Lease Today, Own Tomorrow – Catering Equipment Lease-to-Buy Simplified

Why Catering Equipment Lease-to-Buy Makes Financial Sense

Catering equipment lease to buy offers restaurant owners a path to equipment ownership through affordable monthly payments instead of massive upfront costs. Here's what you need to know:

Key Benefits: - Low monthly payments - $20,000 of equipment costs around $450-500/month - Immediate ownership path - Own equipment at lease end with $1 or 10% buyout - Fast approval - Most applications approved within 24 hours - Preserve cash flow - Keep working capital for daily operations - 100% tax deductible - Lease payments reduce taxable income

Starting a restaurant or upgrading your kitchen shouldn't drain your bank account. The research shows that outfitting a new restaurant costs $100,000 to $300,000, with kitchen equipment alone accounting for $30,000 to $120,000 of that total.

Traditional equipment financing often requires huge down payments or ties up credit lines. Lease-to-buy changes this game completely.

With lease-to-buy, the equipment itself serves as collateral. You get immediate access to professional-grade ovens, refrigeration, dishwashers, and prep equipment without the crushing upfront expense. After 12 to 60 months of fixed payments, you own the equipment outright.

The numbers work in your favor too. With good credit, you're looking at roughly $450-500 monthly for $20,000 worth of equipment over five years. That's manageable cash flow that won't kill your startup budget or expansion plans.

"Here's reality—not every restaurant or food service business can afford to purchase new equipment outright," notes one industry financing expert. Lease-to-buy bridges that gap between needing professional equipment and having the cash to buy it.

Basic catering equipment lease to buy glossary: - catering equipment finance - restaurant equipment financing

Catering Equipment Lease-to-Buy: How It Works

Think of catering equipment lease to buy as a layaway plan for grown-ups running restaurants. Instead of saving up for years to buy that dream convection oven outright, you get to use it immediately while making affordable monthly payments toward eventual ownership.

Here's how it works: A leasing company buys the equipment you need upfront, then you make fixed monthly payments over an agreed timeframe. When your payment schedule ends, you exercise a buyout option—usually just $1 or 10% of what the equipment is worth—and boom, you own it.

The brilliant part? Every payment you make builds equity toward ownership while keeping that expensive equipment humming in your kitchen right now. You're not just throwing money at rent forever like traditional leasing.

Traditional bank loans require massive down payments and tie up your credit lines. Equipment rental never leads to ownership and costs more long-term. Lease-to-buy gives you the best of both worlds—immediate access with a clear path to ownership.

The equipment itself serves as collateral, which means faster approvals and more flexible credit requirements. Plus, your monthly payments stay fixed regardless of what interest rates do in the broader market.

As one financing expert puts it: "Leasing frees up cash flow and operating lines for your day-to-day expenses." Instead of dropping $50,000 on equipment today, you spread that investment over manageable payments while keeping your working capital available for ingredients, payroll, and unexpected expenses.

Many agreements also let you upgrade equipment mid-term, return items you no longer need, or buy out early with discounted interest calculations. That's flexibility you won't get with traditional equipment loans.

Learn more about restaurant equipment financing to explore your options, or dive into our comprehensive Restaurant Equipment Lease Guide for detailed comparisons.

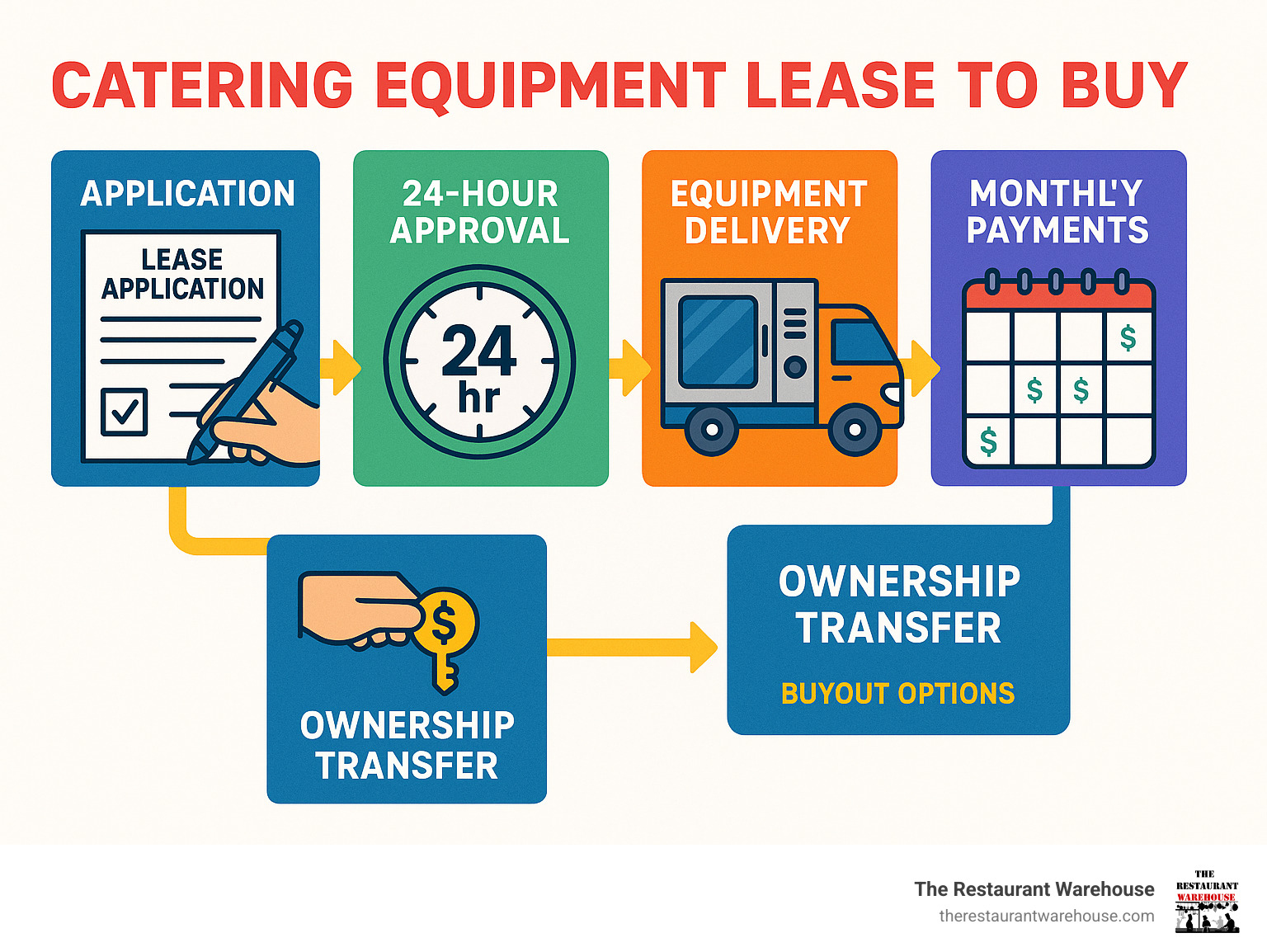

From Application to Ownership: catering equipment lease to buy steps

Getting approved for catering equipment lease to buy is refreshingly simple. Most leasing companies have ditched the bureaucratic nightmare in favor of getting you equipped fast.

The application asks for basic business info—your Social Security number, business details, annual revenue, and bank account information. For funding up to $50,000, you'll need minimal documentation. No thick folders of financial statements or tax returns.

Credit decisions happen lightning-fast, usually within 24 hours. Since the equipment serves as its own collateral, credit requirements are often more forgiving than traditional bank loans. Even newer businesses can qualify when banks might say no.

Once approved, you pick your equipment and the leasing company purchases it directly from suppliers. They often get better pricing than you could negotiate alone—another hidden benefit.

Delivery and setup happen next. Some agreements roll installation costs into your monthly payments, making budgeting cleaner. No surprise charges or separate contractor bills.

Your fixed monthly payments start according to your agreement. Many programs offer 2-3 month grace periods before the first payment, giving new restaurants breathing room during those crucial early weeks.

At lease end, you exercise your buyout option and legally own all the equipment. The entire process from application to equipment delivery typically takes less than a week for standard items.

Typical Terms & Conditions

Catering equipment lease to buy agreements offer terms from 12 to 60 months, letting you match payments with your business's cash flow reality. Shorter terms mean higher monthly payments but faster ownership. Longer terms spread costs out for better monthly cash flow.

12-month agreements work great for smaller purchases or businesses with strong cash flow. 24-36 month terms offer the sweet spot between manageable payments and reasonable ownership timelines. 48-60 month agreements provide the lowest monthly payments for expensive equipment packages.

End-of-term buyout options give you choices. The $1 buyout means you pay just one dollar and own everything. The 10% fair market value option means paying 10% of what the equipment is worth at lease end. Some agreements set a fixed purchase price upfront, so you know exactly what ownership will cost.

Early buyout is where things get interesting. Many agreements let you purchase early with discounted interest on remaining payments. If your restaurant takes off faster than expected, you can accelerate ownership and potentially save money.

Some programs offer seasonal payment plans that recognize how food service businesses actually work. You might pay more during busy summer months and less during slower winter periods. This flexibility helps match payments to revenue cycles.

The biggest advantage? Payment predictability. Unlike variable-rate loans that can spike with interest rate changes, lease-to-buy agreements lock in fixed payments for the entire term.

What You Can Lease & Typical Costs

When you're exploring catering equipment lease to buy options, you'll be pleasantly surprised by just how much equipment qualifies for financing. From the big-ticket items that make your kitchen run to the smaller essentials that keep service smooth, lease-to-buy programs cover nearly everything you need.

The beauty of comprehensive equipment financing is that you can outfit your entire operation with one agreement. Think about it—instead of piecing together purchases over months or years, you can get everything delivered and operational from day one.

Major cooking equipment forms the backbone of most lease packages. Commercial ranges, griddles, and fryers are obvious choices, but you can also finance specialized equipment like steamers, combi units, and pressure cooking systems. These workhorses typically represent the biggest chunk of your equipment investment.

Refrigeration systems are another major category where lease-to-buy really shines. Walk-in coolers and freezers, reach-in units, prep tables with refrigerated storage, and ice machines all qualify. Since refrigeration equipment can easily run $15,000 to $40,000 for a complete setup, spreading those costs over monthly payments makes perfect sense.

Don't overlook the prep and cleaning equipment that keeps your kitchen running efficiently. Commercial mixers, food processors, dishwashing systems, prep sinks, and work tables might seem less glamorous, but they're essential for smooth operations. Including them in your lease package means everything arrives together and gets covered under one payment.

Front-of-house equipment rounds out most comprehensive packages. Coffee machines, POS systems, restaurant furniture, and serving equipment all qualify for lease-to-buy financing. Even bar equipment and beverage systems can be included if you're setting up a full-service establishment.

Here's where the numbers get interesting. Industry research shows remarkably consistent pricing patterns that make budgeting straightforward.

A $20,000 equipment package typically runs about $450 to $500 monthly over a five-year term. That might cover a basic kitchen setup with essential cooking, refrigeration, and prep equipment for a smaller operation.

Step up to a $50,000 equipment package, and you're looking at roughly $1,100 to $1,200 monthly. This level gets you into comprehensive kitchen buildouts with multiple cooking stations, walk-in refrigeration, and complete prep areas.

These numbers assume good credit and standard terms, but they give you a realistic baseline for planning. The monthly payments stay fixed throughout your lease term, so there are no surprises or escalating costs to worry about.

Smart operators often include related costs in their lease payments rather than paying separately. Shipping, delivery, installation, and setup costs can all be rolled into your monthly payment. Some agreements even cover initial training and extended warranties.

This approach means one predictable monthly payment covers everything from purchase to installation to getting your team trained. No surprise bills, no separate invoices to track—just simple, straightforward financing that lets you focus on running your business.

Maintenance bundles represent another smart option many lease programs offer. While adding service contracts increases your monthly cost slightly, it eliminates surprise repair bills and ensures your equipment stays operational. For critical equipment like refrigeration systems, this peace of mind is often worth the extra expense.

The key advantage of comprehensive equipment leasing is getting everything you need to operate from day one, without the massive upfront investment that traditionally comes with restaurant equipment purchases. For detailed guidance on specific equipment categories and selection criteria, our Lease Commercial Kitchen Equipment Guide covers financing options for different types of foodservice equipment.

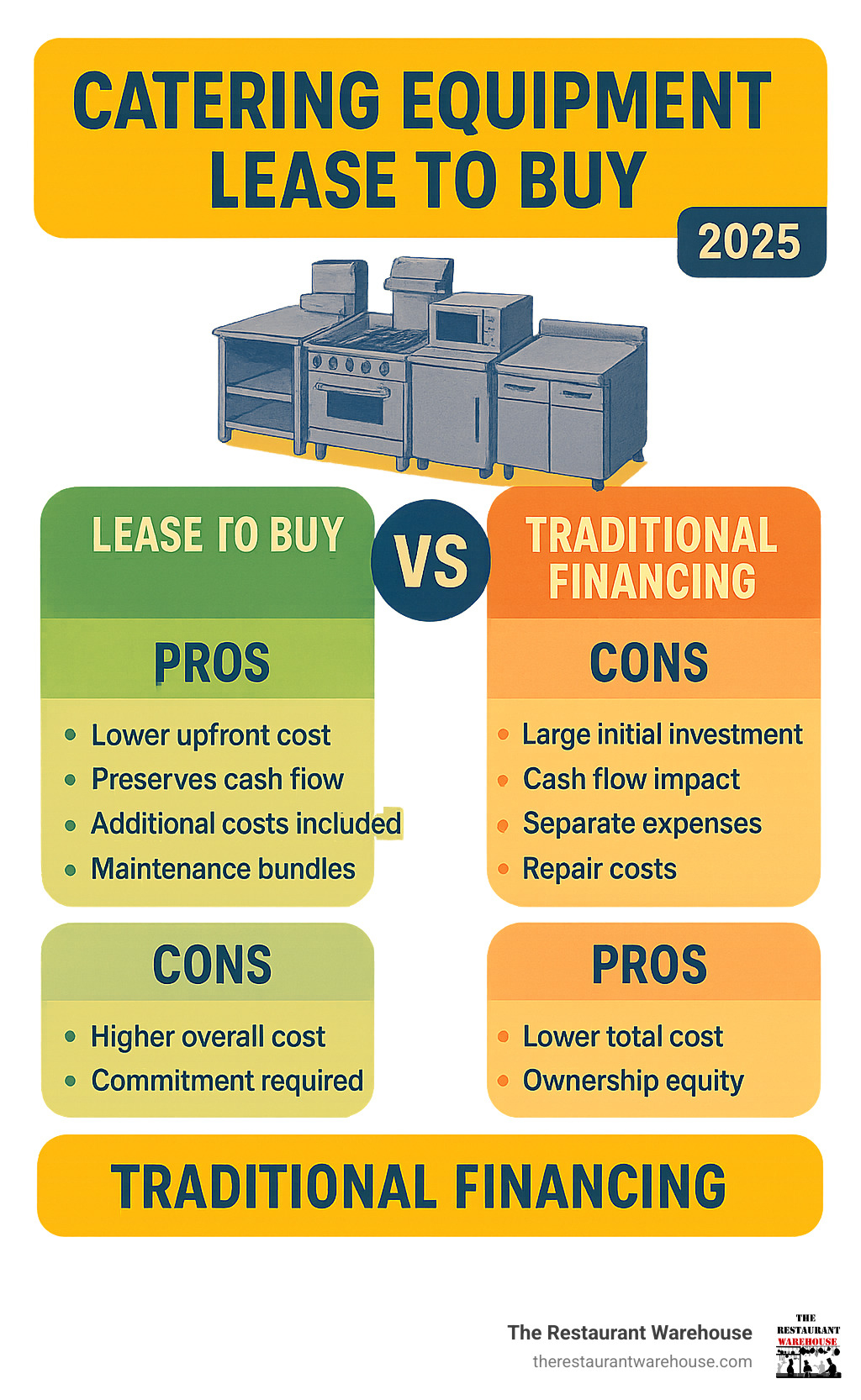

Pros, Cons & Financing Alternatives

Like any financing decision, catering equipment lease to buy has advantages and disadvantages you should weigh against other options.

Let's be honest—every restaurant owner faces the same dilemma. You need professional equipment to serve great food, but you also need cash in the bank to keep the lights on and pay your staff. This is where lease-to-buy really shines.

Cash flow preservation is the biggest win here. Instead of dropping $50,000 on a complete kitchen setup, you keep that money working for you. Inventory spoils, employees need paychecks, and unexpected repairs always seem to happen at the worst possible time. Having cash available for these realities can make or break your business.

The tax benefits are pretty sweet too. Your lease payments are typically 100% tax-deductible as business expenses, which reduces your effective equipment cost significantly. Plus, you might qualify for Section 179 deductions that can really help come tax time.

Here's something most people don't realize: the equipment itself serves as collateral. This means you don't need to put up your house or other assets to secure financing. For startups or businesses still building credit, this opens doors that traditional bank loans keep firmly shut.

Upgrade flexibility is another major advantage. Technology changes, your menu evolves, and your business grows. Many lease-to-buy programs let you swap out equipment during the term without penalty. Try doing that with equipment you purchased outright.

But let's talk about the downsides too, because nobody likes surprises.

The total cost over time will be higher than paying cash upfront. Interest and fees add up, though the tax benefits often offset much of this difference. You're essentially paying for the privilege of keeping your cash available for other needs.

Contractual obligations mean you're committed to those monthly payments whether business is booming or slow. Most reputable companies work with you during temporary rough patches, but the obligation remains.

You also have limited control until you complete the buyout. The leasing company technically owns the equipment, which might restrict major modifications or relocations without approval.

So what are your other options? Traditional bank loans offer lower interest rates but demand stronger credit, bigger down payments, and mountains of paperwork. The approval process can take weeks or months—not great when you need equipment yesterday.

Equipment rental gives you maximum flexibility but no path to ownership. You're essentially paying rent forever, which often costs more than lease-to-buy payments without building any equity.

Cash purchases cost the least over time and give you immediate ownership, but they tie up working capital that most restaurants desperately need for daily operations.

Business credit lines and credit cards offer flexibility but typically carry higher, variable interest rates that can spike unexpectedly. They're useful for short-term needs but risky for major equipment purchases.

The truth is, there's no perfect financing solution for everyone. Established restaurants with strong cash flow might prefer traditional loans, while growing operations often find catering equipment lease to buy provides the best balance of access, affordability, and flexibility.

The key is matching your financing choice to your actual business situation, not just the lowest advertised rate. Sometimes paying a bit more for flexibility and cash flow preservation is the smartest move you can make.

Eligibility, Taxes & Managing Your Agreement

Getting approved for catering equipment lease to buy is often easier than you might expect. Whether you're opening your first restaurant or expanding an established operation, these programs are designed to work with businesses at different stages.

Startup-Friendly Approval Process

New businesses face unique challenges when seeking equipment financing. Traditional banks want years of financial history you simply don't have yet. Lease-to-buy programs take a different approach—they focus on your business plan and ability to make monthly payments rather than demanding extensive trading history.

For funding up to $50,000, many programs require minimal documentation. You'll need basic business information, personal guarantor details, and bank account verification. The equipment itself serves as collateral, which reduces the lender's risk and makes approval more accessible to startups.

Flexible Credit Requirements

Catering equipment lease to buy programs often work with various credit profiles. Since the equipment secures the agreement, lenders can be more flexible with credit requirements than traditional bank loans demand.

Established restaurants, cafes, and catering companies typically qualify for larger amounts and better terms. But even businesses with less-than-perfect credit often find approval possible. The key is demonstrating your ability to make consistent monthly payments.

Tax Benefits That Actually Matter

The tax implications of lease-to-buy agreements can significantly improve your bottom line. Lease payments are typically 100% tax deductible as business operating expenses. This immediate deduction reduces your taxable income dollar-for-dollar, lowering the effective cost of your equipment.

When you exercise your buyout option and take ownership, you may qualify for Section 179 deductions. This allows you to deduct the full purchase price in the year you take ownership, subject to annual limits and business income requirements.

Once you own the equipment, you can claim depreciation deductions over its useful life. This provides ongoing tax benefits even after the lease ends, making the total cost of ownership more attractive than the monthly payments might suggest.

Many lease-to-buy arrangements also qualify as operating leases for accounting purposes. This keeps debt off your balance sheet and preserves borrowing capacity for other business needs—a significant advantage when you're managing multiple financing requirements.

Smart Agreement Management

Managing your lease-to-buy agreement effectively can save money and provide valuable flexibility as your business evolves. Equipment upgrades during the lease term are often possible through many programs. If newer, more efficient equipment becomes available, you can frequently trade up by adjusting your payment schedule or extending your term slightly.

Consider early buyout strategies if your business generates stronger cash flow than expected. Many agreements offer discounted interest calculations for early purchase, potentially saving money while accelerating ownership.

Seasonal payment adjustments can significantly improve cash flow management for businesses with revenue variations throughout the year. Some programs allow you to pay more during busy seasons and less during slower periods, aligning your equipment costs with your income patterns.

While you don't own the equipment during the lease term, you're typically responsible for maintenance and care. Maintenance agreements or service contracts protect your investment and ensure optimal performance. Including these costs in your monthly payments simplifies budgeting and prevents surprise repair bills.

Planning for Success

Start planning your end-of-term strategy early. Whether you'll exercise the buyout option, upgrade to newer equipment, or return items you no longer need, advance planning ensures smooth transitions and optimal financial outcomes.

For comprehensive guidance on lease agreements and their implications, review our detailed guide on Obtaining Restaurant Equipment Through a Lease Agreement.

The key to success with catering equipment lease to buy is understanding how these agreements fit into your overall business strategy. They're not just financing tools—they're flexible solutions that can adapt as your business grows and changes.

Frequently Asked Questions about Catering Equipment Lease-to-Buy

What happens at the end of a catering equipment lease to buy contract?

When your catering equipment lease to buy contract reaches its end, you're not stuck with just one option. The beauty of this financing method is the flexibility it offers right up to the final payment.

Taking ownership is the most popular choice. Depending on what you agreed to upfront, you'll pay either a single dollar, 10% of the equipment's current market value, or a predetermined buyout amount. After months of payments, that final step to ownership usually feels pretty satisfying.

But maybe your needs have changed. Upgrading to newer models is often possible, especially if technology has improved or your business has grown beyond your current equipment's capacity. Many lessors will work with you to trade up, applying your payment history toward newer gear.

Returning equipment you no longer need is another option. If you've downsized, changed your menu, or simply don't use certain pieces anymore, you can hand them back without penalties once you've completed your full term.

Some programs even offer extension options at reduced rates. This gives you breathing room to decide your next move while keeping your kitchen running smoothly.

The real advantage over traditional leasing is that ownership is always within reach. After making payments faithfully for years, that buyout amount is typically a fraction of what the equipment is worth.

Can I upgrade or add gear during a catering equipment lease to buy term?

Absolutely, and this flexibility is one of the biggest advantages of catering equipment lease to buy over traditional financing. Your business needs change, and your equipment financing should be able to change with you.

Mid-term upgrades happen more often than you might think. Maybe a more energy-efficient model comes out that could save you hundreds monthly on utilities. Or perhaps you've finded a piece of equipment that could streamline your operations. Most lessors will work with you to make the swap, applying your remaining payments toward the new equipment and adjusting your schedule accordingly.

Adding equipment as you grow is equally straightforward. Instead of juggling multiple lease agreements or loan payments, you can often fold new equipment into your existing agreement. This keeps your bookkeeping simple with one monthly payment covering everything.

Some programs offer flexible swap options that let you try different equipment configurations. This is incredibly valuable when you're refining your menu or testing new service styles. What works in theory doesn't always work in practice, and having the ability to adjust keeps you from being stuck with the wrong equipment.

Seasonal adjustments make sense for many food service businesses. Maybe you need extra refrigeration for summer catering or additional prep equipment during your busy season. Many lease-to-buy programs accommodate temporary additions, letting you return items you don't need year-round or keep them if they prove valuable.

This adaptability beats traditional equipment loans hands down. Once you sign a loan, you're committed to those specific pieces for the entire term, whether they still serve your business or not.

How fast can I get approved and receive equipment?

Speed is where catering equipment lease to buy really shines compared to traditional bank financing. Most applications get approved within 24 hours, sometimes even faster for straightforward requests.

The approval process is streamlined because the equipment itself serves as collateral. You won't spend weeks gathering financial documents or waiting for loan committees to meet. For amounts up to $50,000, many lessors need just basic business information, your details as the guarantor, and bank account verification.

Getting your equipment delivered depends on what you're ordering. Standard commercial kitchen equipment typically arrives within 3-7 business days after approval. Custom or special-order items take longer—usually 2-4 weeks—but that's due to manufacturing time, not financing delays.

Installation and setup can often be included in your agreement, adding just 1-2 days to the timeline. This comprehensive approach means you go from empty kitchen to fully operational in about a week for standard equipment.

Expedited options exist for urgent situations. If your main refrigerator dies during your busy season, many lessors offer rush processing and delivery. Yes, there might be additional fees, but getting back in business quickly usually justifies the cost.

The documentation requirements stay simple throughout the process. No overwhelming paperwork or endless back-and-forth requests for additional information. The focus is on getting you equipped and operational, not creating administrative problems.

This efficiency becomes crucial when you're racing toward an opening date or dealing with equipment failures that shut down operations. Traditional bank loans can take weeks or months—time most food service businesses simply don't have.

Conclusion

Finding the right financing for your restaurant equipment doesn't have to keep you up at night. Catering equipment lease to buy gives you a straightforward path to getting the gear you need today while building toward ownership tomorrow.

Think about it this way: when you're facing equipment costs of $30,000 to $120,000 just for your kitchen setup, paying cash upfront can wipe out your working capital faster than a dinner rush. But with lease-to-buy, that same $20,000 equipment package becomes a manageable $450-500 monthly payment that won't break your budget.

The real beauty of this approach is how it keeps your cash flow healthy. Instead of emptying your bank account on equipment, you preserve that capital for the thousand daily expenses that pop up in food service—from emergency repairs to seasonal inventory needs.

Fast approvals within 24 hours mean you're not waiting weeks for financing decisions when equipment breaks down. Flexible terms from 12 to 60 months let you match payments to your business's rhythm. And those 100% deductible payments help reduce your tax burden while you're building equity.

What really sets lease-to-buy apart is the flexibility to grow with your business. Need to upgrade your equipment mid-term? Most programs let you do exactly that. Want to add more gear as you expand? You can often fold new equipment into your existing agreement.

At The Restaurant Warehouse, we've built our reputation on wholesale pricing that cuts out the middleman markup. That same philosophy guides how we think about equipment financing—finding solutions that work for real food service businesses, not just the ones with perfect credit and unlimited cash.

Your monthly lease payments aren't just another expense line item. They're an investment in your business's future, with ownership as the ultimate goal. Every payment brings you closer to owning equipment that will serve your business for years to come.

Ready to explore what lease-to-buy can do for your operation? Our detailed guide on Lease to Own Restaurant Equipment walks you through everything you need to know about making the right choice for your business.

The Restaurant Warehouse is here to support your success from day one through full ownership. Because when your business thrives with the right equipment and smart financing, we all win.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment