Fuel Your Kitchen: Low Monthly Payments for Restaurant Equipment

Open uping Your Restaurant's Potential with Equipment Financing

Equipment financing restaurant is a specific type of loan that helps restaurant owners get vital kitchen gear without draining their cash flow. It's a smart way to equip your business.

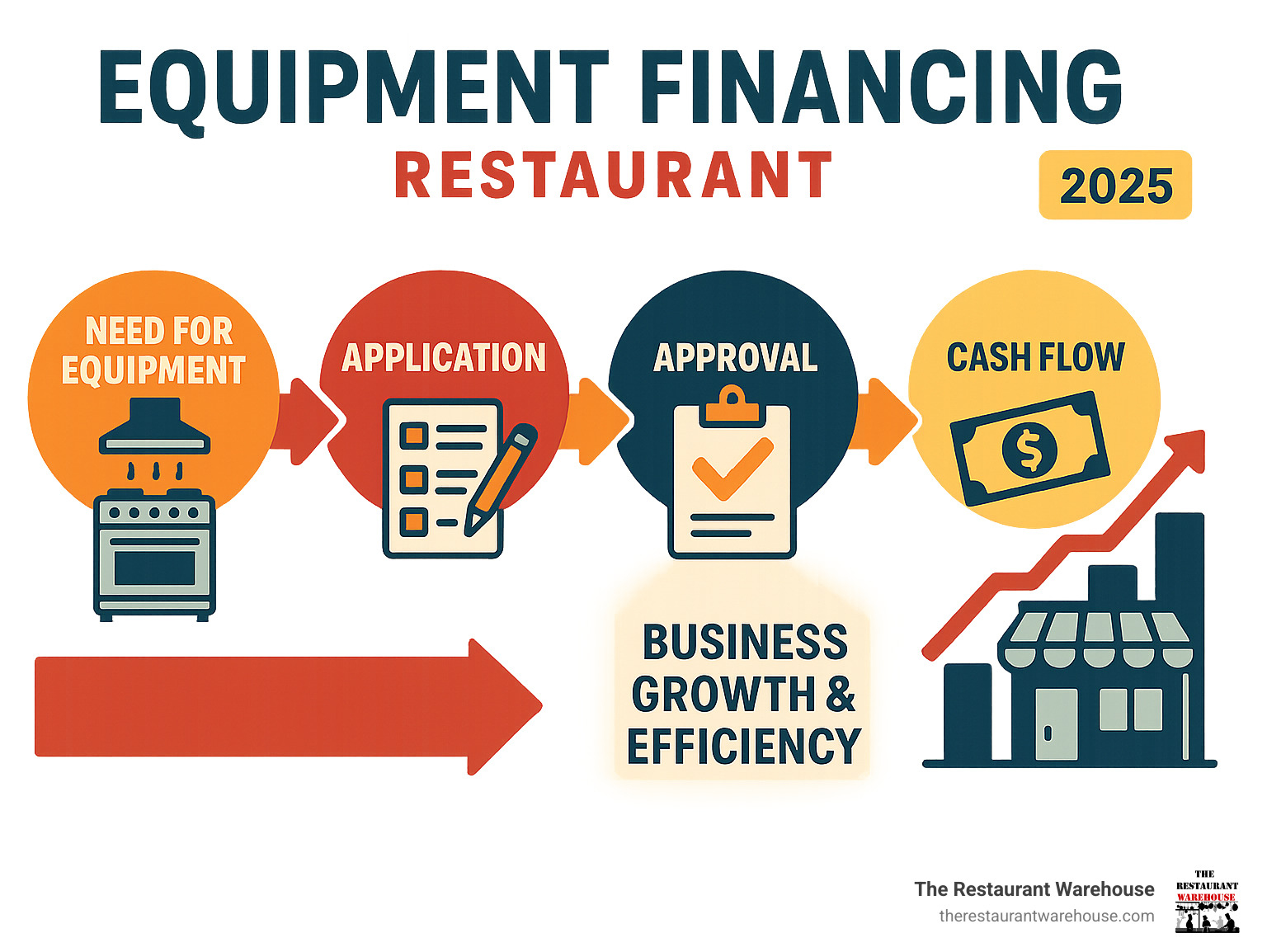

Here’s how equipment financing restaurant can help your business:

- Preserve Cash Flow: Keep your working capital for daily needs, like payroll and ingredients.

- Acquire Essential Equipment: Get the high-quality, specialized gear you need to compete.

- Spread Out Costs: Pay for expensive equipment over time with predictable monthly payments.

Starting or growing a restaurant is demanding, and equipment costs are a major hurdle. Restaurant owners need top-notch equipment to succeed but must also keep cash for daily operations. Financing bridges this gap.

It allows you to get the tools you need now and pay for them as they generate revenue. This approach avoids large upfront costs, keeping your business financially strong and nimble.

Quick look at equipment financing restaurant:

- used restaurant equipment leasing

- catering equipment lease to buy

- lease restaurant equipment near me

Understanding Your Options: Financing vs. Leasing

When looking to get new gear for your restaurant, you have two main choices: equipment financing restaurant (a loan) or equipment leasing. Both help you get the tools you need without a large upfront cost. Knowing the difference is key to picking what's best for your business.

An equipment loan is straightforward: you borrow money to buy the equipment, making it yours from day one. The equipment itself usually serves as collateral, which can simplify approval. With each monthly payment, you build equity. Once paid off, you own it completely. This is ideal if you plan to use the equipment long-term and want to build your business's assets. On your balance sheet, the equipment is an asset, and the loan is a liability.

An equipment lease agreement is like renting. You use the equipment for a set term with regular payments but don't own it. At the lease's end, you can return it, renew the lease, or buy it. Leasing is great for frequent upgrades or avoiding ownership duties like maintenance. It treats the cost as an operating expense, not a large asset. Leasing can also cover 100% of costs, including installation, and may have easier credit requirements.

While leasing has perks, equipment financing restaurant (loans) is more common in the industry. This is likely because restaurant equipment is durable, and owners prefer to build equity. Both options offer predictable monthly payments for easier budget management.

To help you see the differences clearly, here's a quick comparison:

| Feature | Equipment Financing (Loan) | Equipment Leasing |

|---|---|---|

| Ownership | You own the equipment from day one. | The leasing company owns the equipment. |

| Upfront Cost | Typically requires a down payment, though 100% financing is possible. | Often no down payment required. |

| Total Cost | Generally lower total cost over time if you keep the equipment long-term. | May have a higher total cost over time, especially if purchased at the end. |

| Balance Sheet Impact | Equipment is an asset, loan is a liability. | Lease payments are typically an operating expense. |

| End-of-Term Options | You own the equipment outright. | Return, renew, or purchase the equipment. |

| Flexibility | Less flexible if you want to upgrade frequently. | High flexibility for upgrades or technology changes. |

| Tax Implications | Can deduct interest and depreciation. | Lease payments are often fully tax-deductible as an operating expense. |

Ready to dive deeper into leasing? Check out our Lease Commercial Kitchen Equipment Guide and find flexible options with Lease To Own Restaurant Equipment.

What Types of Equipment Can You Finance?

Equipment financing restaurant is incredibly flexible. You can finance almost any equipment essential for your restaurant's operation, from large machines to smaller tools. If it helps your business generate revenue, it's likely financeable.

You can finance all sorts of essential items. For your kitchen's heart, this includes cooking equipment like heavy-duty ranges, fryers, griddles, and specialized tools like charbroilers, tilt skillets, or steam-jacketed kettles.

Crucial refrigeration and freezing units are also covered, including walk-in coolers, reach-in refrigerators, prep tables, ice machines, and display cases. Learn more in our guide on Choosing The Right Commercial Refrigeration System For Your Restaurant.

Financing also applies to food preparation equipment that speeds up your workflow, such as mixers, food processors, slicers, and grinders. For cleanliness, dishwashing and sanitation equipment like commercial dishwashers and waste disposal systems are also financeable.

Modern Point-of-Sale (POS) systems and software—including hardware and payment processing—are key for managing orders and inventory. You can also finance your dining room furniture and fixtures, from tables and chairs to lighting and HVAC systems, which are all crucial for your customer's experience and brand identity.

Finally, financing can cover specialized equipment like coffee brewers, ventilation hoods, or delivery vehicles. Smaller items can often be bundled into one agreement, so you don't have to pay cash for every pot and pan. The rule is simple: if it helps your restaurant earn money, it's likely financeable!

The Tangible Benefits of Equipment Financing for Your Restaurant

How you acquire equipment can significantly impact your restaurant's financial health. Equipment financing restaurant offers strategic benefits beyond just getting the tools you need, enabling smart growth and financial management.

A primary advantage is cash flow management. Restaurants have steep operating costs and tight margins. Financing lets you get essential equipment without a large upfront purchase, preserving capital for daily needs like inventory, payroll, and marketing. This keeps your business financially flexible.

This leads to capital preservation. Financing keeps your working capital free for unforeseen expenses or new opportunities. It also preserves your bank credit lines for other needs, like expansion or emergencies.

Another benefit is budget predictability. Equipment financing typically involves fixed monthly payments, making cash forecasting and budgeting easier. This stability helps you spread costs over the asset's useful life, unlike loans with fluctuating interest rates.

Finally, financing helps you gain a competitive edge. Modern equipment improves food quality, service speed, and operational efficiency. It can boost staff morale and productivity. Financing allows you to acquire these upgrades without a large capital outlay, keeping you competitive.

For more detailed insights, check out our article on the Benefits Of Restaurant Equipment Financing.

Opening up Tax Advantages with Section 179

Here’s a fun fact that can put a smile on your accountant's face: equipment financing restaurant can come with significant tax advantages, particularly through Section 179 of the IRS tax code.

Section 179 allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year, rather than depreciating it over several years. This means you can write off the entire cost of the equipment in the year it's put into service, potentially leading to a substantial tax deduction.

The best part? This deduction applies to both new and used equipment, as long as it's put into use during the tax year. For 2023, businesses financing less than $1,000,000 in new or used restaurant equipment may qualify for a 100% tax deduction under Section 179. It's a powerful incentive to invest in your business.

Let's look at an example: Say you finance $10,000 worth of new kitchen equipment, and your business is in a 35% tax bracket. With the Section 179 deduction, you could potentially get a $3,500 tax deduction, effectively reducing the "true" cost of that equipment to $6,500. That's a pretty sweet deal!

To maximize your savings, it’s often beneficial to finalize your equipment financing restaurant and acquire the equipment before December 31st of the tax year. This allows you to claim the deduction for that year. It's always a good idea to consult with your tax advisor to understand how Section 179 specifically applies to your business.

For the official word, you can always refer to the Official IRS information on Section 179 Deduction.

How Financing Impacts Your Financials

Understanding how equipment financing restaurant impacts your financial statements is crucial for any savvy restaurant owner. It’s not just about monthly payments; it’s about how these transactions reflect your business's health.

When you take out an equipment loan, the equipment itself is recorded as an asset on your balance sheet. This is a good thing, as it increases your business's overall value. Simultaneously, the loan amount is recorded as a liability. This reflects your obligation to repay the borrowed funds.

Each month, as you make your payments, two things happen:

- A portion of your payment reduces the principal amount of your loan, decreasing your liability.

- The interest portion of your payment is recorded as an interest expense on your income statement. This expense reduces your taxable income, which can be another subtle tax benefit.

Additionally, the equipment, as an asset, will undergo depreciation over its useful life. This is a non-cash expense that also reduces your taxable income over time.

In contrast, if you were to lease equipment, it often doesn't appear as an asset or a liability on your balance sheet (depending on the type of lease). Instead, the lease payments are typically treated as an operating expense, directly impacting your income statement. This can be beneficial if you're trying to keep your debt-to-equity ratio low or if you prefer a simpler accounting approach for equipment that you don't intend to own long-term.

Equipment financing restaurant provides a clear picture of your assets and liabilities, allowing for transparent financial reporting and strategic planning. It's a way to grow your operational capacity while maintaining a clear understanding of your financial position.

Navigating the Application Process: From Quote to Funding

Getting equipment financing restaurant approval is much faster and more predictable than you might think. The process is streamlined for restaurant owners who need quick solutions for unexpected breakdowns or new opportunities.

The journey starts once you've identified the equipment you need. Get a detailed vendor quote specifying the model, features, and total cost. This quote is crucial for your application, as the equipment serves as collateral.

Next, the application step is straightforward. Most lenders have simple online applications that take minutes. You'll provide basic business information, like time in business, annual revenue, and details on the equipment.

The approval timeline is often surprisingly quick. Many lenders provide a credit decision within hours, sometimes in minutes, thanks to automated underwriting systems that assess your application rapidly.

Once approved, you'll review and sign documents, usually online. The funding speed is a major benefit; many lenders transfer funds within 24 to 48 hours of signing. You could apply on Monday and have your equipment by Wednesday.

The entire process is designed around the reality of restaurant operations. Having a solid business plan ready can help smooth the process, and our guide on How To Write A Restaurant Business Plan can help you prepare the documentation that might be requested.

Common Eligibility Requirements for equipment financing restaurant

While every lender has their own recipe for approval, there are common ingredients that most look for when evaluating equipment financing restaurant applications. Understanding these requirements upfront can help you prepare and increase your chances of quick approval.

Time in business is a key factor. Most lenders prefer at least six months to one year of operation to show you can manage the industry's challenges. However, startup-friendly options are available.

Your annual revenue shows lenders if you can handle monthly payments. Requirements vary, but many look for minimums between $100,000 and $250,000 to ensure payments won't strain your cash flow.

Your personal credit score is significant, especially for smaller businesses. A FICO score of 620 or higher is a good starting point, but some lenders are flexible. Because the equipment serves as collateral, financing is often more forgiving than other business loans.

Business credit history is another piece of the puzzle. Lenders will review how your business has handled credit in the past – things like paying suppliers on time, managing business credit cards, and any previous loan payments. Even if your business credit is limited, a strong personal credit history can often compensate.

The equipment itself needs to be clearly defined through a detailed quote from your vendor. Since the equipment serves as collateral, lenders want to know exactly what they're financing and its value. This collateral aspect is actually what makes equipment financing more accessible than many other business loans.

If you're wondering about your chances, our article on How Hard Is It To Get A Restaurant Equipment Loan provides more detailed insights into what lenders are really looking for.

Securing equipment financing restaurant options for Startups and Bad Credit

Every restaurant deserves a shot at success, regardless of how long they've been in business or what their credit report looks like. The restaurant industry is full of comeback stories and fresh starts, and equipment financing restaurant providers understand this reality.

Startup financing might seem like an uphill battle, but it's more achievable than many new restaurant owners realize. The equipment itself serves as collateral, which significantly reduces the lender's risk. This means that even without years of operating history, you can still qualify for financing. Many lenders specifically cater to startups and understand that every successful restaurant had to start somewhere.

The key for startups is preparation. Having a solid business plan, demonstrating industry experience (even if it's from working for other restaurants), and showing realistic financial projections can go a long way. Some lenders may require a larger down payment from newer businesses, but 100% financing is still possible in many cases. Check out our guide on Restaurant Equipment Leasing For Startups for more specific strategies.

Bad credit solutions are more common than you might think. Life happens – maybe you went through a divorce, had medical bills, or experienced a previous business setback. The beautiful thing about equipment financing is that the equipment serves as security for the loan. This collateral-backed approach means lenders are often willing to look beyond credit scores to other factors like current cash flow, time in business, and revenue trends.

Alternative lenders have emerged specifically to serve businesses that traditional banks might turn away. These lenders often use different underwriting criteria and may focus more on your business's current performance than past credit issues. While interest rates might be slightly higher with challenged credit, the ability to get the equipment you need to grow your business often makes it worthwhile.

The most important thing is to be honest about your situation. Many lenders appreciate transparency and are willing to work with you to structure a deal that makes sense for your circumstances. Don't let past financial challenges keep you from pursuing the equipment your restaurant needs to thrive. Our detailed guide on Restaurant Equipment Financing Bad Credit offers more specific strategies and options for businesses in this situation.

Frequently Asked Questions about Restaurant Equipment Financing

It's completely normal to have questions when you're considering a big step like equipment financing restaurant. In fact, asking questions means you're doing your homework, and that's fantastic! We hear a lot of similar queries from restaurant owners like yourself, and we're always happy to clear things up. Let's explore some of the most common ones.

How quickly can I get funding for my restaurant equipment?

This is often one of the first questions we get, and for good reason! When you need equipment, you usually need it yesterday. The great news is that equipment financing restaurant is designed to be incredibly fast, especially compared to traditional bank loans that can feel like they move at a snail's pace.

Imagine this: your walk-in cooler suddenly gives up the ghost right before a busy weekend. You can't wait weeks for a new one. This is where the speed of equipment financing truly shines. Many online applications can be completed in just a few minutes – seriously, sometimes as little as two! Once you've applied, credit decisions can come back at lightning speed. We're talking approvals in minutes for some lenders, or within an hour during normal business hours.

And the best part? Once you're approved and you've signed the necessary documents, funding can be remarkably swift. It's not uncommon for the funds to be available in as little as 24 hours, often hitting your bank account by the very next business day. This rapid process is a huge advantage, allowing you to quickly replace essential gear or seize new opportunities without missing a beat.

Can I finance used restaurant equipment?

Absolutely, you can! This is a fantastic option for many restaurant owners, as purchasing used equipment can offer some serious cost savings. It allows you to stretch your budget further, getting more of what you need without breaking the bank.

However, when you're looking at financing used equipment, it's super important to do your homework. We always recommend a thorough inspection of the equipment. Look for any cosmetic blemishes, but more importantly, check for functional issues. Ask for detailed maintenance records to understand the equipment's history and ensure it's been well-cared for. And don't forget to inquire about any remaining warranties or guarantees from the seller.

Just like with brand-new items, the used equipment itself acts as collateral for the loan. This means it's a perfectly viable financing option that lenders are comfortable with. By choosing to finance used equipment, you can save money while still equipping your kitchen with reliable tools. To learn more about navigating the used equipment market, check out our guide on Used Restaurant Equipment.

What happens at the end of an equipment financing term?

This is truly the most rewarding part of equipment financing restaurant! Once you've diligently made all your scheduled monthly payments and the loan term has come to an end, something wonderful happens: you will own the equipment outright.

There's no catch, no hidden fees, and no further payments required. The title to the equipment (if applicable, especially for larger items) will be officially transferred to your business. This means that piece of equipment is now a debt-free asset on your balance sheet, contributing directly to your business's overall value. You have complete freedom to continue using it for as long as it serves your needs, sell it if you upgrade, or even trade it in. It's a clear, straightforward path to building equity and investing in the long-term success of your restaurant.

Conclusion: Equip Your Dream Kitchen Today

Running a restaurant is a true labor of love, isn't it? It's a journey filled with passion, hard work, and delicious creations. And at the heart of every successful restaurant lies the right equipment. Having the best tools allows you to serve your customers efficiently, maintain top-notch quality, and truly expand your culinary dreams.

That's where equipment financing restaurant comes in. It's so much more than just a loan; it's a smart, strategic tool designed to empower your business. Imagine being able to preserve your precious working capital, keeping it free for daily operations like payroll and ingredients. Think about benefiting from significant tax advantages, like the incredible Section 179 deduction, which can put money back in your pocket. Plus, with predictable monthly payments, you gain clear control over your budget and cash flow.

Whether you're a busy, established eatery with a loyal following, or a vibrant new startup just getting your feet wet, there are flexible equipment financing restaurant solutions custom-made for your unique needs. Even if your credit history isn't picture-perfect, don't worry – options exist to help you get the gear you need.

Here at The Restaurant Warehouse, we genuinely understand the pulse of the foodservice industry and just how vital accessible, affordable equipment is. We're dedicated to providing you with the very best tools to succeed, all without the high commissions and retail overhead that can inflate costs elsewhere. Our wholesale pricing is designed specifically to give you a real competitive edge, helping your bottom line.

Don't let the high upfront cost of commercial kitchen equipment stand between you and your dreams. With the right equipment financing restaurant partner, you can fully equip your dream kitchen today. This frees you up to focus on what you do best: crafting incredible dining experiences that keep your customers coming back for more.

Ready to take that exciting next step and transform your kitchen? Explore your financing options with us and find how surprisingly low monthly payments can truly fuel your restaurant's growth.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment