Used Equipment, New Opportunities: Financing Solutions for Your Restaurant

Open uping Opportunities: Your Guide to Used Restaurant Equipment Financing

For restaurant owners, launching or expanding means getting the right tools. But new equipment costs can be huge. This is where the smart choice of used equipment shines, often costing 30-50% less than new models. This instantly reduces your upfront costs, but finding the capital can still be tough. That's where strategic financing comes in, helping you get what you need without tying up all your cash.

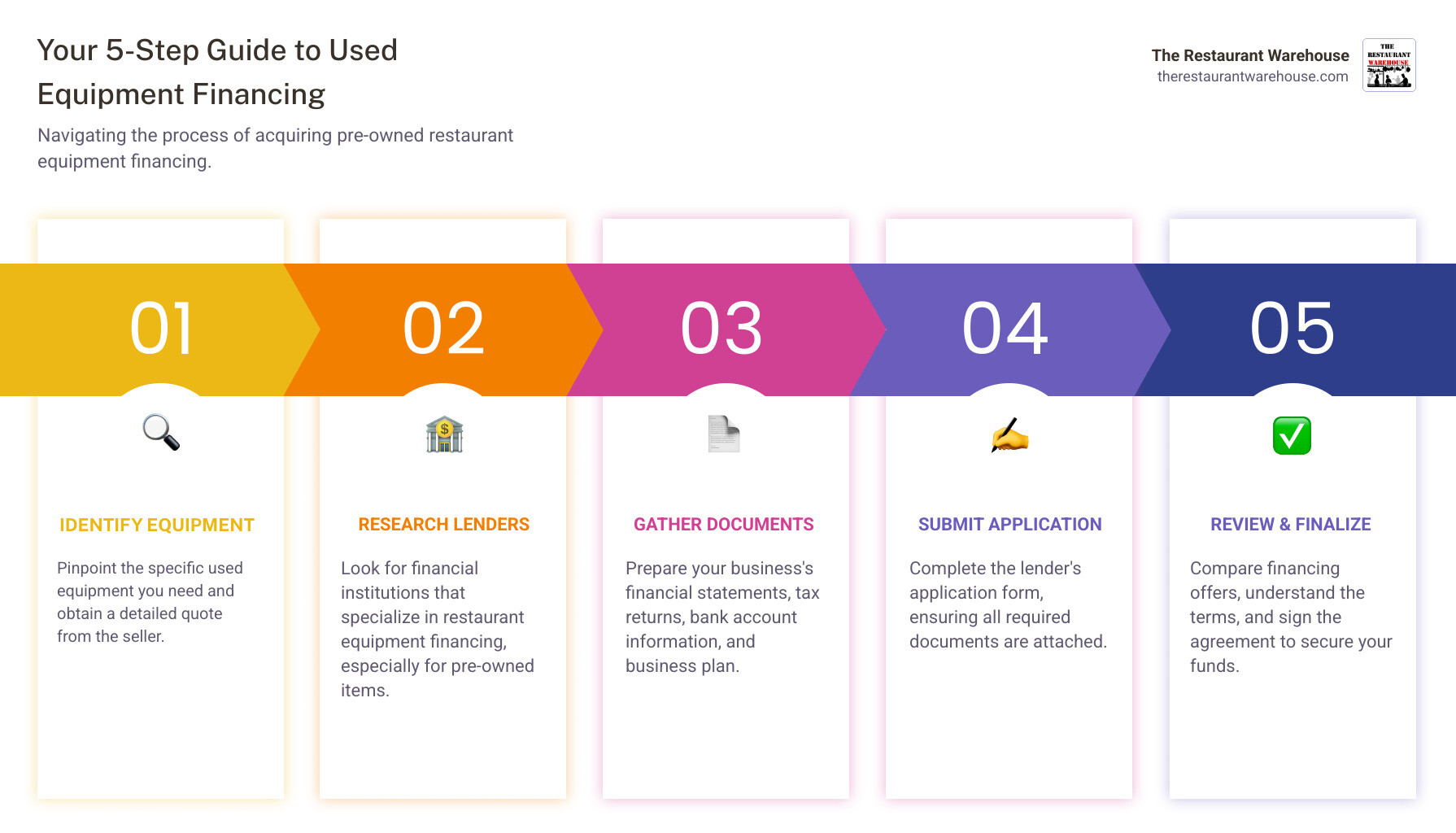

Securing used restaurant equipment financing boils down to a few clear steps:

- Identify Equipment: Pinpoint the specific used equipment you need and get a detailed quote.

- Research Lenders: Look for financial institutions specializing in restaurant equipment financing.

- Gather Documents: Prepare your business's financial statements, tax returns, and business plan.

- Submit Application: Complete the lender's application form with all required documents.

- Review & Finalize: Compare financing offers, understand the terms, and sign the agreement.

This guide will show you how to steer financing for pre-owned restaurant equipment. You'll learn about your options, how to qualify, and how to make the best financial decisions for your business.

The Strategic Advantages of Financing Pre-Owned Equipment

Making smart financial decisions is crucial for long-term success. While new equipment is appealing, pre-owned gear offers the same functionality at a fraction of the cost. Used restaurant equipment financing is the secret ingredient to acquiring these assets without draining your working capital.

Financing pre-owned equipment is a strategic move that improves your financial health and operational agility. It empowers growth, improves cash flow, and provides flexibility in a dynamic industry. Learn more in our guides on Buy Used Restaurant Equipment and the Benefits Of Restaurant Equipment Financing.

Key benefits of financing used equipment

Financing used equipment is a strategic investment that fosters business growth and provides budget flexibility.

-

Lower Upfront Costs & Faster ROI: Used equipment is 30-50% cheaper than new. Financing this lower cost means smaller monthly payments and a quicker return on investment. You get

immediate useof the equipment,generating revenuewhilespreading costsover time. -

Preserve Cash Flow: Financing avoids large, upfront payments, allowing you to keep your working capital for payroll, inventory, or unexpected expenses. It's about

preserving capitalfor other growth opportunities. -

Access to Better Equipment: Financing can make higher-grade or more specialized equipment affordable, giving you a

competitive edgein quality and efficiency. -

Flexible Upgrade Options: The restaurant industry evolves quickly. Leasing, in particular, offers

upgrading capabilities, allowing you to transition to newer technology easily and keep your kitchen competitive.

How financing improves your cash flow

Cash flow is the lifeblood of a restaurant. Equipment financing is a powerful tool for managing it.

- Predictable Monthly Payments: Fixed monthly payments make budgeting and financial forecasting simpler and more accurate, helping you avoid sudden financial shocks.

- Avoid Large Cash Depletion: Acquire essential equipment without draining your cash reserves, keeping your business liquid and resilient against unexpected breakdowns.

- Align Expenses with Revenue: Pay for equipment as it generates revenue, ensuring it pays for itself through productivity rather than being a financial drain.

- Invest Capital Elsewhere: Free up capital for marketing, employee training, or menu expansion to drive growth and profitability.

- Manage Seasonality: Some financing options offer flexible payment schedules, such as deferred or seasonal payments, to help you manage cash flow through slower periods.

Tailoring Your Financing Strategy: Startups vs. Established Restaurants

While the benefits of financing used equipment apply to all food service businesses, the strategic approach can differ based on your operational maturity.

For Startups and New Ventures:

- Lowering the Barrier to Entry: The single biggest hurdle for a new restaurant is the initial capital expenditure. Financing used equipment dramatically reduces this barrier, making it possible to launch with a fully functional kitchen without securing a massive, high-risk bank loan. It allows you to allocate precious startup funds to marketing, initial inventory, and hiring.

- Proof of Concept with Lower Risk: A new restaurant concept is an unproven hypothesis. By financing less expensive, used equipment, you can test your menu, service model, and market fit with a significantly lower financial commitment. If the concept needs to pivot, you aren't tied to expensive, specialized new machinery.

- Building Business Credit: Successfully managing an equipment financing agreement is an excellent way for a new business to build a positive credit history. Making timely payments demonstrates financial responsibility, which will make it easier to secure other forms of financing (like a line of credit) in the future.

For Established Restaurants:

- Strategic Expansion and Upgrades: For a proven restaurant looking to expand to a second location, launch a catering arm, or add a food truck, financing used equipment is a low-impact way to fund growth. It avoids draining cash reserves needed for the existing operation's day-to-day needs.

- Systematic Replacement Cycles: Equipment doesn't last forever. Instead of waiting for a critical piece of machinery to fail—forcing an emergency purchase at a premium—established restaurants can use financing to create a planned replacement cycle. This proactive approach replaces aging equipment with reliable used models before they disrupt service, all while keeping payments predictable.

- Maintaining a Competitive Edge: Financing allows you to acquire specialized equipment to add new, profitable menu items (like a high-capacity smoker or a specialty pasta maker) without a huge upfront cost. This agility helps you respond to culinary trends and stay ahead of the competition.

A Deep Dive into Used Restaurant Equipment Financing Options

Now that you know why financing used equipment is a smart move, let's explore the how. The world of used restaurant equipment financing offers a variety of options designed to fit different business needs and financial situations. Whether you want to own your equipment or prefer the flexibility of renting, there's a path for you. For a deeper dive into leasing, see our Lease Commercial Kitchen Equipment Guide.

What Types of Used Equipment Can You Finance?

Almost any piece of commercial restaurant equipment can be financed, as long as it has a good useful life ahead of it and holds its value. This includes everything from core kitchen appliances to dining room furniture.

Commonly financed used equipment includes:

- Cooking Equipment: Fryers, griddles, and grills.

- Refrigeration: Walk-in coolers, freezers, and prep tables.

- Food Preparation: Mixers, slicers, and food processors.

- Sanitation: Dishwashers and three-compartment sinks.

- Other Essentials: Ice machines, POS systems, and furniture.

A note on product safety: Some products may contain chemicals known to the State of California to cause cancer and birth defects or other reproductive harm. For more information, please visit https://www.p65warnings.ca.gov.

Financing vs. Leasing: Understanding the Core Differences

Equipment loans and leases are the two main paths to financing. They differ in ownership, cost, and end-of-term options. Understanding these differences is key to choosing the right option for your business. For more details, check out our page on Leasing Restaurant Equipment.

Here's a quick comparison:

| Feature | Equipment Loan | Equipment Lease |

|---|---|---|

| Ownership | You own the equipment from day one. | The leasing company owns the equipment. |

| Total Cost | Typically lower for long-term ownership. | Can be higher, but offers more flexibility. |

| Monthly Payments | Fixed payments that build equity. | Often lower than loan payments. |

| End-of-Term | You own the equipment free and clear. | Return, renew, or purchase the equipment. |

| Tax Implications | Deduct interest and depreciation (Sec 179). | Lease payments are often 100% tax-deductible. |

Choose a loan for long-term use where you want to build equity. Choose a lease for flexibility, lower monthly payments, and short-term needs.

Common Financing Products: Loans and Lines of Credit

- Equipment Loans: A straightforward option where you receive a lump sum to buy equipment, which serves as its own collateral. You get predictable monthly payments and own the asset after the final payment.

- Business Line of Credit: A flexible pool of funds you can draw from as needed, paying interest only on what you use. It's ideal for smaller or multiple purchases over time.

- SBA Loans: Backed by the Small Business Administration, these loans offer competitive rates and long repayment terms. SBA 7(a) loans are flexible for general business needs, while SBA 504 loans are for major fixed assets.

- Vendor Financing: A convenient option offered by suppliers like The Restaurant Warehouse, who partner with financing companies to provide a streamlined, one-stop-shop experience with quick approvals.

For more details, visit our Loan Option For Your Restaurant page.

Common Leasing Products: From Operating to Buyout

- Operating Lease: Similar to renting. You make lower monthly payments and return the equipment at the end of the term. Payments are typically treated as a tax-deductible operating expense.

- Capital Lease (Finance Lease): More like a loan in structure. You have the option to buy the equipment for a nominal fee (like $1) at the end. It's treated as an asset for tax purposes, allowing for depreciation deductions.

- Fair Market Value (FMV) Lease: Offers flexibility at the end of the term: you can buy the equipment at its fair market value, renew the lease, or return it.

- $1 Buyout Lease: A popular type of capital lease where you own the equipment for just $1 at the end of the term. It combines the benefits of leasing with the goal of ownership.

Our Lease To Own Restaurant Equipment guide has more information.

Qualifying and Applying: Your Step-by-Step Guide

Ready to apply for used restaurant equipment financing? The process is often smoother than you think, especially with lenders who understand the restaurant industry. Being prepared is the key to a successful application.

What Are the Qualification Requirements?

Lenders assess a few key factors to determine your eligibility:

- Credit Score: A FICO® score of 620 or more is generally preferred. A higher score can lead to better rates and terms.

- Business Financials: Be prepared to share recent tax returns, bank statements, and profit & loss statements to show your restaurant's financial health.

- Time in Business: Most lenders prefer at least one year of operation, but some do finance startups.

- Annual Revenue: Lenders often look for at least $100,000+ in annual revenue, though this can vary.

- Business Plan: A solid plan is crucial, especially for new businesses, as it shows lenders your vision and financial projections.

- Down Payment & Collateral: While not always required, a down payment can strengthen your application. The equipment itself usually serves as collateral.

For more details, read our guide: How Hard Is It to Get a Restaurant Equipment Loan?.

The Application Process from Start to Finish

Applying for financing is a straightforward process:

- Assess Your Needs: Get a detailed quote for the specific equipment you need from a seller like The Restaurant Warehouse.

- Research Lenders: Compare offers from different lenders to find the best interest rates, terms, and fees.

- Prepare Documents: Gather your financial statements, tax returns, bank statements, business licenses, and business plan.

- Complete the Application: Fill out the lender's form carefully. Many partners of The Restaurant Warehouse offer quick online applications.

- Follow Up: Be available to answer any questions from the lender. Approvals can often come within 24-48 hours.

- Review and Finalize: Carefully read the financing offer. Once you understand and agree to the terms, sign the agreement to secure your funds.

Before finalizing, you can verify lender licenses at www.nmlsconsumeraccess.org.

Maximizing Your Investment: Tax Benefits and Smart Comparisons

Securing used restaurant equipment financing is just the first step. To maximize your investment, it's crucial to understand the available tax advantages and how financing pre-owned gear compares to buying new. These smart decisions can significantly boost your restaurant's profitability.

Open uping Tax Advantages with Section 179 and Depreciation

Tax benefits can genuinely lower the net cost of your equipment. The two primary advantages are:

- Section 179 Deduction: This IRS tax code provision allows businesses to deduct the full purchase price of qualifying new or used equipment in the year it's put into service. This can significantly lower your taxable income. For example, deducting a $10,000 piece of equipment could result in thousands of dollars in tax savings, depending on your tax bracket. Businesses that finance less than the annual limit (which is over $1 million) in equipment should qualify. You can apply for financing and explore this option here.

- Depreciation: If you don't use Section 179, you can still deduct a portion of the equipment's cost each year over its "useful life." For operating leases, the monthly payments are generally 100% tax-deductible as a business expense.

Disclaimer: Tax laws change. Always consult a qualified tax professional to understand how these benefits apply to your specific situation. For a broader overview, see our Restaurant Equipment Financing Guide.

How Does Used Restaurant Equipment Financing Compare to New?

Deciding between financing used or new equipment involves weighing several factors.

- Cost: Used equipment is 30-50% cheaper, leading to a smaller financed amount and lower monthly payments.

- Interest Rates: Rates for used equipment may be slightly higher due to perceived risk, but the total interest paid can still be lower because the principal is smaller.

- Loan Terms: Terms for used equipment are typically shorter (2-5 years), aligning with the asset's remaining useful life.

- Approval Rates: Financing is widely available for quality used equipment from reputable sellers, making approval rates strong.

- Warranty & Lifespan: New equipment comes with a manufacturer's warranty, while used equipment usually does not. You'll need to budget for potential maintenance and repairs.

If saving money upfront and achieving a faster ROI are your priorities, used restaurant equipment financing is an excellent choice.

Frequently Asked Questions about Used Equipment Financing

Navigating used restaurant equipment financing can bring up questions. Here are concise answers to some of the most common inquiries, followed by a deeper dive into additional topics that owners often overlook when they start comparing lenders and offers.

Can I get financing for used equipment with bad credit?

Yes, it is possible. While traditional banks may be hesitant, many alternative lenders specialize in financing for business owners with less-than-perfect credit. They often look beyond the credit score to your restaurant's cash flow. Be prepared for potentially higher interest rates. To strengthen your application, consider offering a larger down payment or showing strong, consistent revenue. For more information, read our guide on Restaurant Equipment Financing Bad Credit.

How long can I finance used restaurant equipment?

Financing terms for used equipment typically range from 24 to 60 months (2 to 5 years). The exact term depends on the age, condition, and expected useful life of the equipment. Lenders align the financing term with the asset's lifespan to ensure it remains a valuable piece of collateral throughout the loan.

Are there any hidden costs I should be aware of?

Reputable lenders are transparent, but it's always wise to review your agreement carefully. Potential costs beyond the monthly payment can include:

- Origination or documentation fees for processing the loan.

- Prepayment penalties if you decide to pay off the loan early.

- Late fees for missed payments.

- Maintenance and repair costs, as used equipment often lacks a warranty.

- Insurance on the financed equipment, which is typically required by the lender.

Always ask for an itemized breakdown of all fees before signing.

Can I bundle multiple pieces of used equipment into a single financing package?

Absolutely. Most equipment financers allow you to group several items under one loan or lease, provided they are purchased at the same time (or within a short window). Bundling simplifies bookkeeping—one monthly payment instead of several—and may give you more leverage to negotiate lower rates or fees since the total ticket size is larger.

What is the typical interest-rate range for used equipment financing?

Rates vary widely based on credit profile, time in business, collateral quality, and overall market conditions. As a rule of thumb, expect to see APRs ranging from 7% to 20% for well-qualified borrowers. Businesses with weaker credit could see rates move into the 20–30% range. Always compare offers from at least three lenders and calculate the total cost of borrowing, not just the advertised “teaser” rate.

How quickly can I receive funds and take delivery of my equipment?

Speed is one of the biggest advantages of specialized equipment lenders. A complete application with supporting documents can lead to an approval decision in 24–48 hours, and funds (or a vendor purchase order) can be released within a day of signing final paperwork. Traditional banks often take one to three weeks, so plan your timeline accordingly if you need equipment fast.

Can I refinance existing equipment debt to improve cash flow?

Yes. If interest rates have dropped or your credit profile has strengthened, refinancing can reduce your monthly payment or shorten the payoff term. You’ll need a current payoff statement from the existing lender and proof that the equipment is still in good working order. That most lenders will not refinance gear that is nearing the end of its useful life.

Does taking on an equipment loan limit my ability to secure other types of financing later?

It depends on your restaurant’s overall leverage and cash-flow coverage. A well-structured equipment loan with affordable payments typically builds credit strength and shows lenders you can manage debt responsibly. However, if payments strain your operating cash flow, it may hurt future borrowing capacity. Use realistic revenue projections and maintain a debt-service-coverage ratio (DSCR) of at least 1.25x to stay attractive to additional lenders.

What happens if the equipment breaks down while I’m still paying for it?

Because the equipment itself is collateral, lenders expect you to maintain it in good working condition. Repairs are typically your responsibility, although some lenders offer optional maintenance packages or extended warranties. If the item is irreparable, insurance proceeds (from your mandatory equipment-coverage policy) can be used to pay down or pay off the remaining balance. Always read how “loss or destruction of collateral” is handled in your contract.

Is a personal guarantee required for used equipment loans?

Most lenders require at least one owner with 20% or more equity in the business to sign a personal guarantee. This extra assurance lowers the lender’s risk and may help you secure better rates. Some non-recourse programs exist, but they generally come with higher interest rates and stricter collateral requirements.

Can seasonal restaurants negotiate flexible repayment schedules?

Yes. Many lenders that focus on hospitality understand the revenue dips that come with seasonality. Ask about step-up, step-down, or seasonal-skip plans that let you pay more during peak months and less (or even nothing) during slow periods. Structured correctly, this keeps cash flow smooth without increasing the total cost of borrowing.

Are there sustainability incentives for financing energy-efficient used equipment?

Increasingly, yes. Some local utilities and regional economic-development agencies offer rebates or low-interest “green” financing for ENERGY STAR® or other efficiency-rated units—even if they are refurbished. Check your state’s energy department website and ask lenders about pairing your equipment loan with these incentive programs to reduce net cost.

Can I use an SBA loan to finance used restaurant equipment exclusively?

SBA 7(a) loans allow proceeds to be used for working capital, leasehold improvements, and equipment—new or used. The key is that the equipment must have a remaining useful life that meets the SBA’s appraisal guidelines. Because SBA loans involve more paperwork and longer approval timelines, many owners secure interim financing to avoid operational delays, then roll the short-term loan into the SBA package once it closes.

Adding these nuanced questions—and their corresponding answers—should equip you with a 360-degree view of the financing landscape, empowering you to secure terms that align with your restaurant’s long-term vision and cash-flow realities.

Conclusion: Equip Your Restaurant for Success

We've covered the ins and outs of used restaurant equipment financing, a strategic move that opens doors for your restaurant. By opting for pre-owned equipment, you get the essential tools you need at a significantly lower cost, preserving vital cash flow and leveraging tax advantages to boost your bottom line. Smart financing is your ticket to growth and efficiency, whether you're just starting out or upgrading an established kitchen.

Having the right equipment is the foundation of any great culinary experience. With a solid grasp of the financing options, qualification requirements, and tax benefits, you are well-equipped to make informed decisions that will fuel your success for years to come.

At The Restaurant Warehouse, we are passionate about helping you achieve your restaurant dreams. We offer affordable, high-quality equipment that helps you stretch your financing dollars further. We understand the demands of the foodservice industry and are committed to being your partner in building your dream kitchen without breaking the bank.

Don't let budget worries hold you back. It's time to take the next step. Explore our financing options and get started today!

About The Author

Sean Kearney

Sean Kearney is the Founder of The Restaurant Warehouse, with 15 years of experience in the restaurant equipment industry and more than 30 years in ecommerce, beginning with Amazon.com. As an equipment distributor and supplier, Sean helps restaurant owners make confident purchasing decisions through clear pricing, practical guidance, and a more transparent online buying experience.

Connect with Sean on LinkedIn, Instagram, YouTube, or Facebook.

Leave a comment