Catering Equipment Lease Made Easy – Cook Without Breaking the Bank

Financing Your Kitchen Dreams: Why Consider a Catering Equipment Lease

Catering equipment lease is a financing option that allows restaurant owners and caterers to access commercial kitchen equipment without making a large upfront purchase.

For quick reference, here's what you need to know about catering equipment leasing:

| Aspect | Details |

|---|---|

| Definition | A financial arrangement where you pay monthly for equipment use |

| Equipment Types | Ovens, refrigeration, dishwashers, food prep, service items |

| Monthly Cost Range | From $26 for refrigeration to $200+ for high-end ovens |

| Typical Terms | 1-5 years with fixed monthly payments |

| Tax Benefits | 100% tax deductible against profits in many cases |

| End-of-Lease Options | Return, upgrade, or purchase the equipment |

| Credit Requirements | Available for startups and established businesses |

As a restaurant owner, you know that equipping your kitchen properly can make or break your business. Yet the cost of commercial-grade equipment often feels like a roadblock to getting started or expanding. That's where leasing comes in.

Think of it this way: restaurants don't pay staff before they contribute value—they pay as employees work. Similarly, leasing lets you pay for equipment as it generates revenue for your business.

Leasing preserves your precious working capital for other critical expenses like inventory, marketing, and staffing. Instead of depleting your savings on depreciating assets, you can invest in areas that directly grow your business.

"Today's successful restaurants acquire new equipment while preserving credit scores and liquidity."

With fixed monthly payments that you can budget for, leasing offers predictability in an industry where surprises are rarely welcome. It also provides access to higher-quality, more efficient equipment than you might be able to afford outright.

For startups especially, leasing can be the difference between opening your doors now or waiting months (or years) to save enough capital. Even established restaurants use leasing to stay current with technology and trends without straining cash reserves.

Ready to explore how catering equipment leasing might work for your business? Let's dive deeper into the specifics.

Catering Equipment Lease 101: How It Works

Ever wondered how restaurant owners get all that shiny equipment without emptying their bank accounts? That's where a catering equipment lease comes in—it's essentially a friendship between your business and that commercial oven you've been eyeing.

Think of it as "try before you buy" for your kitchen. Instead of dropping thousands upfront, you make manageable monthly payments while putting that equipment to work making money for you. Here's the simple flow:

You pick out equipment from us at The Restaurant Warehouse -> apply for a lease -> the leasing company buys it -> you make monthly payments -> at the end, you decide what's next!

When you're looking at leases, you'll typically encounter two main flavors:

Operating leases feel more like renting—lower monthly payments and you usually return the equipment when done. Capital leases are more like a payment plan toward ownership, often ending with you keeping the equipment for just a dollar or small fee.

One thing our customers love is rolling everything into one neat package. Beyond just the equipment itself, your catering equipment lease can include delivery, installation, training for your staff, extended warranties, and even maintenance agreements. It's the whole enchilada, financed in one monthly payment!

What Does a Catering Equipment Lease Cover?

Almost anything your kitchen needs can be covered under a catering equipment lease. We've helped folks lease everything from tiny toasters to entire kitchen setups.

Your refrigeration needs? Covered—from reach-in fridges starting at just $26 monthly to walk-in coolers for bigger operations. Cooking equipment like ovens, ranges, and fryers? Absolutely. Food prep equipment including mixers and slicers? You bet.

Coffee machines start around $65 monthly, while dishwashers, display cases, and even complete food trucks can all be leased. Don't forget the front of house—tables, chairs, and serving stations are all fair game too.

Even your smaller kitchen tools can be bundled together to meet the typical $500 minimum threshold most leasing companies prefer. Most leasing companies actually like to see packages of $1,000 or more, but don't worry—we can help you group items together to make it work.

Who Can Qualify for a Catering Equipment Lease?

Here's the beautiful part about leasing—it's much more accessible than traditional financing. While banks might run away from restaurant startups (knowing that sadly, many new restaurants struggle in their first year), leasing companies often welcome them with open arms.

Startups with just a dream and a business plan can qualify. Established restaurants looking to upgrade can preserve their working capital. Even businesses with bumpy credit histories have options since the equipment itself serves as collateral.

Whether you're a sole proprietor or a corporation, the approval process is refreshingly straightforward: a simple application, a soft credit check (that won't hurt your score), and some basic financial information. For startups, they'll want to peek at your business plan too.

If your credit has seen better days, don't lose hope. You might:

- Work with lessors who specialize in challenged credit situations

- Bring in a cosigner with stronger credit

- Start small to build payment history

- Offer a larger security deposit

At The Restaurant Warehouse, we've partnered with leasing companies who understand that everyone deserves a shot at their culinary dreams. They know restaurants, they know equipment, and most importantly—they know how to say "yes" when others say "no."

Want to learn more about the nuts and bolts of restaurant equipment leasing? Check out our comprehensive Restaurant Equipment Lease Guide for even more details.

Pros, Cons & Cash-Flow Math

Let's talk about what really matters when you're considering a catering equipment lease – how it affects your wallet and your business. Making this decision isn't just about getting equipment; it's about smart financial planning for your restaurant's future.

Key Advantages of a Catering Equipment Lease

Think about this: instead of dropping $10,000+ on a commercial oven all at once, you could be paying just $200 monthly. That's the beauty of leasing – you keep your cash reserves ready for other critical needs like inventory, staff wages, or that unexpected plumbing emergency that always seems to happen on your busiest weekend.

One of my favorite things about leasing is that it's typically 100% tax deductible as a business expense. Unlike purchasing equipment outright where you'd depreciate it over several years, lease payments can often be deducted immediately, giving your tax situation a nice boost.

With inflation being what it is these days, there's something comforting about locking in fixed monthly payments. You're essentially paying with tomorrow's cheaper dollars while protecting yourself from price increases. Plus, leasing opens doors to equipment you might otherwise only dream about – that energy-efficient refrigeration system that would slash your utility bills but has a scary upfront price tag suddenly becomes accessible.

Smart restaurant owners align their lease terms with warranty periods. Why pay for equipment beyond its useful life? And when it comes to budgeting, those predictable monthly payments make financial planning so much easier than dealing with unexpected repair costs of aging equipment.

Unlike traditional loans that might require your house as collateral, leases typically only need the equipment itself as security. And when technology improves or your business needs change, many leases let you upgrade to newer models at the end of your term – keeping your kitchen competitive without starting the financing process from scratch.

Some leases even bundle maintenance into your monthly payment, which means no surprise repair bills and less downtime in your kitchen. And when you need equipment quickly, lease approvals typically happen within 24-48 hours, sometimes even instantly, compared to weeks of waiting for traditional bank loans.

Potential Disadvantages & Hidden Pitfalls

Let's be honest about the downsides too. Over time, you'll generally pay more for leased equipment than if you had purchased it outright. That's the trade-off for the flexibility and cash flow benefits.

With an operating lease, you don't build equity in the equipment until you exercise a buyout option – something to consider if ownership is important to you. And once you sign that lease, you're committed to payments for the full term, even if your business changes direction or you stop using the equipment.

Breaking a lease early? Prepare for some potentially steep penalties. Most leases also require you to carry insurance on the equipment, adding another expense to your monthly budget. And when the lease ends, return conditions can be surprisingly strict, sometimes leading to unexpected charges if equipment isn't in the expected condition.

There are other limitations too – you may face restrictions on modifying leased equipment to suit your specific needs, and missed payments can damage your business credit score, affecting future financing options.

Let's look at a real-world example to understand the cash flow impact:

Imagine you need a commercial convection oven priced at $12,000. Through leasing, you might pay $275 monthly for 48 months (totaling $13,200).

In your first year, buying outright means a $12,000 cash outlay, while leasing requires only $3,300 ($275 × 12). That preserves $8,700 in working capital during that critical first year. Yes, you'll pay $1,200 more over the life of the lease, but think about what that preserved $8,700 could do – fund a marketing campaign, cover several months of inventory, or help you weather a slow season without stress.

When that preserved capital helps you increase sales or reduce other costs, leasing often becomes the more profitable choice despite the higher nominal cost. It's not just about the equipment – it's about what that equipment helps your business achieve without draining your bank account.

Step-by-Step Leasing Roadmap

Getting your hands on the equipment you need through a catering equipment lease is actually pretty straightforward. Let me walk you through the journey from equipment wish list to kitchen installation:

Assess Your Equipment Needs: Start by figuring out exactly what your kitchen needs to thrive. Think about what will directly boost your revenue and improve operations.

Research and Select Equipment: Browse through our selection at The Restaurant Warehouse to find equipment that matches your needs. Take note of specifications and pricing that work for your situation.

Get Multiple Quotes: Shop around a bit! Request quotes from different vendors to make sure you're getting the best value for your hard-earned money.

Pre-Qualification: Most leasing companies offer a "soft pull" credit check that won't ding your credit score but gives you a sneak peek at what terms you might qualify for. It's like trying on the financial outfit before you buy it!

Submit Formal Application: Once you've chosen your equipment and leasing provider, the formal application usually takes less than 5 minutes online. Quick and painless!

Provide Documentation: Depending on your business stage and lease amount, you'll need to share some paperwork. For established businesses, this might include bank statements and tax returns. Startups will likely need to show a solid business plan and financial projections.

Review and Sign Lease Agreement: Take time to carefully read all the terms before signing. Pay special attention to payment schedules, end-of-lease options, and any potential fees hiding in the fine print.

Equipment Delivery and Installation: After approval, the leasing company pays us directly, and we'll coordinate delivery and installation of your equipment. It's like Christmas day for your kitchen!

Begin Making Payments: Your first payment typically kicks in about 30 days after your equipment arrives, giving you a little breathing room to start generating revenue.

End-of-Lease Decision: As your lease wraps up, you'll need to decide whether to return the equipment, buy it at the predetermined residual value, or upgrade to newer models. It's nice to have options!

Comparing Catering Equipment Lease, Lease-to-Own & Loans

Let's break down your financing options in plain English:

Traditional Equipment Lease (Operating Lease) is like renting an apartment. You're paying for the right to use the equipment, not to own it. This option gives you lower monthly payments and 100% tax-deductible payments. It's perfect for equipment that becomes outdated quickly, like certain electronics. When the lease ends, you simply hand back the keys, so to speak.

Lease-to-Own (Capital Lease) is more like a rent-to-own home. Your monthly payments (slightly higher than an operating lease) go toward eventual ownership. The equipment shows up as an asset on your balance sheet, and at the end, you'll make a small buyout payment – often just a symbolic $1. This works great for equipment that lasts many years, like heavy-duty ovens or refrigeration.

Equipment Loan is straightforward ownership from day one. You'll typically need to put down 10-20% upfront, but you might score lower interest rates than with leases. The approval process takes longer, and you'll be responsible for all maintenance and repairs. Tax-wise, you can depreciate the equipment and deduct the interest on your payments.

Each option has its sweet spot depending on your business situation, cash flow needs, and how long you plan to use the equipment. At The Restaurant Warehouse, we can help you steer which option makes the most sense for your specific circumstances.

Can I Roll Maintenance, Delivery & Installation Into My Lease?

Absolutely! One of the best perks of a catering equipment lease is the ability to finance the whole package deal – not just the equipment itself.

Think about it: when you're setting up a new kitchen or upgrading equipment, the sticker price is just the beginning. There's delivery (which can be substantial for heavy commercial equipment), professional installation to make sure everything works safely, staff training for complex equipment, extended warranties for peace of mind, and ongoing maintenance to keep everything humming along.

Rather than paying for all these extras upfront, you can bundle them into your lease. This means one simple monthly payment covers everything – the equipment, getting it to your door, setting it up, and keeping it running smoothly.

For instance, let's say you're eyeing a commercial dishwasher that costs $5,000. Add $800 for delivery and installation, plus $1,200 for a three-year maintenance agreement, and you're looking at $7,000 out of pocket. With a lease, that becomes about $220 monthly over 36 months instead of one big cash drain.

This approach preserves your working capital for things that directly generate revenue, like marketing or inventory. Plus, the entire payment – including all these "soft costs" – is typically tax-deductible, making it an efficient way to manage your business expenses.

At The Restaurant Warehouse, we specialize in creating these turnkey solutions. We'll help you structure a lease that includes everything you need, so you can focus on what you do best – creating amazing food and experiences for your customers – while we handle the equipment details.

Rates, Terms & Tax Perks You Should Know

Let's talk money – the part that makes most restaurant owners' eyes glaze over, but I promise to keep this straightforward! Understanding the financial nuts and bolts of your catering equipment lease can actually save you thousands and make budgeting a whole lot easier.

Lease Rates and Terms

Think of lease rates like restaurant menu pricing – they vary based on what you're ordering and who's doing the ordering. Your "financial reputation" (that's your credit score) plays a big role here. The better your score, the sweeter the deal you'll typically get.

Established businesses with a few years under their belt often qualify for more favorable terms than startups – it's like the difference between being a regular customer and a first-timer. The equipment itself matters too; newer equipment generally comes with better rates than used gear.

Most catering equipment lease agreements run between 12 and 60 months. The shorter the term, the higher your monthly payment, but you'll pay less overall. It's a classic tradeoff.

At The Restaurant Warehouse, we've seen commercial refrigeration units lease for as little as $26 per month – about the cost of a few coffee drinks! High-end equipment like combi ovens might start around $162 monthly on a 60-month plan. Most leases require little to no down payment, which is fantastic for preserving your cash flow.

Just watch for that documentation fee – usually $100-$300 – which covers all the paperwork processing. Think of it as the "cover charge" to enter the leasing club.

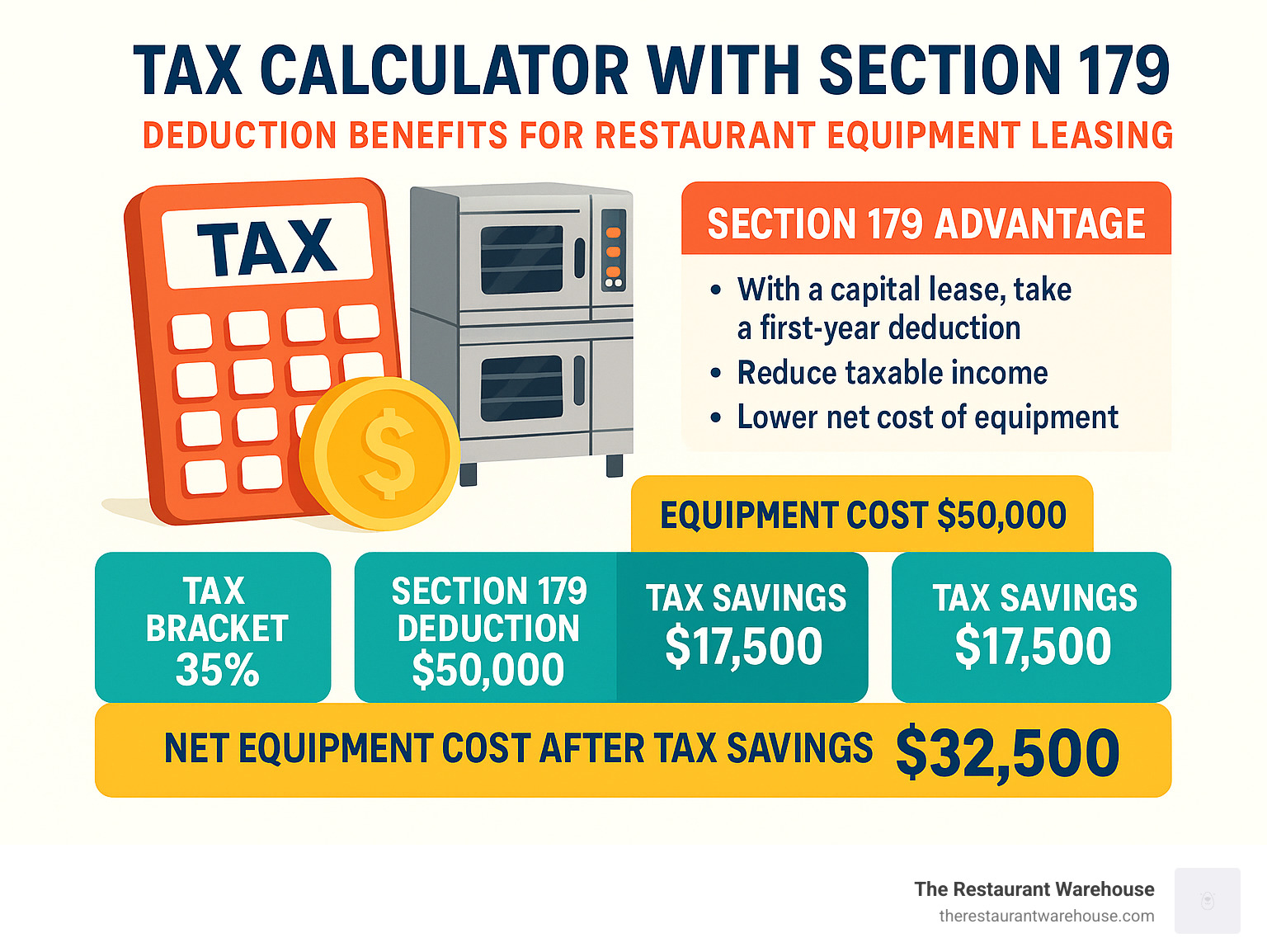

Tax Benefits: Section 179 Advantage

Now here's where it gets really interesting – the tax benefits! Section 179 of the IRS tax code is like a secret menu item that savvy restaurant owners take full advantage of.

This provision lets you deduct the full purchase price of qualifying equipment that you purchase or finance during the tax year. As of 2025, you can deduct up to $1,250,000 – that's not a typo!

With a capital lease (the lease-to-own type), you can typically take this deduction in the first year, potentially saving you thousands. Here's a quick example that shows the power of this benefit:

If you lease $50,000 worth of equipment and you're in the 35% tax bracket, your Section 179 deduction could save you $17,500 in taxes. That effectively reduces your equipment cost to $32,500!

Of course, I'm not a tax professional (and neither is your equipment supplier), so always chat with your accountant about how these benefits apply to your specific situation.

Typical Documentation Checklist for a Catering Equipment Lease

Paperwork – not the fun part of opening a restaurant, but necessary nonetheless. For smaller leases under $10,000, the process is usually pretty streamlined. You'll typically need to provide your completed application with basic business information, proof of your business's existence (license, EIN, etc.), and some financial information.

For established businesses, expect to share recent bank statements and tax returns. If you're just starting out, a solid business plan becomes even more important – it shows the leasing company you've thought things through.

You'll also need to provide personal information (yes, they'll check your credit), a detailed quote for the equipment you want, and proof that you'll insure it. For bigger leases over $50,000, the paperwork requirements typically increase – kind of like how the wine list gets longer at fancier restaurants.

How Leasing Improves (or Hurts) Your Budget Forecast

Let's be real – running a restaurant means constantly juggling expenses. A catering equipment lease can make this juggling act easier with predictable monthly payments. Instead of watching $10,000 vanish from your account for that new oven, you might pay just $200 monthly. That leaves cash available for inventory, marketing, and handling those inevitable surprises (like when your star chef decides to open their own place).

The tax benefits we discussed earlier can significantly reduce your tax bill, effectively lowering your equipment costs. Plus, there's something beautiful about matching your equipment payments to the revenue it helps generate – that pizza oven starts paying for itself with the first pie it bakes.

On the flip side, leasing does mean committing to payments for the full term. If business slows down, those payments keep coming. And yes, you'll typically pay more over the long haul than with a cash purchase – that's how financing works.

When forecasting, ask yourself: Will this new equipment increase your production capacity? Reduce labor costs? Enable new menu items with higher profit margins? If the equipment generates more additional profit than its monthly lease payment, it's probably a smart move, even with the higher long-term cost.

At The Restaurant Warehouse, we understand that every dollar counts in the restaurant business. That's why we offer competitive leasing options that help you get the equipment you need while keeping your budget on track. Check out our Restaurant Equipment Financing Guide for even more detailed information on making the numbers work for your business.

Alternatives & Decision Framework

While a catering equipment lease offers many benefits, it's worth exploring all your options before making a commitment. Let's walk through the alternatives and provide a practical framework to guide your decision.

Outright Purchase

Buying equipment outright gives you immediate ownership – something many restaurant owners find appealing. You'll enjoy the lowest total cost over time and complete freedom to modify or sell the equipment as needed. Plus, there's a certain peace of mind that comes with not having monthly payment obligations.

However, this approach requires a substantial cash investment upfront. You'll also shoulder all maintenance and repair costs yourself. While Section 179 can help with taxes, standard depreciation schedules spread deductions over years rather than providing immediate benefits. And let's face it – that shiny new equipment will eventually become outdated, regardless of how you acquired it.

Outright purchase works best for businesses with healthy cash reserves and when you're buying equipment with a long useful life – think stainless steel work tables or gas ranges that could serve you for a decade or more.

Equipment Loans

Equipment loans typically offer lower interest rates than leases and allow you to build equity with each payment. Many lenders offer extended terms of 5-10 years, which can make monthly payments more manageable. You'll also benefit from tax deductions on interest and depreciation.

The downside? Most lenders require a down payment of 10-20%, and they'll scrutinize your credit history more closely than leasing companies. The approval process tends to be lengthier too. And remember, at the end of your loan term, you'll own equipment that's seen years of hard kitchen use.

Equipment loans make sense for established restaurants with solid credit and for purchasing equipment that maintains its value and functionality for many years.

Equipment Rental

Sometimes you just need equipment temporarily – perhaps for a big catering job or seasonal rush. Rentals offer maximum flexibility with minimal commitment. You won't worry about maintenance, and you can easily upgrade when needed. It's also a great way to test equipment before making a longer-term commitment.

But convenience comes at a price – monthly rental costs exceed lease payments, and you'll never own the equipment. Selection may be limited in some markets, and the tax benefits are typically less advantageous than leasing or purchasing.

Rentals are ideal for temporary needs, seasonal operations, or when you want to test equipment before committing to a purchase or lease.

Used Equipment Purchase

The restaurant industry's high turnover rate means there's always used equipment available at substantial discounts. Buying pre-owned gives you immediate ownership at a fraction of new prices, and quality equipment may retain reasonable resale value.

Of course, warranties are limited or nonexistent, and reliability can be questionable. You'll likely face higher maintenance costs and shorter remaining useful life. That bargain might not seem so great if it breaks down during your Saturday dinner rush.

Used equipment purchases work well for budget-conscious operators with mechanical skills or reliable service providers on speed dial.

Scratch-and-Dent or Closeout Equipment

At The Restaurant Warehouse, we frequently offer scratch-and-dent or closeout models that deliver exceptional value. These units function perfectly but may have minor cosmetic imperfections or be discontinued models. You'll enjoy substantial discounts – often 30-50% off retail – while still getting new equipment warranties. Plus, the reduced initial cost means less depreciation over time.

The tradeoffs? Those cosmetic imperfections, limited selection, and the need to act quickly as these deals don't last long. But for equipment tucked away in your kitchen, does a small dent on the side really matter?

Scratch-and-dent equipment is perfect for value-conscious buyers who care more about performance than perfect appearance.

Decision Framework

To determine your best path forward, consider these key factors:

Your cash position matters tremendously – how much working capital do you need to preserve for other aspects of your business? Your credit status will influence which financing options are realistically available. Think about the equipment lifespan – how quickly will technological advances make it obsolete?

Your tax situation might make certain options more advantageous than others. Consider your growth plans – will you need to upgrade as your business expands? And be honest about your maintenance capability – do you have resources to handle repairs yourself?

For many new restaurants, a blended approach works best – perhaps leasing critical cooking equipment while purchasing used or scratch-and-dent items for less essential needs. This strategy preserves capital while ensuring reliability where it matters most.

For more detailed information about equipment financing options, check out the Equipment Leasing and Finance Association, which provides industry resources and educational materials about equipment leasing.

Common Mistakes to Avoid When Signing a Catering Equipment Lease

We've seen restaurant owners make the same mistakes repeatedly when signing leases. Don't be one of them! Always read the fine print carefully, especially regarding early termination fees and end-of-lease obligations. Understand your end-of-term options completely – whether you can return, purchase, or renew, and what each will cost you.

Be careful not to mismatch the lease term and equipment lifespan – paying for equipment that's no longer functioning properly is painful. Maintain adequate insurance coverage to avoid being responsible for full replacement costs if accidents happen. Clarify maintenance responsibilities upfront so there are no surprises when something breaks.

Look beyond the monthly payment to consider total cost over the lease term. Only lease equipment that will contribute to your revenue – that fancy ice cream machine isn't worth it if specialty desserts aren't part of your business model. And remember that many lease terms are negotiable, especially if you have established credit.

At The Restaurant Warehouse, we're committed to helping you steer these decisions transparently. We'll connect you with reputable leasing partners who understand the unique challenges of the restaurant industry and can structure agreements that truly support your business goals.

Frequently Asked Questions about Catering Equipment Lease

Is leasing catering equipment 100% tax deductible?

One of the most appealing benefits of a catering equipment lease is indeed its tax advantages. In most cases, your lease payments can be 100% tax-deductible as a business expense. This gives leasing a significant edge over purchasing, where you'd typically need to depreciate the equipment over several years.

If you've chosen an operating lease (where you return the equipment at the end), you can generally deduct the entire payment as a simple rental expense. It's clean, straightforward, and helps reduce your taxable income each year.

With capital leases (those lease-to-own arrangements), the tax picture looks a bit different but still favorable. The interest portion of your payment is deductible, and you may also be able to depreciate the equipment or take advantage of Section 179 for an immediate deduction.

That said, tax laws have more twists and turns than a food truck rally, and they change frequently. We always recommend sitting down with your tax professional to understand exactly how these deductions will work for your specific situation. They can help you maximize your tax benefits while keeping everything by the book.

Can startups with limited credit still lease equipment?

Absolutely! In fact, many startups find that leasing is their financial lifeline when other doors are closed. While traditional banks might look at new restaurant ventures with raised eyebrows (we all know the statistics about restaurant success rates), many leasing companies actually specialize in helping new businesses get off the ground.

Why can startups often qualify when traditional financing says no? Several reasons:

First, the equipment itself serves as collateral, which reduces the lender's risk. If you're leasing a $10,000 oven and can't make payments, they can take back the oven—they're not left empty-handed.

Second, leasing typically requires little to no down payment, which preserves your precious startup capital for other critical expenses like inventory and marketing.

Third, many lessors have flexible credit requirements with programs specifically designed for businesses with limited history. They understand that everyone has to start somewhere!

If you're launching your culinary dream with less-than-perfect credit, don't despair. Consider starting with a smaller equipment package to establish payment history, or bring in a cosigner with stronger credit. A detailed business plan showing how the equipment will generate revenue can also work wonders. Sometimes, offering a slightly larger security deposit can seal the deal.

At The Restaurant Warehouse, we've partnered with leasing companies who understand the unique challenges facing restaurant startups. They've helped countless culinary entrepreneurs turn their dreams into reality, even with limited credit history.

What happens at the end of my catering equipment lease term?

When your catering equipment lease reaches its finale, you're not left hanging—you've got options! Think of it as a choose-your-own-trip ending for your financial agreement.

Option 1: Return the Equipment. With an operating lease, you can simply hand back the keys (figuratively speaking) and walk away. Just remember that the equipment needs to be in good working condition with only normal wear and tear. No returning that deep fryer that somehow ended up in the parking lot during your staff party!

Option 2: Purchase the Equipment. Most leases offer a buyout option that lets you keep the equipment you've come to know and love. The price tag varies depending on your lease type:

- With a $1 buyout lease, it's exactly what it sounds like—one dollar and that commercial mixer is all yours

- A 10% buyout means you'll pay 10% of the original equipment value

- Fair market value (FMV) leases require you to pay whatever the equipment is worth at that time (as determined by an appraisal)

Option 3: Upgrade to New Equipment. Many lessors are happy to set you up with shiny new models on a fresh lease. This is particularly valuable for technology-dependent equipment that becomes outdated quickly. Out with the old, in with the new!

Option 4: Extend the Lease. Not ready to commit to buying but still want to use the equipment? Many lessors will let you extend the lease, often at a reduced monthly payment. It's like dating a little longer before deciding whether to put a ring on it.

All these options should be clearly spelled out in your lease agreement before you sign. We recommend reviewing these terms carefully and planning your strategy well before the lease ends. For instance, if you have a 48-month lease on a commercial oven with a $1 buyout option, you might want to budget for that final payment to take ownership of equipment that still has several years of useful life ahead.

A little planning goes a long way in making sure the end of your lease is a beginning of new opportunities rather than a financial headache.

Conclusion

A catering equipment lease can be the game-changer that open ups your restaurant or catering business's full potential without emptying your bank account. Throughout this guide, we've seen how leasing creates a pathway to success that aligns with how restaurants actually operate—paying for resources as they generate value.

Think about it—having the right equipment isn't just about cooking food. It's about creating experiences, meeting customer expectations, and building a sustainable business. When you preserve your working capital through leasing, you're giving yourself breathing room to weather those inevitable slow periods or unexpected challenges that come with the territory.

I've seen countless restaurant owners breathe a sigh of relief when they find they can access that high-efficiency oven or state-of-the-art refrigeration system without a massive upfront investment. The predictability of fixed monthly payments brings peace of mind in an industry where surprises usually mean stress and unexpected costs.

The tax advantages shouldn't be overlooked either. While your accountant can give you the specifics for your situation, those 100% deductible lease payments often make more financial sense than depreciation schedules for purchased equipment. It's not just about spending less—it's about spending smarter.

Perhaps the most beautiful aspect of leasing is the flexibility it provides as your business evolves. That equipment package that's perfect for your current volume might not be sufficient when your catering business takes off next year. With leasing, upgrading becomes a natural part of your growth journey rather than a financial hurdle.

At The Restaurant Warehouse, we've built our business around removing unnecessary costs from the equipment equation. Our wholesale pricing approach perfectly complements the financial advantages of equipment leasing. We're not just selling equipment—we're partnering with you to find the right acquisition strategy for your unique circumstances.

Whether you ultimately decide that leasing, financing, or purchasing outright makes the most sense, our team is here to guide you through the options without the high-pressure sales tactics. We understand that your equipment decisions impact your business for years to come, and we take that responsibility seriously.

Ready to explore how equipment leasing might work for your specific situation? Our extensive selection of commercial kitchen equipment awaits, and our team is standing by to answer your questions about leasing options that align with your business goals.

Smart equipment decisions create the foundation for sustainable restaurant growth. The information in this guide is your first step toward equipping your kitchen in a way that supports both your culinary vision and your financial health.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment