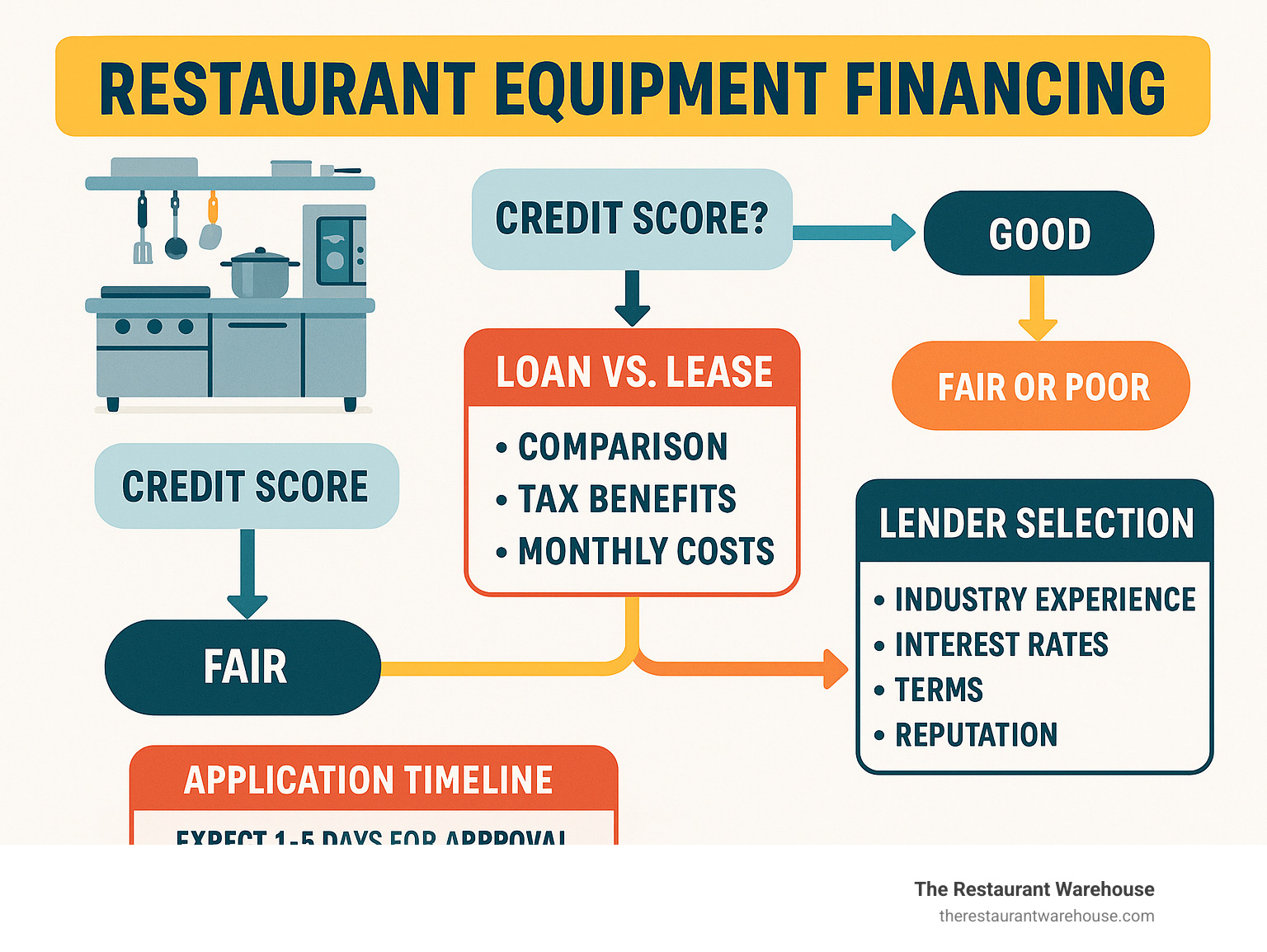

Most lenders look for a credit score of 620 or higher, though some will work with lower scores if other factors are strong. Your restaurant should generate at least $100,000 in annual revenue, and having been in business for one year or more definitely helps your case.

The documentation process is refreshingly simple. You'll need your last three months of bank statements to show cash flow, two years of tax returns to verify income, and equipment quotes from suppliers to specify what you're buying. Don't forget your business license and be ready to authorize both personal and business credit checks.

Here's the best part: most applications get approved within 24 hours. Some lenders even offer instant approval for amounts up to $50,000, which means you could be shopping for equipment the same day you apply.

Restaurant Equipment Financing for Startups & New Restaurants

New restaurant owners often worry they can't get financing without an established track record. The good news is that many lenders specialize in working with startups because the equipment provides solid collateral.

Collateral-focused lenders care more about the value of what you're buying than how long you've been in business. If you're purchasing a $30,000 commercial refrigerator, they know they can recover their investment even if things don't go as planned.

Some innovative programs offer revenue-based payments that automatically adjust based on your daily credit card sales. This can be a lifesaver during your first year when business might be unpredictable or seasonal.

Most startup financing requires a personal guarantee, but this actually works in your favor. It allows lenders to evaluate your personal credit history instead of focusing solely on your brand-new business.

Boosting Approval Odds with Good Credit

Your credit score makes a huge difference in both getting approved and securing favorable terms. With a score above 720, you'll qualify for the best rates between 6-12% and face minimal paperwork requirements.

If your score falls between 650-719, you're still in good shape with rates typically ranging from 12-18%. Scores between 620-649 will face higher rates around 18-25%, but financing remains accessible.

The fastest way to improve your approval odds is paying all bills on time for three to six months before applying. Keep your credit utilization below 30% on all cards, and resist the urge to close old credit accounts since they help establish your credit history length.

Monitor your credit report regularly and dispute any errors promptly. Even small improvements in your score can save you thousands in interest costs over the life of your financing.

Timeline: From Application to Equipment Delivery

Modern restaurant equipment financing moves at lightning speed compared to traditional bank loans. The entire process typically takes just two to seven business days from start to finish.

You'll spend about 15-30 minutes completing the online application, then receive an initial credit decision within one to four hours. Many lenders provide instant decisions for qualified applicants.

Once approved, you'll submit your supporting documents through email or an online portal the same day. Final approval and funding authorization usually happens within 24-48 hours, followed by equipment delivery within the next few days.

Some lenders even offer same-day funding for emergency equipment replacements. If your walk-in cooler dies unexpectedly, you could have a replacement installed within days instead of weeks.

Restaurant Equipment Financing Guide

Best Restaurant Equipment Financing Options

Costs, Benefits, Risks & Tax Considerations

Let's talk numbers. Restaurant equipment financing costs more than paying cash upfront - that's just reality. But the question isn't whether financing costs more. It's whether the benefits outweigh those extra costs for your specific situation.

Interest rates vary dramatically based on your credit score and the lender you choose. With excellent credit (720+), you might pay just 6-12% APR. Good credit (650-719) typically means 12-18% APR. Fair credit (620-649) pushes rates to 18-25% APR. Below 620? You're looking at 25-35% APR or alternative lending products.

Here's where it gets tricky: some lenders use factor rates instead of traditional interest rates. A 1.3 factor rate sounds reasonable - you pay back $1.30 for every dollar borrowed. But when you calculate the actual annual percentage rate, that "reasonable" 1.3 factor often translates to 30-50% APR. Always ask for the APR to compare apples to apples.

Beyond interest, watch for origination fees (1-5% of the loan amount), documentation fees ($100-500), and late payment penalties. Some lenders charge prepayment penalties, though these are becoming less common as competition increases.

Financial Benefits of Financing vs Buying Outright

The biggest advantage of financing isn't avoiding a large purchase - it's preserving your working capital for the unexpected expenses that kill restaurants. Your walk-in cooler doesn't care that you just spent your emergency fund on new equipment when it decides to die during your busiest weekend.

Financing also multiplies your purchasing power. Instead of buying one piece of equipment for $20,000 cash, you might finance $80,000 worth of equipment for similar monthly cash flow impact. This lets you upgrade your entire operation instead of limping along with mismatched, aging equipment.

The tax benefits can be substantial too. Section 179 allows you to deduct the full purchase price of financed equipment in the year you buy it, up to $1,160,000 for 2023. If you're in a 25% tax bracket and finance $40,000 in equipment, you could save $10,000 in taxes - significantly offsetting your financing costs.

There's also an inflation hedge benefit that most restaurant owners overlook. When you lock in fixed payments today, you're paying back tomorrow's debt with inflated dollars while equipment prices continue climbing.

Potential Downsides to Watch

The total cost reality is unavoidable. That $30,000 commercial oven might cost $38,000 by the time you finish paying for it. For some restaurant owners, this feels like throwing money away. For others, it's the cost of staying in business and growing.

Over-leveraging is the bigger danger. Easy access to financing can tempt you to buy more than you need. Multiple equipment payments add up fast, reducing your ability to handle slow seasons or unexpected repairs. A good rule of thumb: keep total equipment payments under 10% of your gross revenue.

Equipment obsolescence is real in our rapidly changing industry. Financing a 7-year loan on POS equipment that becomes outdated in 3 years creates a financial anchor. Consider shorter terms for technology purchases, even if monthly payments are higher.

Maintenance responsibility falls on you with equipment loans. Unlike leasing arrangements where the lessor sometimes handles repairs, financed equipment is your problem when it breaks. Budget for ongoing maintenance costs from day one.

Tax considerations vary significantly between financing structures. Equipment loans let you depreciate the equipment or use Section 179 immediate expensing, while interest payments are deductible business expenses. Equipment leases typically allow you to deduct the full payment as a business expense, providing more predictable monthly tax benefits.

Your accountant can help determine whether the depreciation benefits of ownership or the consistent deductions of leasing work better for your tax situation. Every restaurant's circumstances are different.

Restaurant Equipment Financing Mistakes

7 Must-Know Restaurant Equipment Financing Tips

Conclusion

Restaurant equipment financing is the bridge between your culinary vision and financial reality. Instead of watching competitors serve customers while you save pennies for that essential commercial oven, financing puts professional-grade equipment in your kitchen today.

The math is simple: a $30,000 equipment purchase becomes a manageable $600 monthly payment. Your cash stays in the bank for payroll, ingredients, and those unexpected repairs that always seem to happen at the worst possible time.

At The Restaurant Warehouse, we've seen too many talented chefs and restaurant owners struggle because they couldn't access the right equipment at the right price. That's exactly why we cut out the middlemen and retail markups that inflate equipment costs. When you're financing equipment, every dollar of savings multiplies across your entire loan term.

Smart financing isn't just about getting equipment - it's about positioning your restaurant for long-term success. The energy-efficient commercial refrigerator you finance today will save money on utilities for years. The faster POS system improves customer service and reduces labor costs. The reliable dishwasher prevents the weekend disasters that kill your reputation.

Your financing choice depends on your specific situation. Established restaurants with good credit often benefit from traditional equipment loans that build equity while minimizing total costs. Newer businesses or those with credit challenges might find leasing or rent-to-own programs offer the flexibility needed during unpredictable early years.

The application process has never been easier. Most lenders provide approval decisions within 24 hours and can have your equipment delivered within a week. Compare that to the months you'd spend saving cash while your competition pulls ahead.

Don't let perfect become the enemy of good. Yes, financing costs more than paying cash upfront. But the restaurant that opens next month with financed equipment will likely out-earn the one that waits six months to save cash. In the restaurant business, timing often matters more than perfect financial optimization.

Your next step is simple: gather your bank statements and tax returns, check your credit score, and start the conversation with a financing partner. The equipment you need is available today. The financing to make it happen is just an application away.

The restaurant industry rewards those who act decisively when opportunities arise. Equipment financing gives you the tools to compete from day one, not someday when your savings account finally catches up to your ambitions.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment