How to Get Equipment Financing with Bad Credit

Your restaurant is built on your passion, hard work, and a vision for creating amazing food and experiences. A three-digit credit score from your past shouldn't stand in the way of your future. When you need to upgrade your kitchen or replace a vital appliance, feeling stuck because of your credit history is incredibly frustrating. But your business is more than just a number. This is where equipment financing bad credit solutions come in. They provide a pathway to getting the tools you need to grow, based on the strength of your business itself. This guide is designed to help you prepare, apply, and get approved.

How Bad Credit Equipment Financing Can Save Your Restaurant

Restaurant equipment financing bad credit options exist to help restaurant owners secure essential kitchen equipment despite poor credit scores. While traditional banks may deny your application, specialized lenders and alternative financing programs like restaurant equipment rental can get you the commercial kitchen equipment you need.

Quick Answer: Yes, you can get restaurant equipment financing with bad credit:

- Minimum credit scores: Some lenders accept scores as low as 500-575.

- Equipment as collateral: The equipment itself secures the loan, reducing lender risk.

- Online lenders: More flexible than traditional banks for bad credit applicants.

- Higher costs: Expect higher interest rates and shorter repayment terms.

- Alternative options: Lease-to-own, equipment leasing, and merchant cash advances are available.

Commercial kitchen equipment comes with hefty price tags. Bad credit (typically a FICO score below 630) makes acquiring it even tougher, as traditional banks often see restaurant owners with poor credit as high-risk borrowers.

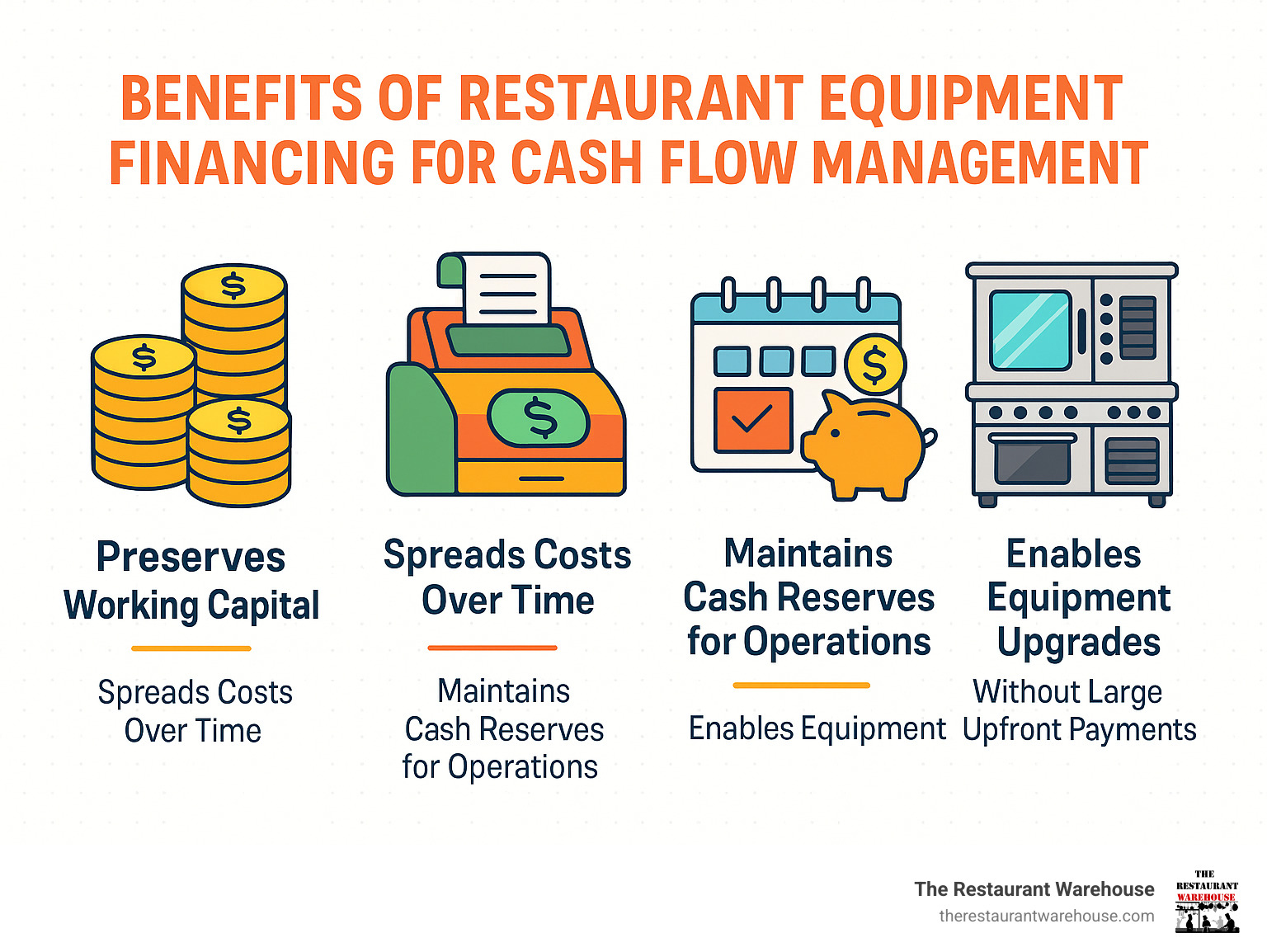

However, your credit score doesn't define your restaurant's potential. Equipment financing exists specifically to help businesses like yours preserve working capital while getting the tools needed to serve customers and generate revenue. Having access to financing means you can respond quickly to equipment breakdowns or changing customer demands without emptying your bank account.

Can You Get Equipment Financing with Bad Credit?

If you're a restaurant owner with a less-than-stellar credit score, you might feel like your financing options are limited. The good news is that restaurant equipment financing bad credit isn't just possible; it's a common solution for restaurateurs.

"Bad credit" typically refers to a FICO score below 630. However, many equipment lenders work with business owners whose scores dip into the 500s. You might qualify with a score as low as 575, and some specialized lenders consider scores around 500.

Lenders are more flexible because equipment financing is "self-collateralized." The equipment you're buying serves as security for the loan. If you default, the lender can reclaim the equipment. This built-in safety net reduces the lender's risk and allows them to be more lenient with credit requirements than traditional banks.

Online lenders, in particular, often look at the bigger picture of your business, not just a three-digit credit score. They understand that past personal credit issues don't always predict future business success.

More Than a Number: What Lenders Really Look For

When your credit score is low, lenders look for other signs of your business's health and your ability to make payments.

- Time in business: Most lenders want to see at least 6 months to 2 years of operation. Experience shows stability. If you've been in business for less than 2 years, you might need a higher credit score (around 650).

- Annual revenue and cash flow: This often matters more than your credit score. Lenders typically look for minimum annual sales from $100,000 to $500,000. Consistent cash flow proves you can handle monthly payments.

- A strong business plan: This shows lenders you have a clear strategy for profitability and are not just winging it.

- Industry experience: At least three years of experience in the restaurant industry is a major plus, as it shows you understand the unique challenges.

- Down payment capacity: Offering a 15-20% down payment shows you have skin in the game and reduces the lender's risk. For scores under 600, a down payment may be required.

Revenue and Cash Flow Requirements

Your credit score tells a story about your past, but your revenue tells a story about your present and future. This is why lenders often place more weight on your business's financial health. They typically look for minimum annual sales ranging from $100,000 to $500,000. More important than the total number is the consistency of your cash flow. Lenders want to see that you have a steady stream of income to comfortably cover your existing expenses plus a new monthly payment. This proves your restaurant is a viable, operating business that can handle the financial responsibility of new restaurant equipment, making you a much more attractive applicant, even with a lower credit score.

Why Traditional Banks Often Say No

It can be incredibly disheartening to get a loan rejection from a traditional bank, but it’s important not to take it personally. Big banks operate on very strict, conservative lending models. They usually require a business credit score of 680 or higher and rarely make exceptions. Because the restaurant industry is known for its tight margins and high turnover, traditional banks often view restaurant owners with poor credit as high-risk borrowers. This is where alternative lenders and specialized financing programs shine. They are built to serve industries that big banks often overlook, and they understand that a FICO score below 630 doesn't mean your business is doomed to fail.

Common Hurdles to Getting Approved

Understanding potential roadblocks helps you prepare a stronger application.

- Minimum credit score: Most bad credit programs accept scores between 500-575. Below 500, your options are very limited.

- Time in business: Newer restaurants (under 6 months) may struggle to find lenders, often needing to compensate with higher revenue or a larger down payment.

- Annual sales minimums: If your restaurant isn't hitting revenue benchmarks, focus on building sales before applying.

- Automatic denial triggers: Certain issues can lead to automatic denial. These include a recent bankruptcy (within 12 months), felony convictions (within 10 years), delinquent child support, or unsatisfied tax liens (unless on a payment plan).

- No credit history: Having no credit can be as challenging as having bad credit, as lenders have no data to assess your payment habits.

Your Best Financing Options with Bad Credit

When your credit score isn't perfect, you still have a diverse menu of financing options. Restaurant equipment financing bad credit solutions are designed for situations like yours, offering the flexibility that traditional banks often can't.

Key options include equipment loans, equipment leasing, and lease-to-own agreements. Understanding how each works is crucial for choosing the best fit for your restaurant's cash flow and long-term goals.

Should You Lease or Buy Your Equipment?

These two common methods work very differently. An equipment loan is straightforward: you borrow money to buy equipment, which acts as collateral. Once repaid, you own it outright. This is ideal for long-term assets and allows you to claim the Section 179 tax deduction. However, monthly payments are typically higher, and a down payment of 10-20% may be required for bad credit applicants.

Equipment leasing is like renting. You make monthly payments to use the equipment, but the leasing company retains ownership. At the end of the term, you can return the equipment, renew the lease, or buy it. Leasing preserves cash flow with lower monthly payments and often requires no money down. Lease payments are usually fully tax-deductible as an operating expense.

| Feature | Equipment Loans | Equipment Leasing |

|---|---|---|

| Ownership | You own the equipment once loan is repaid | The leasing company owns the equipment |

| Upfront Cost | May require a down payment (especially with bad credit) | Often 100% financing, minimal or no down payment |

| Monthly Payments | Generally higher than lease payments | Typically lower monthly payments |

| Maintenance | Your responsibility | Your responsibility (unless specified in lease) |

| End-of-Term | You own the asset | Options: return, renew lease, or purchase |

| Tax Benefits | Section 179 deduction (depreciation) | Lease payments are often fully tax-deductible as expenses |

Considering Lease-to-Own and Other Options

Alternative financing options are often well-suited for those with credit challenges.

- Lease-to-own agreements: This hybrid option offers the lower monthly payments of a lease but with a clear path to ownership. At the end of the term, you own the equipment for a nominal fee (often $1). This is an excellent choice for restaurant equipment financing bad credit because the equipment serves as collateral, making lenders more comfortable.

- Merchant Cash Advances (MCAs): An MCA provides immediate cash by purchasing a portion of your future credit card sales. Repayment is an automatic percentage of your daily sales. While very accessible for bad credit, MCAs are typically the most expensive option, with high factor rates. Consider this only for urgent needs.

- Short-term loans: These loans (3-18 months) are easier to qualify for than bank loans but have higher interest rates and may require daily or weekly payments.

- Microloans: Offered by non-profits, these smaller loans (up to $50,000) have flexible credit requirements and more reasonable rates, though the application process can be longer.

- Revenue-based financing: Similar to an MCA, but payments are based on your overall monthly revenue, offering more flexibility during slow periods.

Alternative Lenders and Programs to Consider

When traditional banks aren't an option, several other doors open up. Alternative lenders and government-backed programs are often more flexible, focusing on your restaurant's actual performance rather than just your credit history. These options can provide the capital you need to purchase essential equipment, from commercial freezers to high-performance deep fryers. Exploring these avenues can make all the difference in getting your kitchen fully equipped and operational without the strict requirements of a conventional loan.

SBA Microloans

If you're looking for an affordable, government-backed option, SBA Microloans are worth considering. These loans provide up to $50,000 and typically come with more manageable interest rates, ranging from 8% to 13%. The credit requirements are also more forgiving. While some lenders might look for a minimum score around 500, others don't check credit at all, making this a viable path for many business owners. The main trade-off is time; the funding process isn't instant and can take anywhere from 30 to 90 days. This makes it a better fit for planned equipment purchases rather than emergency replacements.

Crowdfunding and Fintech Lenders

Online lenders, often called fintech lenders, are a game-changer for business owners with bad credit. Unlike traditional banks that might automatically deny an application based on a low score, these lenders look at a broader set of data. They prioritize factors like your restaurant's sales history and your ability to repay the loan, giving them a more complete picture of your business's health. Crowdfunding platforms also offer another way to raise capital by sourcing smaller amounts of money from a large number of individuals, which can be effective for specific projects or equipment needs.

Invoice Financing

If your restaurant does a lot of catering or corporate events, you might find yourself waiting on unpaid invoices. Invoice financing lets you turn those outstanding receivables into immediate cash. Instead of waiting for clients to pay, you can use your unpaid invoices as collateral to secure funds right away. This is an excellent solution for managing cash flow gaps, allowing you to purchase equipment or cover other expenses without delay. It’s a practical way to get quick access to money you've already earned, based on the value of your customer accounts.

How to Apply and Secure Your Financing

Getting restaurant equipment financing bad credit approval is achievable with the right preparation. Most online lenders have streamlined their applications to help restaurant owners get funded quickly.

The key to approval is being organized. The smoother your application process, the faster you can get your equipment.

Your Step-by-Step Application Checklist

- Get an equipment quote. Before applying, get a detailed quote from an equipment supplier for the equipment you need. Lenders require this to process your application.

- Gather your documents. Be prepared with 3-6 months of recent bank statements to show cash flow. For larger requests, you may need 2 years of business tax returns and profit and loss statements. Also have your business registration documents, driver's license, and a voided business check ready.

- Complete the application. Many online lenders offer simple, one-page applications. Be honest and thorough, as transparency is valued, especially with credit challenges.

- Compare offers. Don't just accept the first approval. Carefully compare interest rates, repayment terms, fees, and funding speed to find the best fit for your business.

Because the equipment serves as collateral, the approval process is often faster than for other business loans, with some online lenders providing funds in as little as 24 hours.

Tips for a Stronger Application

Even with challenged credit, you can take steps to make your application more attractive.

- Offer a larger down payment. Putting down 10-20% or more reduces the lender's risk and shows your commitment, which can be a deciding factor.

- Provide additional collateral. If you own other business assets like real estate, mentioning them can strengthen your application.

- Secure a co-signer. A business partner or family member with strong credit can guarantee the loan, providing extra security for the lender.

- Write a letter of explanation. Briefly and honestly explain any negative items on your credit report and the steps you've taken to resolve them.

- Create a detailed business plan. Show lenders how the new equipment will increase revenue or improve efficiency, demonstrating a clear path to repaying the loan.

- Show strong financial performance. Consistent revenue and positive cash flow can often outweigh a poor credit score.

- Be prepared for a personal guarantee. Nearly all lenders will require a personal guarantee for bad credit financing. This is a standard practice where you become personally liable if the business defaults.

Know Your Business Credit Score

Before you fill out a single application, it's essential to know exactly where you stand. Take the time to check both your personal and business credit scores. This number gives you a baseline and helps you manage expectations. While a low score can feel discouraging, remember that many lenders in this space work with scores as low as 500-575. Knowing your score allows you to target the right lenders from the start, saving you time and potential rejections. It’s the first step in taking control of the financing process and finding a partner who understands your situation.

Ask for a "Soft Credit Pull"

Here’s a pro tip: before you formally apply, always ask if the lender can perform a "soft pull" on your credit. A soft credit pull lets you and the lender see what financing options you might qualify for without impacting your credit score. Think of it as window shopping for a loan. Multiple hard inquiries in a short period can lower your score, which is the last thing you need when you're already working with challenged credit. A soft pull is a no-risk way to gather information and compare offers before you commit to a formal application.

Start with Your Current Bank

Don't overlook the power of an existing relationship. Your current business bank has a front-row seat to your restaurant's financial health, including your cash flow and deposit history. If you have a good relationship and maintain consistent deposits, your bank might be more willing to work with you or offer special programs that aren't advertised to the public. They know your business's rhythm better than an outside lender, which can sometimes be enough to outweigh a lower credit score. It’s always worth a conversation before you look elsewhere.

Maintain Healthy Finances

Your day-to-day financial habits speak volumes to lenders. Make it a priority to keep your business bank accounts healthy and consistently avoid overdrafts or non-sufficient funds (NSF) fees. This demonstrates financial responsibility and shows that you manage your cash flow effectively, even if your credit history has some blemishes. Lenders see a well-managed bank account as a strong indicator that you’ll be able to handle loan payments. This simple discipline can significantly improve your credibility and is a foundational step before seeking restaurant equipment financing.

The Fine Print: Understanding Rates, Terms, and Risks

When you're ready to pursue restaurant equipment financing bad credit, it's important to have realistic expectations about the costs and terms. They will differ significantly from options available to businesses with excellent credit.

Breaking Down the Costs: Rates and Terms

- Higher Interest Rates: Lenders charge higher interest rates to compensate for the increased risk associated with a low credit score.

- Shorter Repayment Terms: To limit their exposure, lenders often offer shorter terms, typically from 6 months to 3 years (though some may go up to 72 months). This results in higher monthly payments, so ensure your cash flow can support them.

- Factor Rates vs. APR: Some lenders use a factor rate (e.g., 1.15) instead of an APR. To find your total repayment, you multiply the loan amount by the factor rate ($10,000 x 1.15 = $11,500). Always ask for the equivalent APR to accurately compare the true annual cost of different loan offers.

- Comparing Offers: Shop around and look beyond the headline rate. Consider the total cost of borrowing, hidden fees (origination, administrative), and any prepayment penalties.

Typical Interest Rates and Loan Amounts

Let's talk numbers. When you have bad credit, you should expect to pay more in interest. Lenders see a lower score as higher risk, and they adjust their rates accordingly. While some financing programs advertise rates starting around 6%, those are typically for applicants with stronger credit. For scores in the 500-630 range, it's more realistic to see rates in the double digits. As for how much you can borrow, you might be surprised. Some lenders offer restaurant equipment financing up to $2 million, but your approval amount will depend heavily on your restaurant's sales. A lender needs to see strong, consistent revenue to feel confident in your ability to repay the loan, making your financial documents just as important as your credit score.

How Does Bad Credit Financing Compare?

- Credit Cards: Generally a poor choice for large equipment due to very high interest rates and credit limits that are often too low.

- Traditional Small Business Loans: Difficult to obtain with bad credit due to strict requirements, though they offer better rates for those who qualify.

- SBA 7(a) Loans: These government-backed loans have excellent terms but a lengthy application process and typically require a FICO score of 650 or higher.

- Paying Cash: While ideal for avoiding interest, it can drain your working capital, which is essential for daily operations. Financing preserves this cash.

Additional Loan Features and Benefits

Beyond just getting the funds, many modern financing solutions come with features designed to make your life easier. These perks can be especially helpful when you're managing tight cash flow and unpredictable sales cycles. Think of them as built-in tools that help you adapt and grow, even when your credit history isn't perfect. Understanding these benefits can help you choose a financing partner that truly supports your restaurant's long-term success, turning a simple loan into a strategic asset for your business.

Flexible and Deferred Payment Structures

The restaurant industry rarely has a steady, predictable income stream. Lenders who specialize in this space get it. That's why many offer flexible payment plans that align with your business's natural rhythm. If you run a seasonal business—say, a beachside cafe that's packed in the summer but quiet in the winter—you can arrange for lower payments during your off-season and higher payments when cash is flowing. Some lenders offer monthly, quarterly, or even semi-annual payment schedules. This kind of flexibility is a game-changer for managing your cash flow without stress, ensuring you can meet your obligations even during slower months.

Coverage for Soft Costs like Shipping and Installation

The price tag on a new piece of equipment is rarely the final cost. You also have to account for "soft costs" like shipping, installation, and taxes, which can add a significant amount to your initial outlay. The great news is that many financing agreements can cover 100% of these expenses. This means you can get new refrigerators or deep fryers delivered and installed without paying anything out of pocket. By rolling these costs into your loan, you preserve your working capital for day-to-day operations like payroll and inventory, which is critical when you're building your business.

Lease Add-on Options

Your restaurant's needs are going to evolve. A new menu item might take off, suddenly requiring a second fryer, or you might decide to expand your catering services, which means you need more prep tables. Some leasing agreements offer add-on options, allowing you to add new items to your existing lease without going through a brand-new application process. This flexibility makes it much easier to shop for restaurant equipment and scale your operations smoothly as your business grows. It turns your financing partner into a resource that can adapt with you, supporting your success every step of the way.

What If You Get Denied?

A denial is a signal to re-evaluate. Common reasons include insufficient revenue, very recent negative financial events (like bankruptcy), outstanding tax liens, or a business that is too new (less than 6 months).

If you are denied, take these steps:

- Ask the lender why. Their feedback is valuable for improving your next application.

- Work on your credit. Make timely payments on all bills and reduce existing debt. This is a long-term strategy that will open up better financing options in the future.

- Explore alternatives. Look into options like microloans or asset-based lending.

- Refine your business plan. Clearly demonstrate your growth strategy and ability to generate enough revenue to cover payments.

Beyond the Loan: Tax Breaks and Your Financial Future

Securing restaurant equipment financing bad credit is more than just a short-term fix; it's a strategic financial move. While interest rates may be higher, the associated tax benefits and credit-building opportunities can offset those costs and improve your restaurant's long-term financial health.

What Is the Section 179 Tax Deduction?

The Section 179 Deduction is a significant tax advantage for small businesses. It allows you to deduct the full purchase price of qualifying equipment in the year you put it into service, rather than depreciating it over several years.

For example, financing a $15,000 commercial refrigerator could result in a $3,750 tax saving if your business is in a 25% tax bracket. This benefit applies whether you paid cash or financed the equipment, and it covers most commercial kitchen items, from fryers to POS systems.

Bonus depreciation is another tax benefit that can allow you to deduct a large percentage of remaining equipment costs after you've used the Section 179 deduction. Always consult with a tax professional to understand how these deductions apply to your specific situation, as laws and limits can change.

How to Build Business Credit for a Healthier Future

Every on-time payment you make on your equipment financing helps build a stronger financial future for your business. This restaurant equipment financing bad credit arrangement can be a stepping stone to better terms.

- Make payments on time: This is the most powerful way to improve your business credit profile. It proves your reliability to future lenders.

- Ensure your lender reports payments: Ask potential lenders if they report your payment history to business credit bureaus like Dun & Bradstreet, Experian Business, or Equifax Business. If they don't, your on-time payments won't help build your credit score.

- Demonstrate financial maturity: Successfully managing a loan despite past credit issues shows lenders that you are a responsible borrower.

As your business credit improves, you'll gain access to lower interest rates, longer repayment terms, and financing from traditional banks. What starts as a necessary, higher-cost loan can become your pathway to mainstream, affordable financing for all future business needs.

Frequently Asked Questions about Restaurant Equipment Financing with Bad Credit

It's normal to have questions when exploring restaurant equipment financing bad credit options. Here are answers to some of the most common inquiries from restaurant owners.

Will I need a personal guarantee for bad credit equipment financing?

Yes, almost always. When lending to a business with a lower credit score, lenders require a personal guarantee as an additional layer of security. It's a standard practice that shows your commitment to the loan.

A personal guarantee means that if your business defaults on the payments, you, as the owner, are personally responsible for repaying the debt. It mitigates the lender's risk, making them more willing to approve financing despite a challenging credit history.

Can I finance used restaurant equipment with bad credit?

Yes, absolutely. Many lenders will finance used equipment, which can be a smart, budget-friendly way to outfit your kitchen. It helps you get started without draining your working capital.

However, lenders will consider a few factors, especially with restaurant equipment financing bad credit:

- Equipment Age and Condition: Lenders may have rules about the maximum age of equipment they will finance, as older items can pose a higher risk of breaking down.

- Loan Terms: You might be offered a slightly lower loan amount or a higher interest rate for used equipment compared to new, reflecting the perceived risk.

Despite this, financing used equipment is a savvy strategy for preserving cash and getting your kitchen operational quickly.

How quickly can I get funded?

Funding speed varies, but the good news is that many modern lenders are very fast.

- Online Lenders: These lenders are typically much faster than traditional banks. You can often receive an approval decision within a few hours and have funds available in 24-48 hours.

- Traditional Banks: The process is much slower, often taking weeks or even months.

- Your Preparedness: The fastest way to get funded is to be prepared. Have your equipment quote, bank statements, and other business documents ready to submit with your application. Delays often happen when lenders have to wait for missing information.

While some lenders advertise "same-day approval," this usually refers to the decision, not the funding itself. However, by working with a streamlined online lender and being prepared, you can get your equipment surprisingly fast.

Your Next Steps to Getting Funded

We've explored the ins and outs of restaurant equipment financing bad credit, and the path forward should be much clearer. A less-than-perfect credit score is a hurdle, but it is not a brick wall that blocks you from equipping your restaurant for success.

The key takeaway is that options are available. Lenders are often willing to work with you because the equipment itself serves as collateral, reducing their risk. While you can expect higher interest rates and will almost certainly need to provide a personal guarantee, these are manageable terms to get the tools you need.

By being proactive—gathering your documents, offering a down payment, and presenting a clear business plan—you can significantly boost your approval chances. Every on-time payment is a step toward building better business credit, which open ups more favorable financing in the future. Don't forget to leverage tax benefits like the Section 179 deduction to lower the effective cost of your investment.

Your kitchen's future doesn't have to wait for a perfect credit score. With the right strategy and a little perseverance, you can get your kitchen fully equipped and start serving up success today.

Key Takeaways

- Focus on your business, not just your score: Lenders for equipment financing care more about your restaurant's recent performance than past credit mistakes. The equipment itself acts as collateral, making it possible to get approved with scores as low as 500.

- Prove your restaurant's viability with documents: Your application's strength lies in your financial records. Have 3-6 months of recent bank statements and a clear business plan ready to show lenders you have consistent cash flow to handle new payments.

- Apply strategically to protect your credit: Before committing, ask lenders for a "soft credit pull" to see potential offers without impacting your score. You can also strengthen your application by offering a down payment or adding a co-signer to reduce the lender's risk.

Related Articles

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment