The Secret Sauce for Financing Your Restaurant Equipment

Why Financing Makes Sense for Restaurant Equipment

Learning how to finance restaurant equipment can make the difference between opening your dream restaurant and watching it remain just a dream. The harsh reality is that outfitting a commercial kitchen requires serious capital - often $40,000 to $200,000 or more for a full setup.

Quick Answer: How to Finance Restaurant Equipment

The main financing options for restaurant equipment include:

- Equipment Financing Loans - Use the equipment as collateral, build equity, rates 8%-30%

- Equipment Leasing - Lower monthly payments, tax benefits, upgrade flexibility

- Business Lines of Credit - Flexible funding for smaller purchases and repairs

- Merchant Cash Advances - Fast cash against future sales (expensive, last resort)

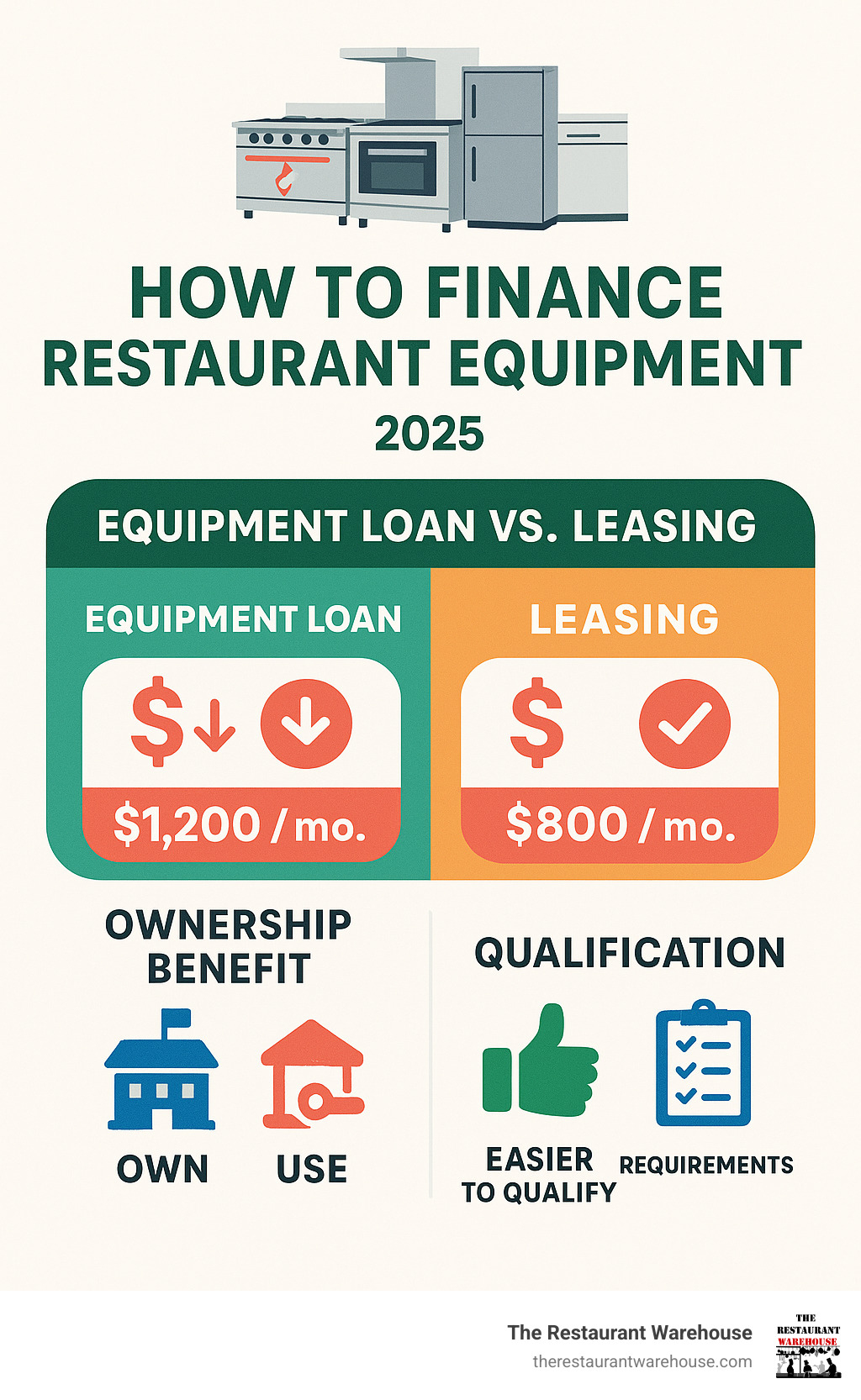

Most restaurant owners choose between equipment financing (to own) or leasing (to use), based on their cash flow needs and long-term goals.

Here's what makes equipment financing so attractive: it's what industry experts call "self-secured." The equipment you're buying serves as the collateral for the loan. This means easier qualification compared to traditional business loans, and you can often get approval within 24-48 hours.

Equipment financing also helps you preserve your working capital - that precious cash you need for inventory, payroll, and unexpected expenses. Instead of dropping $50,000 on a new commercial oven, you might pay $800 per month over 5 years while keeping your cash flow healthy.

The key is understanding which financing method fits your situation. A startup might benefit from leasing to keep monthly costs low, while an established restaurant might prefer financing to build equity and take advantage of tax deductions.

How to finance restaurant equipment further reading:

Understanding Your Restaurant Equipment Financing Options

When facing a large quote for new kitchen equipment, knowing how to finance restaurant equipment is essential. You have several solid options, each suited for different situations. Let's break down the most common ways to fund your equipment so you can choose wisely.

Equipment Financing Loans

When a critical piece of equipment fails unexpectedly, an equipment financing loan can be a lifesaver. With these loans, the equipment itself acts as collateral. This "self-secured" setup makes lenders more willing to approve financing compared to unsecured loans, as you're buying a tangible asset.

You'll make fixed monthly payments over a set term (usually up to 10 years), which helps with cash flow planning. With each payment, you build equity until you own the equipment outright.

Interest rates typically range from 8% to 30%, depending on your credit score and the lender. A key benefit is speed—you can often get approval within 24 hours and funding the next business day.

For a deeper dive into why this option works so well for restaurants, check out our guide on the Benefits Of Restaurant Equipment Financing.

Equipment financing is flexible, covering nearly everything your restaurant needs: refrigerators and freezers, POS systems, dishwashers, commercial ranges and griddles, ice machines, food prep equipment like mixers and slicers, dining room furniture, and even delivery vehicles.

Equipment Leasing

When you lease, you pay for the right to use equipment for a set period (typically 48-60 months). This often results in lower monthly payments and no down payment, which is ideal for cash-strapped restaurants.

A key tax advantage is that lease payments are often fully tax-deductible as a business expense. You also avoid paying sales tax upfront.

At the end of the term, you have choices. A Fair Market Value (FMV) lease lets you buy the equipment at its market value, return it, or renew. This is great for equipment that loses value quickly or for staying current with technology. A $1 Buyout lease is structured so you can own the equipment for a dollar at the end, combining lease benefits with eventual ownership.

Leasing is perfect for technology that evolves quickly, like POS systems. It allows you to upgrade frequently at the end of the lease term instead of being stuck with outdated models.

Want to explore how lease-to-own programs work? Our article on Restaurant Equipment Lease To Own has you covered.

Business Lines of Credit

A business line of credit provides a revolving credit limit you can tap as needed, and you only pay interest on the funds you use. It's perfect for short-term needs and unexpected repairs, allowing you to access funds immediately for smaller equipment replacements without a new loan application.

Lines of credit also help manage seasonal cash flow fluctuations. You can draw funds during busy periods and repay them as revenue increases. Repayment terms are typically 6 months or more, and credit lines up to $50,000 are common for equipment needs.

Merchant Cash Advances (MCAs)

Merchant Cash Advances (MCAs) are a fast cash option but come with a high price tag. An MCA provides funding against your future sales. You receive a lump sum and repay it with a percentage of your daily or weekly credit card sales.

The appeal is fast cash access (often within 24 hours) with no collateral required besides future revenue. Repayments are automatically deducted from your sales.

However, MCAs are expensive. They use factor rates (typically 1.1 to 1.5) instead of interest. A $10,000 advance with a 1.3 factor rate means you repay $13,000, regardless of the repayment speed.

MCAs should be a last resort. The high cost can create a debt cycle. Always explore financing, leasing, or lines of credit first, and only consider an MCA in a true emergency.

Financing vs. Leasing: Which is Better for Your Business?

Choosing between financing and leasing is a critical decision when learning how to finance restaurant equipment. This choice impacts your cash flow, taxes, and long-term asset management. Let's compare them to help you decide.

| Feature | Equipment Financing (Loan) | Equipment Leasing |

|---|---|---|

| Ownership | You own the equipment once the loan is repaid. | The leasing company owns the equipment; you pay for use. |

| Upfront Cost | Often requires a down payment (though 100% financing is possible). | Often requires no down payment, or just a small fee. |

| Monthly Payment | Typically higher, as you're paying towards ownership. | Generally lower, as you're paying for usage. |

| Total Cost | Potentially lower in the long run after ownership. | Can be higher over time, especially with renewals. |

| Tax Benefits | Depreciation deductions (e.g., Section 179) and interest expense. | Payments are often 100% tax-deductible as operating expenses. |

| End-of-Term Options | You own the equipment. | Purchase (FMV or $1 buyout), return, or renew. |

When to Choose Financing

Financing makes sense for long-term asset ownership. If you plan to use equipment for its entire useful life (10+ years), owning it is a smart move. Each payment builds equity, turning the equipment into a valuable asset on your balance sheet.

Another reason to finance is building business credit. Successfully repaying a loan demonstrates reliability to lenders, which can lead to better financing terms for future expansion.

The tax advantages can be substantial. Section 179 deductions may allow you to deduct the full purchase price in the year of purchase, significantly lowering the equipment's true cost.

Want to explore this option further? Check out our guide on Should Your Restaurant Get A Restaurant Equipment Loan.

When to Choose Leasing

Leasing is ideal when cash flow is king. Lower monthly payments free up capital for inventory, payroll, and unexpected expenses. For startups with limited capital or those on tight margins, preserving cash is crucial.

Leasing is also perfect for technology that evolves quickly, like POS systems. It allows you to upgrade frequently at the end of the lease term instead of being stuck with outdated models.

By leasing, you are preserving working capital and maintaining flexibility. You don't tie up funds in depreciating assets, keeping money available for growth, marketing, or slow seasons. The tax benefits are also straightforward, as lease payments are typically 100% deductible as operating expenses.

For a deeper dive into this flexible option, explore our article on Leasing Restaurant Equipment.

Bottom line: Choose financing for long-term ownership and building credit. Choose leasing to prioritize cash flow, flexibility, and access to the latest technology.

How to Finance Restaurant Equipment: The Application and Qualification Process

Securing equipment funding requires preparation, but understanding the process makes it straightforward. Knowing what lenders look for and the steps involved will help you get the equipment you need.

Typical Eligibility Requirements

When you're figuring out how to finance restaurant equipment, lenders evaluate several key factors to assess your eligibility:

- Personal Credit Score: Most lenders prefer a score of 630+. A higher score secures better rates, but options exist for those with lower scores.

- Time in Business: Lenders typically prefer at least two years of operation to show stability. Startup options are covered in the next section.

- Annual Revenue: Many lenders look for a minimum of $130,000 to ensure you can handle payments.

- Business Plan: A strong business plan is crucial, especially for startups or large financing amounts. It should detail your market, strategy, and financial projections. Our guide on How To Write A Restaurant Business Plan can help.

- Financial Statements: Have your income statements, P&L, and balance sheets ready. They provide a clear snapshot of your business's financial health.

The Step-by-Step Application Process

Once your documents are ready, the application process for how to finance restaurant equipment is straightforward:

- Get a Quote: Obtain a detailed quote for the equipment you need. Lenders require specifics, not estimates.

- Gather Documents: Collect your bank statements (3 months), tax returns, and business plan. Being organized prevents delays.

- Complete Application: The application is typically a concise online form designed for quick processing.

- Review Offer: Once approved, carefully review the offer, including terms, rates, and the repayment schedule, before signing.

- Receive Funds: Funds are often disbursed directly to the equipment vendor, streamlining the purchase.

The process is fast. Approval often takes 24-48 hours, with funds available in 2-7 business days. Some online lenders are even faster, minimizing downtime. Financing is available through banks, credit unions, and online lenders. While banks may offer better rates, online lenders are often faster and more flexible. For government-backed programs, you can often Find a lender near you through government business resource portals.

Special Financing Scenarios: Solutions for Startups and Bad Credit

A less-than-perfect financial history doesn't mean you're out of options. Whether you're a startup or have faced credit challenges, there are viable paths to getting the equipment you need.

How to finance restaurant equipment for a startup

When learning how to finance restaurant equipment as a startup, you'll find traditional lenders may see you as a risk due to a lack of operating history. Success is possible with a bulletproof business plan that is comprehensive, covering your concept, market, competition, and detailed financial projections to show lenders a realistic path to profitability.

Your personal credit is crucial. A strong score can help you secure financing, often through a personal guarantee, which gives lenders more confidence. Seek out startup-friendly lenders who specialize in new businesses, as they are often more flexible and focus on your potential rather than just past performance.

Map out your initial costs thoroughly using tools like our Restaurant Startup Costs Calculator to create realistic projections. Lease-to-own programs are also attractive for startups, as they require less upfront capital and have more lenient qualifications.

How to finance restaurant equipment with bad credit

Having a low credit score doesn't close all doors. Restaurant equipment financing with bad credit is more achievable than you might think because the equipment serves as collateral. This collateral-based lending reduces the lender's risk, making them more willing to approve loans.

Lenders often look beyond your credit score to your restaurant's consistent revenue and cash flow. If you can show steady income, many lenders will consider your application. Be prepared for higher interest rates, but think of it as an investment; successfully repaying the loan can improve your credit score over time.

Alternative lenders often specialize in bad credit financing, focusing more on your current business performance than past credit history. Lease-to-own programs are another great option, as they often focus on your ability to make payments rather than credit history, providing immediate access to equipment.

For a deeper dive into strategies for credit-challenged businesses, check out our comprehensive guide on Restaurant Equipment Financing Bad Credit.

Bad credit doesn't have to stop you. With the right approach, you can get the equipment you need to succeed.

Frequently Asked Questions about Restaurant Equipment Financing

We've covered a lot of ground on how to finance restaurant equipment, but a few common questions often pop up. Let's tackle them!

What kind of interest rates and fees should I expect?

When it comes to equipment financing loans, interest rates typically range from 8% to 30%. The exact rate depends heavily on your credit score, time in business, and overall financial health. Businesses with strong credit and a solid operating history will generally qualify for rates on the lower end of that spectrum.

For leases, you won't see a stated "interest rate" in the same way. Instead, the cost is built into the monthly payments, reflecting an implicit rate. It's crucial to understand the total cost over the lease term to make an informed decision.

Merchant Cash Advances (MCAs) use factor rates, which are usually between 1.1 and 1.5. This means you repay the original advance multiplied by this factor, making them very expensive - which is why we recommend them only as a last resort.

Beyond interest or factor rates, be aware of various fees that lenders might charge. Origination fees are a percentage of the loan amount for processing, while documentation fees are flat charges for preparing paperwork. Some agreements include early termination fees if you pay off ahead of schedule. Always ask for a clear breakdown of all costs and calculate the Annual Percentage Rate (APR) to get a true picture of the loan's total cost.

Can I finance used restaurant equipment?

Absolutely! Many lenders will finance used restaurant equipment, and this can be a highly cost-effective strategy for businesses looking to save money. Used equipment often comes at a significantly lower price point than new models, helping you stretch your budget further.

However, when financing used equipment, the equipment's age and condition will affect the terms of the financing. Lenders want to ensure the collateral retains sufficient value throughout the loan term. It's crucial to thoroughly inspect used equipment, ideally with an expert, and request maintenance records to understand its history.

The remaining useful life of the equipment is another key factor lenders consider. A five-year-old refrigerator in excellent condition might get better financing terms than a ten-year-old unit showing wear. Also, confirm any warranty information and whether it's transferable to you as the new owner.

By opting for used equipment, you can significantly reduce your initial capital outlay while still getting the necessary tools for your kitchen. We have a dedicated guide on how to make smart choices when you Buy Used Restaurant Equipment.

What are some alternative funding options if I can't get traditional financing?

Even if traditional loans or leases aren't the right fit, or if you don't qualify, there are still ways to get the equipment you need for your restaurant.

Crowdfunding has become an increasingly popular option for restaurant owners. You can raise funds from your community, and in return, contributors often receive credits to spend at your business once you open. This approach not only provides capital but also helps build a customer base before you even open your doors.

Government programs like the Canada Small Business Financing Program (CSBFP) exist to make it easier for small businesses to get loans by sharing the risk with lenders. The CSBFP has helped over 53,000 businesses access more than $11 billion in financing over the past decade, with loan maximums up to $1.15 million per borrower. Similar government-backed programs exist in other countries to support small business equipment purchases.

Personal loans can work for smaller equipment purchases, especially for startups or those with strong personal credit but limited business history. While you'll be personally liable for the debt, it can bridge the gap when business financing isn't available.

Seller financing is another option worth exploring. Sometimes, equipment vendors or manufacturers offer their own financing plans. This can be convenient since they're directly invested in selling their products and may have more flexible terms. Always compare these offers with other financing options to ensure you're getting the best deal for your situation.

Conclusion

Finding the right way to how to finance restaurant equipment can transform your restaurant dreams into reality. Throughout this guide, we've walked through your main options: equipment financing loans when you want to build equity and own your assets, leasing for those lower monthly payments and upgrade flexibility, lines of credit for unexpected repairs and short-term needs, and merchant cash advances when you're truly in a pinch (though we hope you can avoid that expensive route).

Here's the thing - knowing your options is only half the battle. The real magic happens when you take a step back and honestly assess what your business actually needs. Are you a startup trying to keep monthly expenses low? Leasing might be your best friend. Running an established restaurant with solid cash flow and looking to build long-term assets? Equipment financing could be the perfect fit.

Think about your cash flow patterns - do you have busy seasons that could handle higher payments? Consider your credit profile and how different lenders might view your application. Most importantly, factor in your long-term vision. If you're planning to use that commercial refrigerator for the next decade, ownership through financing makes more sense than paying lease payments indefinitely.

Your tax strategy matters too. The Section 179 deduction can make equipment financing incredibly attractive for profitable businesses, while lease payments offer their own tax advantages as operating expenses.

Once you've secured your funding, the next crucial step is making sure every dollar stretches as far as possible. That's where smart equipment shopping comes in. At The Restaurant Warehouse, we understand that restaurant margins are tight, which is why we cut out the middleman markup and high commissions that drive up equipment costs elsewhere. Our wholesale pricing means your financing dollars go further, letting you get more of the equipment you need without stretching your budget.

Whether you're financing your first commercial kitchen setup or upgrading key pieces, the combination of smart financing choices and wholesale pricing can make all the difference in your restaurant's success.

Ready to turn your equipment plans into action? Explore financing options and get the equipment you need to create the kitchen that will serve your customers and your business for years to come.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment