Who to Call: Companies That Finance Restaurant Equipment

Why Restaurant Equipment Financing Companies Are Essential for Your Success

A restaurant equipment financing company can be the difference between opening your dream restaurant on time or watching your startup capital disappear into equipment costs. Many restaurant owners find that traditional banks can be unhelpful with equipment financing, which is why dedicated equipment financing providers have become essential partners in the industry.

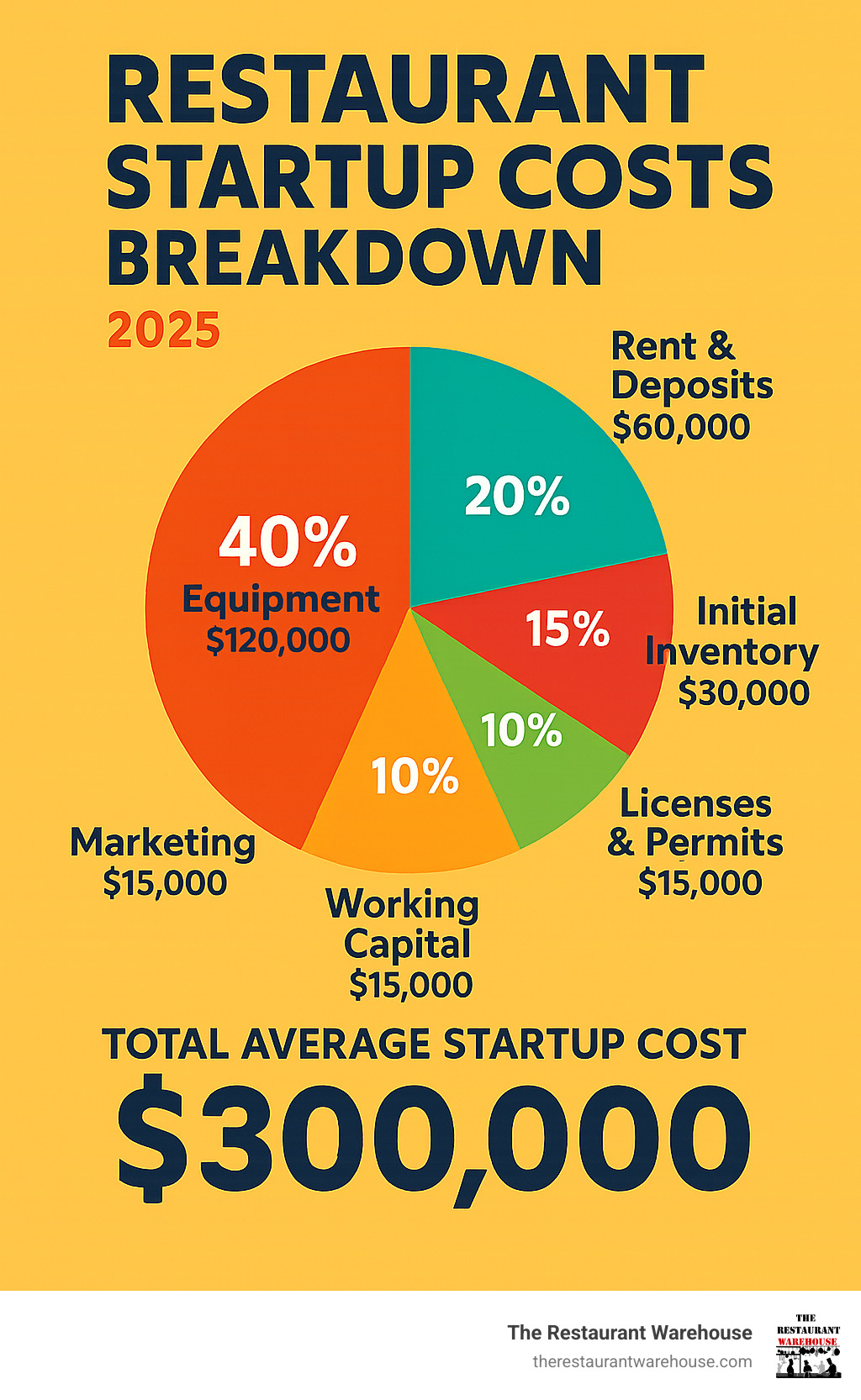

The restaurant industry requires substantial upfront investment—from commercial refrigeration and dishwashers to POS systems and furniture. Rather than depleting your working capital with large equipment purchases, financing allows you to preserve cash flow while acquiring the assets you need to operate successfully.

Restaurant equipment financing companies specialize in understanding the unique challenges of the foodservice industry. They offer flexible terms, often with no money down and approval processes designed specifically for restaurant businesses. Unlike traditional banks that may view restaurants as high-risk ventures, these specialized lenders focus on your business potential and revenue rather than just credit scores. Many offer fast approvals, with some providing funding in as little as 24 hours.

Whether you're opening a new restaurant, expanding an existing operation, or upgrading aging equipment, the right financing partner can provide the capital you need while keeping your cash available for daily operations, marketing, and unexpected expenses.

Quick restaurant equipment financing company terms:

Why Finance? The Strategic Edge of Leasing Over Buying Outright

Imagine you need a commercial refrigeration system that costs $15,000. You could pay for it outright, or you could finance it for a manageable monthly payment. For most restaurant owners, financing is the smarter strategic play.

Cash flow is king in the restaurant business. When you buy equipment, you tie up a large portion of your working capital in assets that don't generate immediate revenue. That refrigeration system is essential, but it doesn't directly bring in customers or pay your staff. Financing preserves your capital for things that drive revenue, like fresh ingredients and marketing.

Predictable monthly payments make budgeting far easier than dealing with massive upfront costs that can disrupt your financial plan. The tax benefits can also be significant. Lease payments often qualify as business expenses, making them typically 100% tax-deductible. Under Section 179 of the IRS tax code, you may be able to deduct the full cost of equipment, reducing your taxable income. We always recommend consulting your accountant, but these deducting payments under Section 179 provisions can lead to substantial savings.

Another key benefit is avoiding equipment obsolescence. The foodservice industry evolves quickly. Today's state-of-the-art dishwasher can become outdated and inefficient in a few years. When you buy equipment, you're stuck with it. Financing provides the flexibility to upgrade at the end of your lease term, allowing you to stay competitive with modern, efficient assets.

Restaurant cash flow can be unpredictable. Smart managing your restaurant's cash flow means having liquid capital available for these fluctuations. By financing equipment, you use someone else's money to acquire necessary tools while keeping your own cash free for operations. It's a strategic move that provides flexibility and reduces financial stress.

Decoding Your Financing Choices: Leases, Loans, and Rentals

Navigating restaurant equipment financing can seem complex, but it becomes clearer once you understand the main options: leases, loans, and rentals. Each serves a different purpose depending on your restaurant's cash flow, risk tolerance, and long-term goals.

Let's compare these three options:

| Feature | Equipment Leases | Equipment Loans | Equipment Rentals |

|---|---|---|---|

| Ownership | Lessor owns; lessee can purchase at end | Borrower owns equipment | Lessor owns; short-term use for lessee |

| Upfront Cost | Low or no money down | Can require a down payment | Low initial deposit or first payment |

| Monthly Payment | Predictable, often lower than loan | Predictable, often higher than lease | Variable by rental duration |

| Maintenance | Lessee's responsibility | Borrower's responsibility | Can be included in agreement |

| End-of-Term Options | Purchase, renew, or return | Owns equipment outright | Return, extend, or Rent-Try-Buy |

Understanding Equipment Leases: Your Flexible Partner

Leasing is a popular choice because it offers flexibility without high upfront costs. There are several types:

- A Capital Lease is structured like an installment plan and is treated as a purchase for accounting purposes. You can claim depreciation on your taxes, and the equipment appears as an asset on your balance sheet, helping you build equity. At the end of the term, you typically purchase the equipment for a nominal fee, sometimes just $1. This option is best for equipment you intend to keep for its entire useful life.

- An Operating Lease is essentially a long-term rental, making it ideal for technology that changes rapidly, like POS systems. The equipment doesn't appear on your balance sheet, which can improve certain financial ratios. At the end of the lease, you can simply return the equipment and upgrade, renew the lease, or purchase it at its fair market value. This preserves your flexibility.

- The Fair Market Value (FMV) Lease offers the lowest monthly payments and maximum flexibility. You use the equipment for the term, and at the end, you can buy it for its current market value, continue leasing, or return it. This is a great choice if you're unsure about long-term needs or want to keep the option to upgrade open without the commitment of ownership.

- The $1 Buyout Lease is a straightforward rent-to-own program. It functions much like a loan, with slightly higher monthly payments than an FMV lease. After making all your monthly payments, you can purchase the equipment for one dollar, guaranteeing ownership at the end of the term.

Equipment Loans: The Straight Path to Ownership

With an equipment loan, you borrow money to buy the equipment outright and own it from day one. The equipment itself serves as collateral, which can help secure better interest rates. While traditional banks offer loans, they often have stringent requirements and a slow approval process. Specialized lenders and financing companies, however, are often more flexible and faster. The main drawback is that loans often require a larger down payment than leases. Government-backed SBA loan programs can be a great resource, often providing better terms than conventional bank loans, though the application process can be more intensive.

Equipment Rentals: Perfect for Testing the Waters

For short-term needs, such as catering special events, handling a seasonal rush, or testing a new menu concept before committing, short-term rentals are ideal. They offer maximum flexibility with no long-term commitment, and the rental company often handles maintenance and repairs, reducing your operational headaches. The rent-to-own model is another great option, allowing you to rent equipment for a trial period with a portion of your payments going toward the purchase price if you decide to keep it. This is especially valuable for new restaurants still determining their exact equipment needs and workflow.

The A-to-Z Guide to Securing Equipment Financing

Securing equipment financing for your restaurant is often a straightforward process, typically involving four main steps: application, approval, documentation, and funding.

Specialized equipment financing companies understand the restaurant business, including its seasonal cash flow patterns and unique equipment needs. This industry knowledge makes the process smoother than dealing with a traditional bank.

What Lenders Look For in Your Application

When you apply, lenders want to confirm your ability to repay the loan. Here’s what they typically review:

- Credit Score: While banks may require high scores, specialized lenders are often more flexible. Many look for a FICO score around 620, but a lower score isn't an automatic rejection. Lenders will assess both your personal and business credit history. A lower score can often be offset by strong revenue, significant time in business, or a larger down payment.

- Time in Business: Most lenders prefer at least one year of operation, as this provides a track record of revenue and financial management. However, many programs exist specifically for startups, though they may require a stronger business plan or a personal guarantee.

- Annual Revenue: Lenders often look for at least $100,000 in yearly revenue to see proof of steady income and the ability to handle monthly payments. Consistent revenue demonstrates stability and reduces the lender's risk.

- Business Plan: A strong business plan is crucial, especially for new businesses. It should detail your concept, target market, competitive analysis, marketing strategy, and, most importantly, realistic financial projections (including profit and loss, cash flow statements, and a balance sheet).

- Financial Statements: You'll likely need three to six months of recent business bank statements. Lenders review these to analyze your cash flow, average daily balance, and deposit history. They want to see consistent cash on hand, not just a single high balance.

- Collateral: The equipment itself often serves as collateral. Lenders categorize it as "hard collateral" (like refrigeration and ranges, which hold value well) or "soft collateral" (like POS systems, software, and furniture, which depreciate faster). You may secure higher financing amounts for hard collateral.

Specialized restaurant equipment financing company providers understand that success depends on more than just a credit score; they also consider your concept, management experience, and overall revenue trends.

A Special Note for Startups and New Restaurants

Securing financing without a long business history can be challenging, but many financing companies specialize in helping startups. Alternative lenders, in particular, focus on business potential rather than just credit history. To improve your chances, focus on creating an impeccable business plan. This is your primary tool for convincing a lender of your future success.

Building business credit from the start is vital. Open a business bank account, get a business credit card, and register for a DUNS number. Always keep your business and personal finances separate. While it's best to keep finances separate, you may need to rely on your personal credit history or provide a personal guarantee initially. This is a common requirement for new businesses. As your restaurant builds its own credit history through timely payments, you'll gain access to more and better financing options in the future.

Don't be discouraged if you're new. Many lenders are eager to partner with promising new restaurants. The key is finding a financing partner who believes in your vision and is willing to invest in your potential.

What to Look for in a Restaurant Equipment Financing Company

Choosing the right restaurant equipment financing company is about finding a true partner, not just the lowest rate. A great partner has the right skills, experience, and a genuine understanding of your restaurant's unique needs.

When searching for a financing partner, look for these key traits:

- Industry Specialization: A company that focuses on the hospitality industry understands the nuances of our business. They know the equipment, the seasonal cycles, and the importance of quick approvals. This specialized knowledge leads to more effective solutions.

- Customer Service: You want a partner who is responsive, accessible, and helps you steer the process. They should treat you as a valued customer, not just a number, and avoid relying solely on impersonal credit scoring.

- Transparency in Terms: A reputable company will be upfront about all terms, conditions, and costs. Ask for clear explanations of the Annual Percentage Rate (APR), fees, and end-of-lease options to avoid hidden fees or confusing jargon.

- Flexible Payment Terms: A great financing partner will offer flexible options, such as seasonal or deferred payment plans that align with your business's cash flow cycle. This ensures you can meet obligations even during slower periods.

- Fast Approval Process: Time is money. Look for companies that boast quick turnaround times, with some offering credit decisions in hours and funding within a day. This speed helps you get equipment without unnecessary delays.

- Application-Only Programs: For financing up to a certain amount (often $150,000 or more), some lenders offer "application-only" programs, which require less paperwork and lead to a quicker, more streamlined process.

- Reputation and Reviews: Before committing, investigate the company's reputation. Look for online reviews, testimonials from other restaurant owners, and check their rating with the Better Business Bureau. A long track record of positive feedback is a strong indicator of a trustworthy partner.

A truly exceptional restaurant equipment financing company offers more than just money. They provide value-added services, such as industry insights and resources to help you stay informed. Their deep industry expertise and strong vendor relationships can lead to smoother transactions and better terms. They act as consultants invested in your success, offering advice on optimizing your equipment portfolio, managing cash flow, and planning for future growth. This might include guidance on selecting energy-efficient equipment to lower long-term utility costs or structuring financing to align perfectly with your seasonal revenue peaks. When you choose a financing company, you're forging a strategic alliance that can help your restaurant thrive.

Understanding the Fine Print: Typical Lease Terms and Equipment

When you're ready to secure financing, understanding the details of the lease agreement is as important as choosing the right equipment. Knowing what to expect ensures a smooth process.

Lease agreements for restaurant equipment are designed for flexibility. The most common contract length ranges from 12 to 60 months, allowing you to match the term to your budget. Shorter terms mean higher monthly payments but faster ownership, while longer terms keep payments lower and preserve cash flow.

The real flexibility of leasing appears in the end-of-lease options. Most agreements offer three main choices:

- Purchase Option: You can buy the equipment. With a $1 buyout lease, you own it for a nominal fee. A fair market value (FMV) option lets you buy it for its worth at the end of the term.

- Equipment Return: This gives you the freedom to walk away and upgrade to newer technology. It's a smart choice for equipment that evolves quickly, like POS systems.

- Lease Renewal: If the equipment still works well but you're not ready to buy, you can often continue leasing it at a reduced rate.

Financing can cover nearly everything you need to run a successful restaurant, including:

- Commercial Refrigeration: Walk-in coolers, freezers, and display cases are essential for keeping ingredients fresh and safe.

- Ice Machines: Crucial for beverages, food prep, and displays.

- Dishwashers: High-capacity machines are an investment in efficiency and sanitation.

- POS Systems: The nerve center of a modern restaurant, handling orders, payments, and inventory.

- Furniture: Dining tables, chairs, and bar stools create the customer experience.

- Signage: Interior and exterior signs attract customers and build your brand.

- Security Systems: Surveillance cameras and alarms protect your investment.

Financing this equipment allows you to create a complete, professional operation from day one without depleting your capital.

Frequently Asked Questions about Restaurant Equipment Financing

Running a restaurant is challenging enough without navigating financing mysteries. Here are answers to some of the most common questions about equipment financing.

Can I get equipment financing with a low credit score?

Yes, your credit score doesn't have to be perfect. While traditional banks may be strict, many specialized restaurant equipment financing company providers are more understanding. They often focus on your restaurant's current revenue and cash flow rather than dwelling on past credit issues. Revenue-based financing options, for example, look at your monthly sales instead of just your FICO score. While you might face slightly higher interest rates, you won't have to put your restaurant's growth on hold. The key is to present a strong business case that showcases your restaurant's potential.

Can I finance used or privately sold restaurant equipment?

Absolutely. Financing isn't just for brand-new equipment. Many restaurant equipment financing company partners understand the value of used equipment and will finance it. This allows you to acquire high-quality, professional-grade equipment at a fraction of the cost of new items. The lender will typically require an equipment appraisal to determine its current market value, which helps establish fair financing terms. This is a great strategy for new restaurants or those expanding on a tight budget.

Can I include costs like shipping and installation in my financing agreement?

Yes, and this is a major benefit of equipment financing. Many lenders offer 100% commercial financing, which means you can bundle all related expenses—including shipping, installation, and necessary supplies—into one simple monthly payment. Instead of paying for these "soft costs" out of pocket, you can roll them into your financing agreement. This makes financial planning much smoother and preserves your working capital for other critical needs like inventory and marketing.

What are typical interest rates for restaurant equipment financing?

Interest rates can vary widely based on your credit score, time in business, annual revenue, the type of equipment, and the length of the term. For well-established restaurants with excellent credit, rates can be as low as 6%. For startups or businesses with challenged credit, rates might be in the 15-30% range. It is crucial to look at the Annual Percentage Rate (APR), which includes not just the interest but also any fees associated with the loan, giving you a more accurate picture of the total cost. While specialized lenders may sometimes have higher rates than a traditional bank, they often provide faster funding and more flexible approval criteria, which can be more valuable than a slightly lower rate.

Conclusion

Building a successful restaurant requires a solid foundation, and smart financing is a cornerstone of that foundation. A restaurant equipment financing company is more than a lender; it's a strategic partner that understands your vision and helps you acquire the tools you need to succeed.

Financing transforms a major capital expenditure into a manageable operating expense. It preserves your working capital, offers tax advantages, and provides the flexibility to upgrade equipment as technology evolves. With options ranging from capital leases to short-term rentals, you can find a solution that fits your restaurant's unique cash flow and long-term goals.

The application process is more straightforward than you might think, especially when working with a specialized partner. Lenders in this space look beyond credit scores to see the potential of your business. Even new restaurants can secure the financing they need with a strong business plan.

The best financing companies offer more than just funds; they provide industry expertise, flexible payment terms, and ongoing support. The ability to bundle all equipment-related costs—from the asset itself to shipping and installation—into one monthly payment simplifies your finances and supports your growth.

At The Restaurant Warehouse, we believe in making restaurant ownership more accessible by offering commercial equipment at affordable prices. We avoid the high overhead that puts quality equipment out of reach. Combining our approach with a smart financing strategy sets you up for success from day one.

The restaurant industry has its challenges, but financing doesn't have to be one of them. The right partner can help you turn your plans into reality without sacrificing financial stability.

Ready to take the next step? Find the right financing options for your restaurant equipment and let's turn your culinary vision into the thriving business you've always imagined.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment