Secure Your Success: Guaranteed Financing for Your Restaurant

Why Guaranteed Restaurant Equipment Financing Is Your Gateway to Success

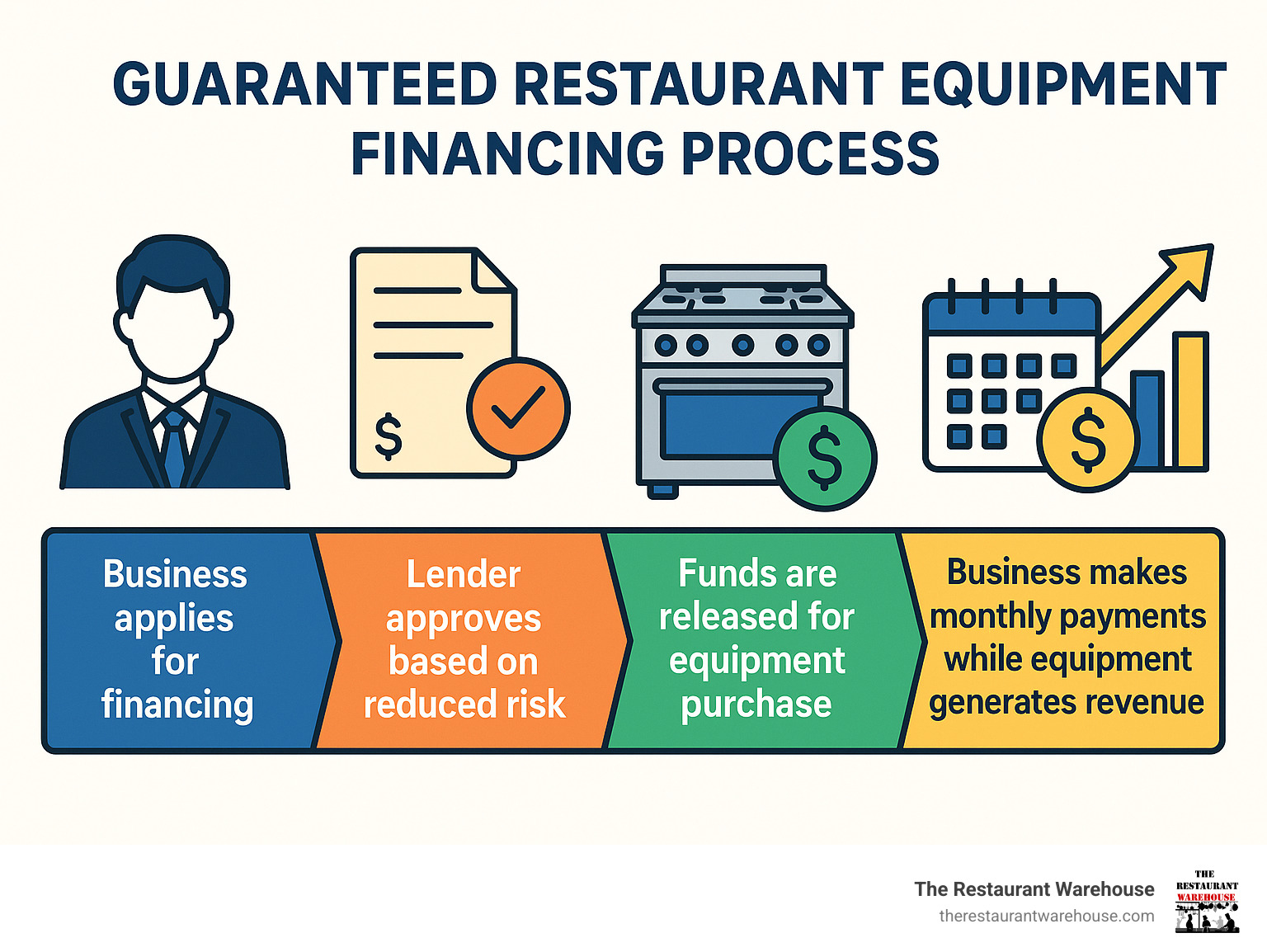

Guaranteed restaurant equipment financing provides an accessible path to acquiring essential equipment. These specialized lending programs use the equipment itself as collateral, which significantly increases approval odds for startups and businesses with less-than-perfect credit.

Quick Answer: What Is Guaranteed Restaurant Equipment Financing?

- Higher approval rates: Equipment as collateral reduces lender risk.

- Faster funding: Approval in 24-48 hours, not weeks like traditional loans.

- Flexible credit requirements: Options for credit scores as low as 550.

- Government-backed programs: CSBFP and SBA loans further reduce lender risk.

- Loan amounts: Typically $5,000 to over $500,000 for restaurant equipment.

- Equipment ownership: You own the equipment from day one.

The restaurant industry is competitive, and quality equipment is expensive, with a full kitchen often costing $150,000 or more. Traditional bank loans are slow and require perfect credit, making them inaccessible for many.

Guaranteed financing programs offer a better way. By sharing risk with lenders, government-backed programs like the Canada Small Business Financing Program have transformed how restaurants get funded. This approach is about more than just getting approved; it's about preserving your cash flow. Instead of depleting capital, you can spread equipment costs over 12-60 months while the new tools generate revenue.

Understanding these financing options can be the difference between struggling with outdated equipment and thriving with the tools you need for success.

Glossary for guaranteed restaurant equipment financing:

What "Guaranteed Restaurant Equipment Financing" Really Means

When lenders use the term "guaranteed restaurant equipment financing," they don't mean every applicant is automatically approved. Instead, "guaranteed" signifies a much higher chance of approval compared to a traditional business loan. The reason it works so well is that the equipment you're buying becomes the collateral for the loan. This built-in security for the lender dramatically reduces their risk, making them more willing to say "yes."

This approach is a game-changer for restaurant startups and owners with imperfect credit. Instead of focusing solely on past credit history, lenders evaluate the value of the equipment and your potential to generate revenue with it. This focus on potential opens doors for many who would be turned away by traditional banks.

Government programs often back these loans, adding another layer of security. When a government agency shares the risk, lenders become much more friendly to small business owners, creating a win-win for the industry.

How Guaranteed Financing Differs from Other Options

Understanding your options is key. Here’s how guaranteed restaurant equipment financing compares to other common funding methods.

Traditional bank loans are the old-school approach. They typically require pristine credit scores (700+), years of business history, extensive financial statements, and often additional collateral. The approval process can drag on for weeks or months, and their tolerance for risk is extremely low.

Equipment leasing is similar to renting. Monthly payments are often lower, and at the end of the lease, you can upgrade, purchase the equipment, or return it. This offers flexibility but means you don't build equity unless you buy it out. For more on this, see our Lease Commercial Kitchen Equipment Guide.

Merchant cash advances (MCAs) offer very fast funding, often within 24-48 hours. Repayment is made by taking a percentage of your daily credit card sales. While convenient for emergencies, MCAs are typically the most expensive form of financing.

Here's how these options stack up:

| Feature | Guaranteed Financing | Traditional Bank Loans | Equipment Leasing |

|---|---|---|---|

| Approval Rate | Higher (equipment as collateral reduces risk) | Lower (very strict requirements) | Moderate (focuses on cash flow) |

| Speed | Fast (often 24-48 hours) | Slow (weeks to months) | Fast (typically 1-2 days) |

| Credit Requirements | Flexible (options for scores as low as 550) | Strict (usually need 700+) | Flexible (easier for new businesses) |

| Ownership | Yes, from day one | Yes, from day one | No (unless you buy at lease end) |

| Down Payment | Often minimal or zero | Can require 10-20% down | Usually just first payment |

The Role of Government-Backed Programs

Government programs don't lend money directly; they act as a co-signer. By guaranteeing a portion of the loan, they reduce the lender's risk, which encourages them to approve more applications from small businesses.

The Canada Small Business Financing Program (CSBFP) is a prime example. The government shares the risk with lenders, making them more willing to finance restaurants with gross annual revenues of $10 million or less. The program allows for substantial loans, with up to $500,000 available for equipment and leasehold improvements. You can learn more about the CSBFP program on the official government website.

In the United States, SBA loans operate on the same principle. The Small Business Administration guarantees a portion of loans made by approved lenders, such as through the popular SBA 7(a) and 504 loan programs. This backing often results in better terms, including lower interest rates and longer repayment periods, leveling the playing field for restaurant owners.

The Benefits and Eligible Equipment for Guaranteed Financing

Guaranteed restaurant equipment financing is a strategic tool for building a thriving business. By financing equipment instead of paying cash, you keep your business flexible and your cash flow healthy, allowing you to focus on creating great dining experiences.

Key Advantages for Your Restaurant

Here are the real-world benefits of financing your restaurant equipment.

Improved Cash Flow Cash flow is the lifeblood of a restaurant. A large equipment purchase can drain your bank account, leaving you vulnerable to unexpected expenses. Financing conserves your working capital by spreading the cost into manageable monthly payments. This gives you the financial flexibility to cover payroll, inventory, and marketing while your new equipment helps generate revenue.

Access to Top-Tier Equipment Financing allows you to acquire the efficient, reliable equipment you need without compromise. Quality equipment leads to safer food, lower energy bills, and smoother operations. Instead of settling for what you can afford today, you can choose equipment based on what your restaurant needs to succeed long-term.

Build Business Credit Every on-time payment on your equipment loan helps build your business's credit history. A strong credit profile makes it easier to secure financing for future expansion or upgrades. It's a financial reputation that opens doors to better loan terms, higher credit limits, and even more favorable terms from suppliers.

Tax Deductions Financing can offer significant tax benefits. Under Section 179, businesses may be able to deduct the full cost of financed equipment in the first year. Alternatively, you might deduct the monthly payments as an operating expense. These advantages can lower your overall costs, but always consult a tax professional for advice specific to your situation. To learn more about what to avoid, read our guide on restaurant equipment financing mistakes.

What Types of Equipment Can You Finance?

Guaranteed restaurant equipment financing is comprehensive, covering nearly everything a modern food service business needs.

- Refrigeration: This is the backbone of your kitchen. Finance everything from walk-in coolers and freezers to reach-in refrigerators, prep tables, and ice machines.

- Food preparation equipment: This is where your menu comes to life. Eligible items include commercial mixers, food processors, slicers, and stainless steel prep tables.

- Warewashing systems: Essential for health and safety, this includes commercial dishwashers, glass washers, and three-compartment sinks.

- Beverage service equipment: Boost profit margins with financed coffee brewers, espresso machines, blenders, and beverage dispensers.

- Point-of-sale systems and technology: Modern POS systems and kitchen display systems streamline operations and can be included in your financing package.

- Restaurant furniture: Even tables, chairs, booths, and bar stools can often be financed to create the perfect dining ambiance.

If it helps your restaurant operate and generate revenue, there's a good chance you can finance it.

Navigating the Application and Approval Process

Getting approved for guaranteed restaurant equipment financing is a straightforward process when you're prepared. Unlike traditional bank loans that can take weeks, specialized online lenders have streamlined the process, allowing for remarkably fast turnarounds.

Understanding the Eligibility Requirements for guaranteed restaurant equipment financing

While more accessible, lenders still have criteria to ensure you can manage the payments. It's about showing you have a viable business, not about being perfect.

Credit Score Matters, But It's Not Everything Both personal and business credit scores are considered, but specialized lenders are flexible. While banks may require a score of 700+, equipment lenders often work with scores as low as 550. They focus more on recent payment history and cash flow than old credit issues. For more guidance, see our resource on Restaurant Equipment Financing for Bad Credit.

Time in Business Requirements Are Flexible Many lenders will work with businesses that have been operating for just six months. Some even finance startups, provided they have a strong business plan. Surviving the first six months demonstrates a basic level of stability to lenders.

Annual Revenue Shows Your Ability to Pay Lenders want to see consistent income to show you can handle the loan payments. A common minimum is $120,000 in annual revenue. This isn't about profitability but about demonstrating steady cash flow to service the debt.

A Strong Business Plan Opens Doors Crucial for new restaurants, a detailed business plan shows lenders your concept, target market, and realistic financial projections. It's your opportunity to tell your story and demonstrate you've thought through potential challenges.

A Step-by-Step Guide to Applying

The application process is simpler than you might think. Here’s how it typically works:

Step 1: Gather Your Documents First Get organized before you apply. You'll generally need your business registration documents, the last 3-6 months of bank statements, equipment quotes from suppliers, and a valid driver's license. Having these ready will make the process much smoother.

Step 2: Find the Right Lender Research online lenders, credit unions, and banks that specialize in the restaurant industry. They understand your unique challenges better than general lenders. Government-backed programs like the CSBFP or SBA loans are also excellent options that work through approved financial institutions.

Step 3: Complete the Application Accurately Most lenders have simple online applications. The key is accuracy and completeness. Double-check all information before submitting. Many specialized lenders can provide a decision within 24-48 hours.

Step 4: Review Your Offer Carefully Once approved, you'll receive a financing offer. Read the fine print carefully. Pay close attention to the interest rate, term length, and any fees like origination charges or prepayment penalties. Don't be afraid to ask the lender to clarify anything you don't understand.

Understanding the Financials, Risks, and Repayment

Before committing to guaranteed restaurant equipment financing, understand the full financial agreement. This means grasping the total cost, potential fees, and the risks involved. A clear understanding protects your business and prevents unwelcome surprises.

Typical Loan Amounts, Terms, and Rates

Here's what you can realistically expect when financing equipment.

Loan Amounts for guaranteed restaurant equipment financing are flexible, ranging from $5,000 for a single item to over $500,000 for a complete kitchen overhaul. This wide range ensures that both small cafes and large restaurants can find a solution to meet their goals.

Repayment Terms typically range from 12 to 60 months. This allows you to align your payment schedule with your cash flow. Shorter terms mean higher payments but less total interest, while longer terms offer lower monthly payments but cost more in interest over time. The goal is to find a balance between affordability and cost-efficiency.

Interest Rates vary based on your credit profile, time in business, and the lender. Rates for business loans can range widely, often between 8% and 29%. Government-backed programs like the CSBFP have capped rates; for example, a floating rate cannot exceed the prime lending rate + 3%. Always get a clear quote and use a business loan calculator to estimate your monthly payments and total interest.

Uncovering Hidden Fees and Potential Risks

While generally transparent, it's wise to be aware of potential fees and risks.

- Origination Fees: Some lenders charge an upfront fee for processing the loan, usually a percentage of the total loan amount. Always ask about this fee beforehand.

- Prepayment Penalties: This is a fee charged if you pay off your loan early. If you anticipate being able to pay off the debt ahead of schedule, clarify if this penalty applies.

- Impact on Borrowing Capacity: Taking on new debt affects your ability to secure other financing in the short term. Be mindful of your overall debt-to-income ratio when planning for future growth.

- Default Risk: This is the most significant risk. If you cannot make payments, you risk losing the equipment and severely damaging your business and personal credit scores.

What Happens if You Cannot Make Payments?

If you anticipate trouble making a payment, communicate with your lender immediately. Most would rather work with you on a solution, like a temporary deferment, than begin default proceedings. Ignoring the problem leads to serious consequences.

- Collateral Repossession: The lender has the legal right to repossess the financed equipment if you default. Losing these essential tools can halt your operations.

- Credit Score Damage: A default will leave a negative mark on your business and personal credit reports for years, making future financing extremely difficult to obtain.

- Personal Guarantees: Many agreements require a personal guarantee, meaning you are personally responsible for the debt if the business defaults. In this case, the lender can pursue your personal assets to cover the outstanding loan balance. Understand this clause fully before signing.

Conclusion: Fueling Your Restaurant's Future

Guaranteed restaurant equipment financing is a strategic partner for growth, acting as a bridge between your culinary vision and operational reality. It opens doors that traditional financing often keeps closed, especially for new and growing businesses.

This financing approach allows you to preserve cash flow, acquire top-tier professional equipment, and build business credit with every on-time payment. The process is more accessible and faster than you might think, covering everything from refrigeration and food prep stations to POS systems and furniture.

By understanding the application process, loan terms, and potential risks, you can make an informed decision that fits your business model. Smart financing is the secret ingredient that separates struggling restaurants from thriving ones. It allows you to invest in the quality tools that drive efficiency and growth without depleting your operating capital.

When you're ready to equip your kitchen for success, you're free to focus on what you do best: creating incredible food and memorable experiences for your customers.

Ready to turn your equipment dreams into reality? Explore your restaurant equipment financing options with The Restaurant Warehouse. We're here to help you build the foundation for lasting success.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment