Finance Your Catering Equipment Without Breaking the Bank

Why Smart Restaurant Owners Choose Equipment Finance Over Cash Purchases

Catering equipment finance helps restaurant owners spread the cost of essential kitchen equipment over time instead of paying large upfront amounts that can drain working capital.

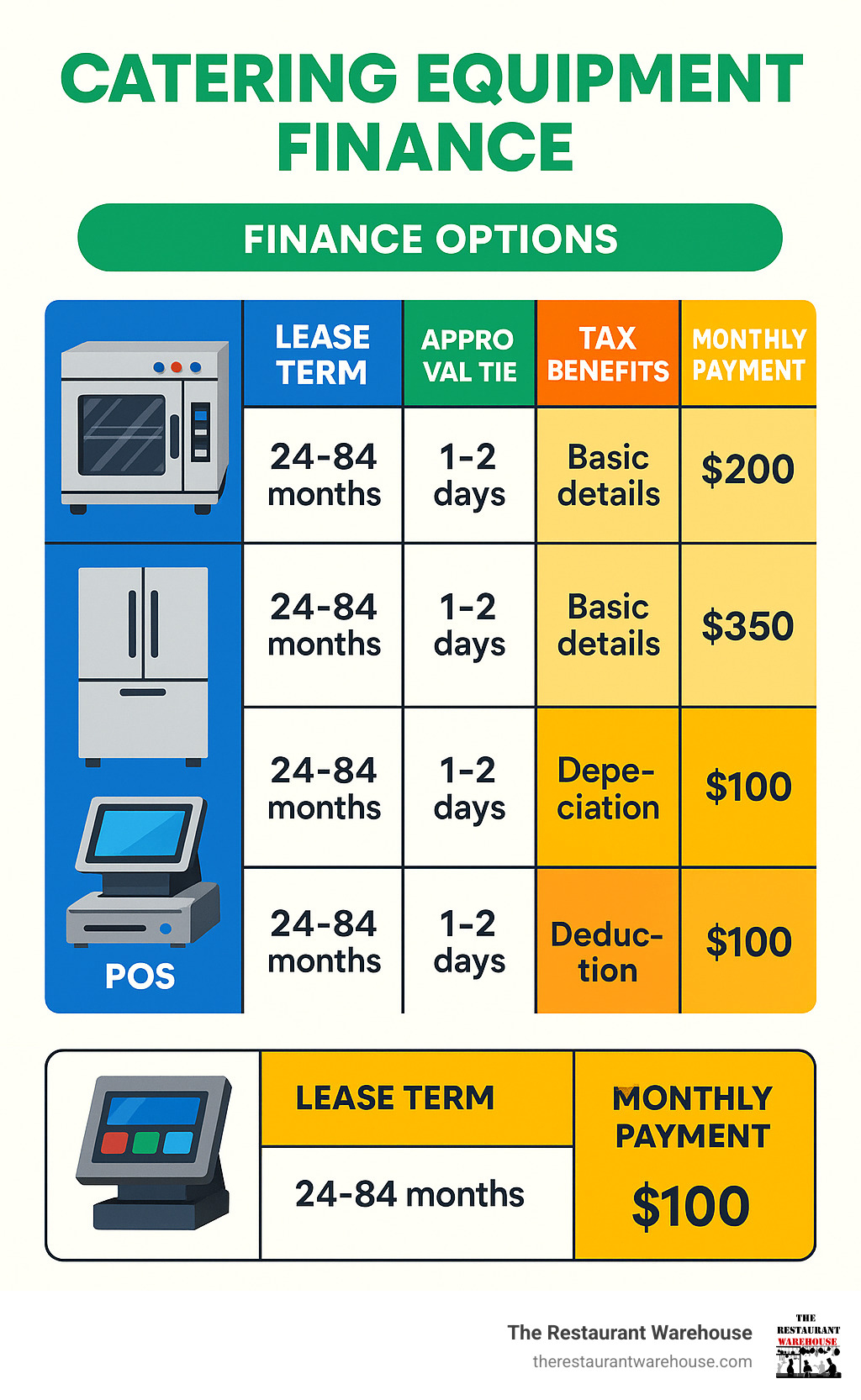

Quick financing options for restaurant equipment:

- Lease-to-own: 24-84 month terms with $1 buyout option

- Rent-try-buy: 12-month flexible rental with upgrade options

- Business loans: Traditional financing up to $5 million

- Hire purchase: Fixed payments leading to ownership

- Operating lease: 100% tax-deductible rental payments

Starting a restaurant or upgrading your kitchen shouldn't mean emptying your bank account. The research shows that 91% of equipment finance applications get approved, with decisions often delivered within 24 hours.

Most successful restaurant owners preserve their cash flow by financing equipment rather than buying outright. Equipment financing lets you get the commercial ovens, refrigeration units, and dishwashers you need today while spreading payments over 2-7 years. Many programs offer 100% financing with no down payment required.

The key benefit? You keep your working capital free for daily operations, inventory, and unexpected expenses that every restaurant faces.

Catering equipment finance terms to learn: - catering equipment lease - restaurant equipment financing

Why This Guide Matters

Chef entrepreneurs face a tough reality: quality commercial kitchen equipment costs tens of thousands of dollars, but most equipment has a useful lifespan of 10-15 years. The smart acquisition strategy isn't always paying cash upfront—it's matching your payment schedule to how the equipment generates revenue for your business.

We've compiled this comprehensive guide to help you steer the maze of financing options available today. Whether you're opening your first restaurant or expanding an existing operation, understanding your financing choices can mean the difference between success and cash flow struggles.

Understanding Catering Equipment Finance 101

Running a restaurant means making tough decisions about money every single day. When your old fryer breaks down during the dinner rush or you need a bigger refrigerator to handle growing orders, you face a choice: drain your bank account with a huge cash payment, or find a smarter way to get the equipment you need.

Catering equipment finance gives you that smarter option. Instead of choosing between going without essential equipment or emptying your working capital, you can spread the cost over time while your new equipment starts earning money from day one.

The world of equipment financing isn't complicated once you understand the basics. The main split is between loans (where you own the equipment immediately but take on debt) and leases (where you use the equipment while making payments, then decide what to do next).

Hire purchase agreements let you make fixed payments that automatically lead to ownership—perfect when you know exactly what you want long-term. Operating leases work more like pure rentals with completely tax-deductible payments, ideal for equipment that might become outdated quickly.

The key is matching your financing choice to how long the equipment will serve your business. A high-tech POS system might need replacing in 3-4 years, while a quality refrigeration unit could run reliably for 15 years or more.

What Is Catering Equipment Finance?

Catering equipment finance simply means spreading your equipment costs over time instead of paying everything upfront. Rather than writing a $30,000 check for a new kitchen setup, you might pay $600-900 monthly over several years.

This approach makes perfect sense when you think about it. Your new equipment starts generating revenue immediately—that commercial refrigerator helps you serve more customers from day one, while your payments spread over 24-84 month terms depending on what works for your cash flow.

Modern financing programs are designed with restaurant owners in mind. Many offer 100% financing that covers not just the equipment but also delivery and installation costs. Fast-track programs can approve up to $50,000 with minimal paperwork, often delivering decisions within 24 hours.

How Does Catering Equipment Finance Work?

The financing process feels refreshingly simple compared to traditional business loans. You start with a simple online application that takes about 5 minutes to complete. The lender does a soft credit pull that won't affect your credit score, then delivers a decision within 24-48 hours.

Once approved, the finance company pays your equipment supplier directly, often handling international transactions. Your equipment gets delivered and installed, then your payment schedule begins.

Eligible Equipment & Associated Costs

Nearly everything your commercial kitchen needs qualifies for financing. The most commonly financed equipment includes cooking equipment like ranges, grills, and fryers, refrigeration systems from ice machines to walk-in coolers, and food prep equipment including dishwashers and mixers.

Technology and furniture—POS systems, digital menu boards, tables, and chairs all qualify for financing programs. Most programs include associated costs in the total financed amount. Delivery, installation, training, and even maintenance agreements can be bundled into one monthly payment.

Top Financing Products & Providers Round-Up

Finding the right catering equipment finance solution feels overwhelming with so many options available. The good news? Each financing type serves a specific purpose, and understanding your business needs makes the choice much clearer.

The smart money is on matching your financing structure to how your business actually operates. Seasonal payment plans work beautifully for outdoor catering businesses that earn more in summer. Step-up payment structures help new restaurants start with lower payments that increase as revenue grows.

More info about leasing options can help you explore specific lease structures that match your situation.

Lease & Hire Purchase Snapshot — Catering Equipment Finance Spotlight

Catering equipment finance through lease and hire purchase agreements wins the popularity contest among restaurant owners. Why? Because they offer something everyone loves: predictability with a clear path to ownership.

Hire purchase works like buying a car. You make fixed monthly payments over 24-60 months, and the equipment is yours at the end. No surprises, no balloon payments, no complicated decisions when the term ends. Interest rates typically range 6-15% depending on your credit.

Finance leases flip the script with lower monthly payments and a small final balloon payment to own the equipment. You might pay $800 monthly for 4 years, then $1 to own everything. This structure often makes 100% of payments tax-deductible.

The fixed end-purchase option eliminates guesswork about residual values or market conditions. You know exactly what you'll pay and when you'll own the equipment outright.

Rent-Try-Buy & Flex-Rent Programs

These programs are perfect for restaurant owners who hate commitment—at least when it comes to equipment decisions. They blend rental flexibility with ownership options in ways that actually make financial sense.

The 12-month rental period gives you real-world experience with equipment before deciding to buy. 60% of rental payments credit toward the purchase price. If you decide to buy after 6 months, you get a significant discount.

The upgrade anytime feature is a game-changer for growing restaurants. Start with basic equipment, then upgrade as your business expands. Minimal documentation for approvals up to $50,000 means you can get equipment fast.

Straight Business Loans & Credit Lines

Traditional term loans and business credit lines offer immediate ownership without the complexity of lease structures.

Business term loans give you immediate equipment ownership with fixed or variable interest rates. Loan amounts range from $10,000 to $5,000,000 with terms typically spanning 2-7 years. If you qualify for SBA or BDC programs, you might access favorable rates that beat traditional leasing costs.

Lines of credit provide ultimate flexibility—draw funds as needed for equipment purchases and only pay interest on amounts used.

For more insights on maximizing your financing benefits, check out this comprehensive guide that explores Section 179 tax deductions and other financial advantages.

Eligibility, Paperwork & Approval Timeline

Getting approved for catering equipment finance might be easier than you think. Most restaurant owners are pleasantly surprised by how straightforward the process has become, especially compared to traditional bank loans.

The secret? Your equipment serves as collateral, which makes lenders much more comfortable saying "yes" to your application. Credit score requirements aren't as scary as you might expect. While excellent credit gets you the best rates, many programs welcome applicants with scores as low as 600.

Approval timelines have shrunk dramatically. What used to take weeks now happens in hours. Many lenders provide decisions within 24 hours and can have funds in your supplier's account within 2 business days of approval.

More info about finance guide can walk you through additional strategies for a smooth approval process.

Documentation Checklist

Lenders need enough information to feel confident about your ability to make payments and understand what equipment they're helping you acquire.

Personal items you'll need include your government-issued photo ID and personal financial information if you're guaranteeing the loan. Business documentation typically includes your last two years of tax returns, recent bank statements (usually 3-6 months), and basic financial statements.

Equipment and location details round out the package. This means quotes from your equipment suppliers and either your lease agreement if you rent or property documents if you own.

Newer businesses need to tell their story a bit more thoroughly. A solid business plan with financial projections helps, along with documentation of your industry experience.

Application Process Walk-Through

Everything starts with a simple online application that takes under 5 minutes to complete. Next comes a soft credit check followed by electronic document upload.

The credit decision typically arrives within 24-48 hours. Once approved, you'll e-sign your contract electronically. The lender pays your equipment supplier directly. Once your equipment arrives, your payment schedule begins.

Financing for New Businesses & Challenging Credit

Don't let a thin credit file or past financial bumps convince you that equipment financing is out of reach. Many lenders actually specialize in working with newer businesses or those rebuilding their credit.

New businesses have several paths forward. You might provide a personal guarantee, make a higher down payment (typically 10-20% instead of zero), or accept shorter loan terms. Sometimes bringing in a co-signer with strong credit opens doors.

Credit-challenged businesses can tap into specialized lending pools designed for their situations. Yes, rates might be higher, but approval odds are better.

Financing Used or Second-Hand Equipment

Used equipment financing opens up possibilities for budget-conscious restaurant owners. Used equipment considerations include higher interest rates due to reduced resale value and shorter loan terms—typically 2-4 years instead of the 5-7 years common with new equipment.

Certified used programs offer a sweet spot between new equipment costs and used equipment risks. These involve professionally refurbished equipment that comes with warranties and financing terms much closer to new equipment rates.

Costs, Tax Advantages & Cash-Flow Impact

The real magic of catering equipment finance isn't just spreading payments over time—it's the surprising tax benefits and cash flow improvements that can slash your effective equipment costs by 25-35%.

Most restaurant owners don't realize that lease payments are often 100% tax-deductible against profits. That $1,200 monthly payment for your new refrigeration system? It comes right off your taxable income, potentially saving you $300-400 monthly depending on your tax bracket.

VAT and GST deferral sweetens the deal further. Instead of paying thousands in sales tax upfront, you spread it across monthly payments. The Section 179 tax deduction lets businesses deduct up to $1,000,000 in equipment costs during the year of purchase rather than depreciating over time.

| Financing Method | Monthly Payment | Tax Deduction | Cash Flow Impact | Total Cost |

|---|---|---|---|---|

| Cash Purchase | $0 | Depreciation only | -$50,000 upfront | $50,000 |

| Finance Lease | $1,200 | 100% deductible | -$1,200 monthly | $43,200 (after tax) |

| Business Loan | $1,100 | Interest + depreciation | -$1,100 monthly | $46,400 (after tax) |

How Repayments Work

Smart financing aligns your payments with how your equipment actually generates revenue. Monthly payments work perfectly for most restaurants with steady revenue streams. Weekly payment schedules align beautifully with high-volume operations that see daily cash flow.

Seasonal payment structures are a game-changer for resort restaurants or seasonal operations. You might pay $2,000 monthly during busy summer months and only $500 during slow winter periods.

Step-up payment plans start with lower payments that increase over time, typically 5-10% annually. This helps new restaurants preserve cash flow during their critical early months while accounting for expected business growth.

End-of-Term Options

Hire purchase and finance lease agreements typically end with automatic ownership transfer. You might pay a small final amount (anywhere from $1 to 10% of the original cost), and the equipment title transfers to your business.

Operating lease agreements offer more flexibility at term end. You can return the equipment and walk away, renew the lease for another term at reduced rates, upgrade to newer equipment with trade-in credit, or purchase at fair market value.

Rent-try-buy programs give you the ultimate flexibility. After 12 months, you can own the equipment for just $1, continue renting month-to-month, upgrade to different equipment anytime, or return everything with no further obligations.

Advanced Tips, Risks & Common Pitfalls

Getting equipment financing right goes far beyond just comparing monthly payments. The smartest restaurant owners dig into the fine print to understand what could go wrong—and how to avoid expensive mistakes.

Hidden fees are unfortunately common in equipment financing. Some lenders tack on documentation fees, processing charges, or "administration costs" that aren't clearly disclosed upfront. Early termination clauses can be particularly painful with pre-payment penalties of 10-20% of remaining payments.

Maintenance responsibility varies dramatically between financing options. Technology obsolescence is the silent killer of equipment financing deals. That state-of-the-art POS system you're financing over five years might be completely outdated in three.

More info about benefits explores additional considerations for making smart financing decisions.

Matching Finance to Equipment Life Cycle

The biggest mistake we see is mismatching financing terms with equipment lifespan.

Short-term financing works best for technology that changes rapidly. POS systems, computer equipment, and digital menu boards should typically be financed over 1-3 years maximum.

Most cooking equipment falls into the medium-term category. Commercial ranges, fryers, and prep equipment typically last 8-12 years with proper maintenance. Financing these over 3-5 years means you'll own reliable equipment for most of its useful life.

Long-term financing makes sense for durable equipment that rarely needs upgrading. Walk-in coolers, major refrigeration systems, and permanent installations can easily last 15-20 years. A 5-7 year financing term gives you many years of payment-free ownership.

Seasonal & Deferred Payment Structures

Restaurant cash flow is notoriously uneven, but most financing companies treat every business like it has steady monthly income. Smart operators negotiate payment structures that match their revenue patterns.

Holiday peak adjustments can be a lifesaver for restaurants that do huge December business but struggle in January and February. Patio season scheduling makes perfect sense for restaurants with significant outdoor dining.

Cash flow smoothing options provide safety nets for unexpected challenges. Skip-payment options (typically 1-2 per year), 120-day deferred payment plans, and emergency payment deferrals can mean the difference between surviving a tough period and losing your equipment.

Frequently Asked Questions about Catering Equipment Finance

What are the tax perks of leasing commercial kitchen gear?

The tax benefits of catering equipment finance can dramatically reduce your actual equipment costs.

Operating lease payments are 100% tax deductible as business expenses. This means every dollar you pay in lease payments reduces your taxable income dollar-for-dollar. If you're in the 35% tax bracket, that $1,000 monthly lease payment effectively costs you only $650 after tax savings.

The Section 179 deduction is another powerful tool if you choose to purchase equipment. You can deduct up to $1,000,000 in equipment costs in the year of purchase rather than spreading depreciation over several years.

VAT and sales tax deferral improves your cash flow too. Instead of paying thousands in sales tax upfront, leasing spreads it across monthly payments.

Many restaurant owners find their effective equipment cost drops by 25-35% when they factor in tax benefits. Always talk with your accountant about the best tax strategy for your specific situation.

Can I get approved if my restaurant is less than a year old?

Absolutely! Many lenders actively work with new restaurants, understanding that every successful business started somewhere.

The key is showing lenders you're serious and prepared. They want to see detailed business plans with realistic financial projections, proof of your industry experience, and evidence that you understand the restaurant business.

You'll likely face slightly different terms than established restaurants. Personal guarantees from business owners are standard, and you might need a higher down payment—typically 10-20% instead of zero down.

Rent-try-buy programs are particularly startup-friendly, often requiring minimal documentation for amounts up to $50,000. Co-signer arrangements can open doors too.

How fast can I receive my equipment after approval?

The speed of modern catering equipment finance might surprise you. We're talking days, not weeks, from application to equipment delivery.

Most credit decisions arrive within 24-48 hours of submitting your application. Final approval with complete documentation typically takes 2-5 business days. Once approved, you can e-sign contracts the same day, and suppliers usually receive payment within 1-2 business days.

Equipment delivery depends on availability. In-stock items often ship within 1-5 business days after the supplier receives payment. Custom orders take longer—typically 2-6 weeks depending on specifications.

The bottom line: once you're approved, your new equipment is typically cooking, cooling, or cleaning within a week.

Conclusion & Next Steps

Catering equipment finance isn't just about getting gear—it's about building a sustainable restaurant business that can weather challenges and seize opportunities. The smart money knows that preserving cash flow often matters more than avoiding monthly payments.

The research shows 91% approval rates and 24-48 hour decisions make financing more accessible than ever, while 100% financing options eliminate the cash flow crunch that kills promising restaurants. Tax benefits can reduce your effective equipment costs by 25-35%, making financed equipment potentially cheaper than cash purchases.

At The Restaurant Warehouse, we've seen too many talented chefs struggle because they tied up all their money in equipment purchases. Our wholesale pricing means you pay less for quality gear, and smart financing stretches those savings even further.

The beauty of modern equipment financing is the flexibility. Whether you need rent-try-buy programs for testing new concepts, seasonal payment structures for tourism-dependent locations, or traditional lease-to-own for established operations, there's a solution that fits your business model.

Your next steps are simpler than you might think:

Start by calculating what you actually need—not what you want, but what equipment will generate revenue immediately. Get quotes from suppliers (including us) and compare your financing options. Most applications take under 5 minutes to complete, and you'll know where you stand within 48 hours.

The restaurant business moves fast, and equipment needs don't wait for perfect timing. Catering equipment finance lets you act quickly when opportunities arise or problems demand solutions.

More info about catering equipment lease can walk you through specific lease options that might work for your situation.

Every successful restaurant owner we know uses financing strategically. They understand that keeping cash available for operations, marketing, and growth opportunities usually trumps avoiding modest financing costs. Your dream kitchen is more achievable than you think.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment