Hungry for Equipment? Lease Restaurant Gear Locally Today

Why Smart Restaurant Owners Choose Local Equipment Leasing

When you lease restaurant equipment near me, you're looking at monthly payments of $450-$500 for $20,000 worth of gear, or $1,100-$1,200 for $50,000 in equipment over five years. Here's what you need to know:

Top Local Leasing Options:

- Lease-to-Own Programs - Own equipment at term end with $1 buyout

- Revenue-Based Financing - Payments tied to your business performance

- No Credit Check Options - Available for startups with 550+ FICO scores

- 100% Financing - Covers equipment, taxes, delivery, and installation

- Fast Approval - Get approved in 24-48 hours with quick delivery

Starting a restaurant is expensive. Really expensive. Research shows that 7 out of 10 small restaurant owners begin with less than $20,000 in working capital. That's barely enough to cover your first month's expenses, let alone outfit a full commercial kitchen.

The good news? 80% of all U.S. companies use equipment leasing to preserve cash flow and stay competitive. Restaurant owners are finding that leasing offers 100% financing, tax benefits through Section 179 deductions, and the flexibility to upgrade equipment as their business grows.

Instead of draining your bank account on a $50,000 kitchen build-out, you can spread those costs over manageable monthly payments while keeping your working capital intact for payroll, marketing, and unexpected expenses.

Simple guide to lease restaurant equipment near me:

Why Lease Instead of Buy?

Here's the thing about restaurant equipment - it's like hiring a great chef. You don't pay your chef's entire year's salary upfront, right? You pay them as they help you make money. Lease restaurant equipment near me works the same way.

When you lease instead of buying outright, you're essentially paying for equipment as it generates revenue for your business. This approach has helped countless restaurant owners preserve their cash flow while still getting the professional-grade equipment they need.

The Section 179 Tax Advantage Changes Everything

Let's talk about a tax benefit that most restaurant owners don't fully understand. The IRS Section 179 Tax Deduction allows businesses financing less than $1,000,000 in equipment during the tax year to deduct the entire cost in year one.

Here's how powerful this can be: If you lease $10,000 worth of kitchen equipment and you're in the 35% tax bracket, you'll receive a $3,500 tax deduction. That brings your actual equipment cost down to just $6,500. It's like getting a instant discount from Uncle Sam.

Your Working Capital Stays Where It Belongs

Leasing provides 100% financing - and we mean everything. Sales taxes, delivery charges, installation costs, even those pesky soft costs that add up quickly. This means your precious working capital stays in your business account where you need it most.

Think about what you can do with that preserved cash flow. Staff wages during your first slow months. Marketing to build your customer base. Extra inventory for busy weekends. An emergency fund for when the unexpected happens (and it always does in the restaurant business).

Inflation Actually Works in Your Favor

Here's something most people don't consider: with fixed monthly payments, you're making future payments with "cheaper dollars" as inflation rises. While equipment prices keep climbing due to supply chain issues and trade complications, your lease payment stays exactly the same throughout the entire term.

It's like locking in today's prices for tomorrow's payments. Pretty smart, right?

More info about Restaurant Equipment Lease Guide

Key Benefits at a Glance

Fixed monthly payments mean you'll never get surprised by changing interest rates. Your payment in month one is the same as month 60, making budgeting incredibly predictable.

Cash flow preservation keeps your working capital available for daily operations, unexpected expenses, and those growth opportunities that pop up when you least expect them.

Maintenance often included in lease agreements means fewer surprise repair bills. Many leasing companies bundle technical support and maintenance into your fixed payments, so you know exactly what you're paying each month.

Comparing Leasing, Renting, and Buying

| Option | Monthly Cost (for $20K equipment) | Equity Building | Tax Benefits | Maintenance |

|---|---|---|---|---|

| Leasing | $450-$500 | Possible at term end | Section 179 deduction | Often included |

| Renting | $600-$800 | None | Limited deductions | Usually included |

| Buying | $0 (after upfront cost) | Full ownership | Depreciation deductions | Your responsibility |

The numbers tell a clear story. Leasing offers the sweet spot between affordability and ownership benefits, while renting costs significantly more per month with no path to ownership. Buying outright might seem appealing, but it ties up massive amounts of capital that most restaurants simply can't afford to lose.

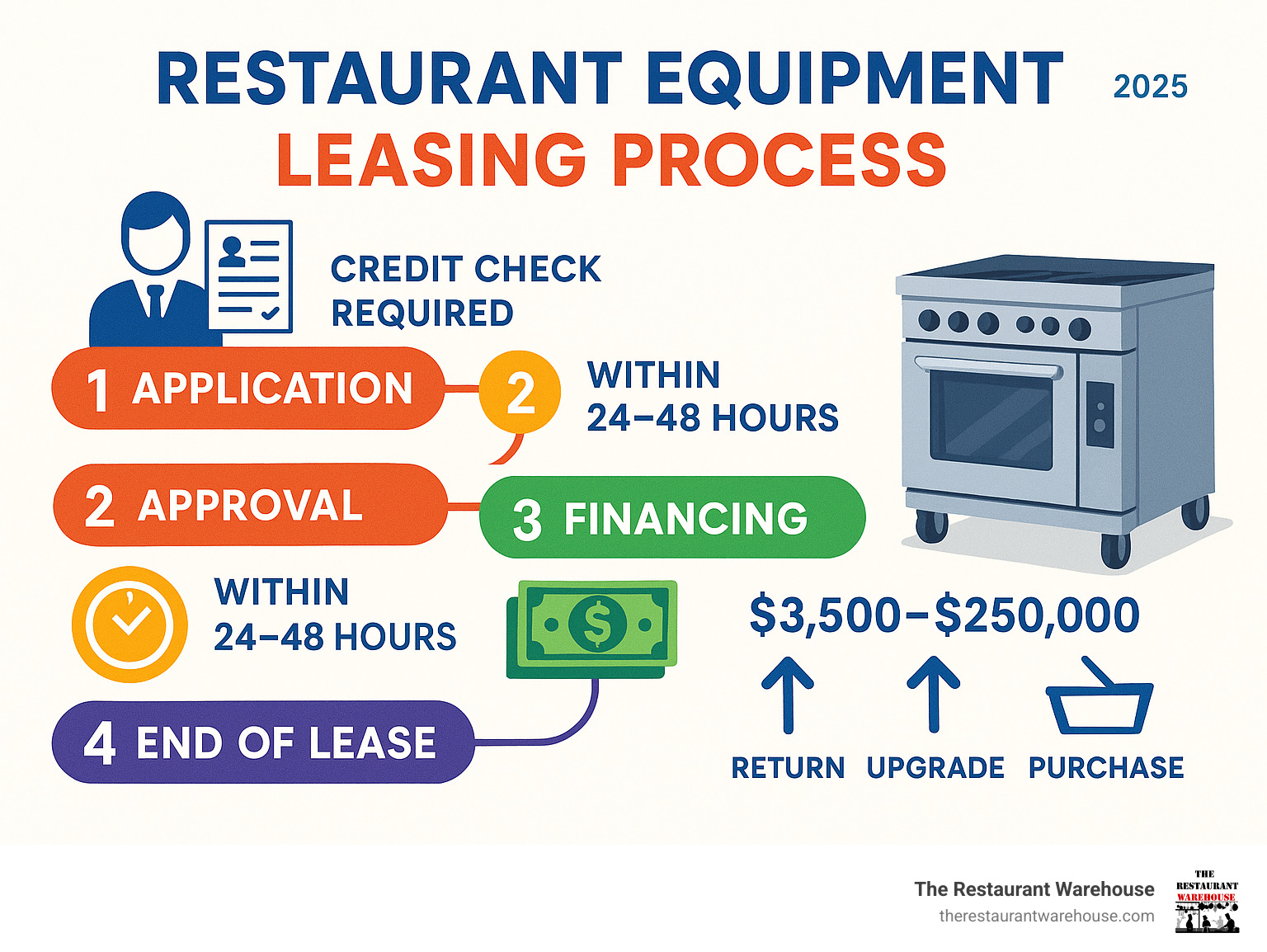

Lease Restaurant Equipment Near Me: How It Works

Getting started with lease restaurant equipment near me is much easier than most restaurant owners expect. The whole process takes about as long as ordering your morning coffee – seriously, most applications are completed in under 5 minutes online.

Here's the beautiful part: while you're still deciding between scrambled or over-easy for breakfast, you could get an approval decision within 24-48 hours. Local leasing companies understand that time is money in the restaurant business, so they've streamlined everything to get you cooking as quickly as possible.

The credit application is refreshingly straightforward. You'll provide basic business information (even if you're just starting out) and some personal details. No need to panic if you're a startup – many local providers have programs specifically designed for new restaurant owners.

What makes local leasing particularly attractive is the delivery speed. While national chains might take weeks to coordinate logistics, local vendors often know your area like the back of their hand. They can steer your city's delivery restrictions, understand local permit requirements, and sometimes even deliver within days of approval.

The 100% financing aspect covers more than just the equipment price tag. We're talking about sales taxes, delivery charges, installation costs, and even setup training. This means you're not scrambling to find extra cash for all those "soft costs" that can add up to thousands of dollars.

Local vendors bring another advantage – they're invested in your success because you're neighbors. They understand your local market, know which equipment works best in your climate, and can provide ongoing support without charging you long-distance rates.

Scientific research on tax savings

Lease Restaurant Equipment Near Me vs Lease-to-Own

Understanding your end-of-lease options before you sign helps you choose the right path for your restaurant's future. Think of it like choosing between renting an apartment or buying a house – both have their place depending on your situation.

Traditional leasing offers flexibility at the end of your term. You might have a fair market value option, where you can purchase the equipment for whatever it's worth at that time. Or you could go with a $1 buyout lease, which means you own everything for a single dollar when the lease ends (though your monthly payments will be higher).

Some programs offer a 10% buyout option – a middle ground where you pay 10% of the original equipment cost to own it outright. This keeps monthly payments moderate while still giving you an affordable ownership path.

Lease-to-own programs work differently. They're structured more like extended payment plans where ownership is always the end goal. These programs often offer weekly payment options, which can be easier for restaurants with fluctuating cash flow. You can sometimes upgrade or exchange equipment during the term, and ownership transfers automatically when you've completed all payments.

The choice really comes down to your business philosophy. Want lower monthly payments with flexible options? Go traditional. Prefer the certainty of eventual ownership? Lease-to-own might be your answer.

Typical Requirements & Approval Tips

Getting approved for restaurant equipment leasing isn't as scary as applying for a traditional bank loan. Most local leasing companies understand that restaurants are unique businesses with their own financial rhythms.

The minimum qualification most places look for is a 550+ FICO score. That's not perfect credit – it's just proof you're responsible enough to handle monthly payments. You'll also need at least 4 tradelines on your credit report (like credit cards, car loans, or other accounts) and business bank statements covering the last 3-6 months.

For startups, lease amounts typically range from $3,500 to $22,000. Yes, you'll likely need to provide a personal guarantee, but that's standard practice. Having a solid business plan helps tremendously – it doesn't need to be a 50-page document, just a clear outline showing you've thought through your concept and projected revenues.

Established businesses with 2+ years of operation get access to better terms and higher lease amounts ($5,000 to $75,000). Your business credit history starts to matter more than personal credit, and you might not need a down payment.

Here's the insider tip: check your credit report before applying. You'd be surprised how many applications get delayed because of simple errors that could have been fixed beforehand. Have your bank statements organized and ready to upload – nothing slows down approval like hunting for financial documents.

If your credit is marginal, consider asking a family member or business partner to co-sign. It's not ideal, but it can open doors to better rates and terms.

More info about Restaurant Equipment Leasing for Start Ups

Finding & Vetting Local Leasing Partners

When you search for lease restaurant equipment near me, you'll find dozens of options. The trick is separating the reliable partners from the fly-by-night operators who disappear when you need service.

Your best bet? Start with companies that have a physical showroom in your area. Online-only lenders might offer flashy websites, but nothing beats walking into a real location where you can see equipment and meet the people who'll handle your account.

Check their BBB rating first thing. An A+ rating with resolved complaints tells you they take customer service seriously. Skip anyone with unresolved issues or ratings below B+. Your business is too important to risk on a company that doesn't handle problems professionally.

Response time matters more than you think. When your walk-in cooler dies on a Friday night, you need someone who answers the phone - not an automated system that promises a callback "within 24-48 hours." Ask potential partners about their emergency service availability and average response times.

Don't be shy about asking for references from restaurants similar to yours. A good leasing company will gladly connect you with satisfied customers. If they hesitate or make excuses, that's a red flag worth noting.

Service radius is crucial too. Some companies promise great rates but can't actually deliver or service equipment in your area. Make sure they cover your location for both delivery and ongoing maintenance before you fall in love with their terms.

For new restaurant owners, look for startup-friendly programs that understand your unique situation. These might include revenue-based financing where payments adjust with your sales, or guarantor programs that let a business partner help you qualify for better terms.

Questions to Ask Before You Sign

The right questions can save you thousands of dollars and countless headaches. Start with maintenance clauses - specifically, what's included in your monthly payment and what you'll pay extra for. Some companies include routine maintenance but charge separately for parts. Others cover everything. Know the difference upfront.

Upgrade rights become important as your business grows. Can you add equipment to your existing lease? What about trading up to newer models mid-term? The best leasing partners make growth easy, not expensive.

Early payoff fees vary wildly between companies. Some charge hefty penalties if you want to buy out your lease early. Others offer discounts for early payment. If you're planning rapid growth or think you might want to own your equipment sooner, this matters.

Ask about their process when equipment breaks down. Do they provide loaner equipment during repairs? How quickly can they get a technician to your location? These details separate good leasing companies from great ones.

Bad Credit or Start-Up? Options Still Exist

Poor credit doesn't have to kill your restaurant dreams. Several financing options exist specifically for businesses that don't fit traditional lending criteria.

No-credit-check programs focus on your business potential rather than past financial mistakes. These lenders look at your business plan, projected revenues, and industry experience. Yes, you'll pay higher rates, but you can get approved and start generating revenue while rebuilding your credit.

Revenue-based financing ties your payments to actual sales performance. During slow months, your payments decrease. During busy seasons, they increase. This flexibility can be a lifesaver for restaurants with seasonal fluctuations or businesses still finding their rhythm.

Microloans for equipment purchases offer another path forward. These smaller loans (typically under $50,000) have easier qualification requirements and can cover lease down payments or direct equipment purchases. Many are backed by SBA programs or local development organizations.

Guarantor programs let you combine your credit profile with a business partner or family member. This shared responsibility often results in better terms and lower rates than you'd qualify for alone. Just make sure everyone understands their obligations before signing.

The key is being honest about your situation and working with lenders who specialize in your circumstances. Don't waste time with companies that require perfect credit - find partners who understand that great restaurants can come from entrepreneurs with less-than-perfect financial histories.

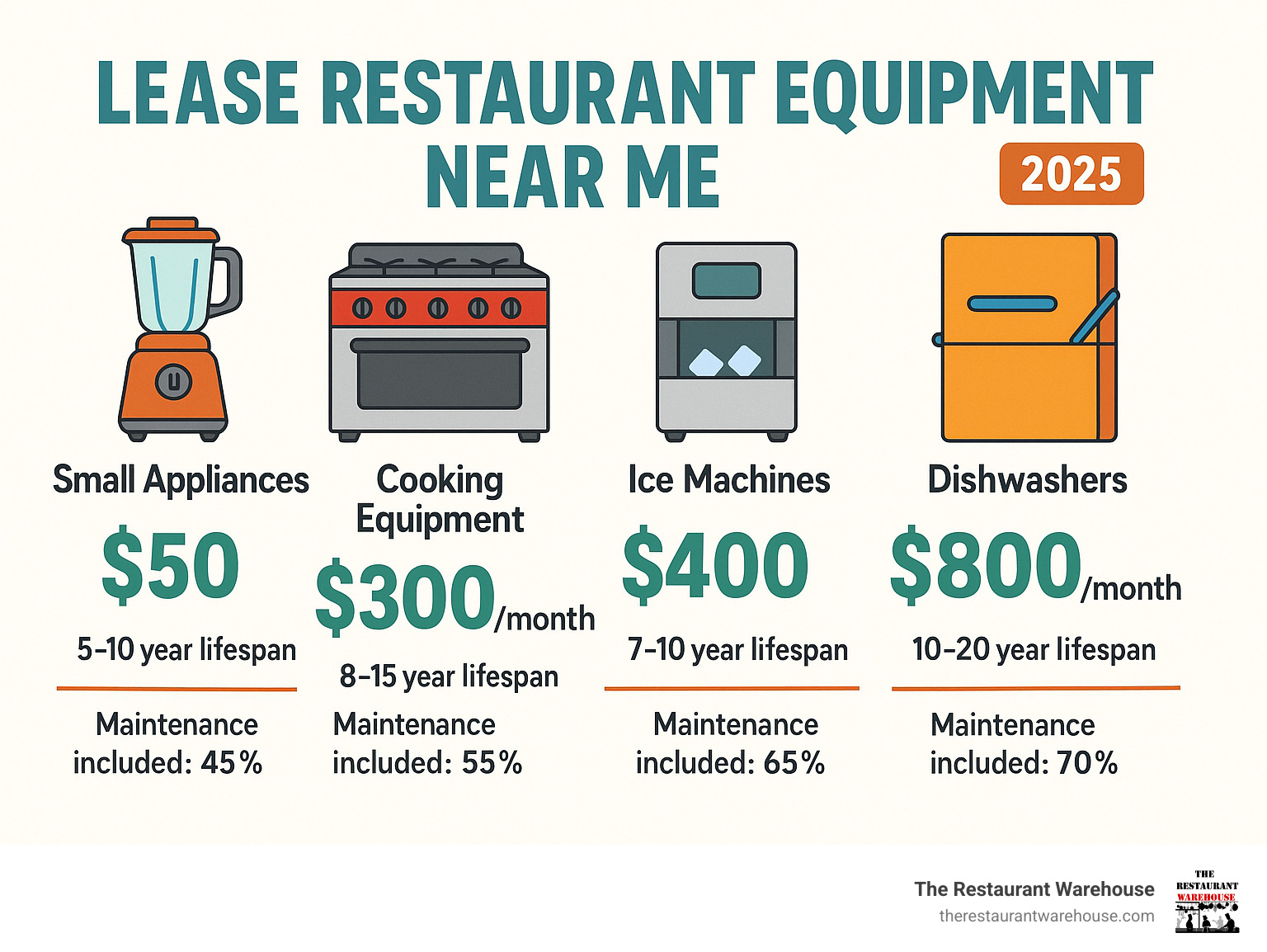

Product Round-Up: Gear You Can Lease Today

The beauty of restaurant equipment leasing is that virtually any commercial kitchen item can be financed. From small appliances to complete kitchen build-outs, leasing companies offer comprehensive equipment catalogs.

Most Popular Leased Items:

- Refrigeration equipment (80% of leases include)

- Cooking equipment (ranges, fryers, grills)

- Dishwashing systems

- Ice machines

- POS systems and technology

- Food prep equipment

- Smallwares packages

Lease-Friendly Equipment Categories:

- High-tech items that become obsolete quickly

- Equipment prone to breakdowns (ice machines, dishwashers)

- Expensive items that strain cash flow

- Seasonal equipment needs

- Backup or secondary equipment

More info about Lease Commercial Kitchen Equipment Guide

Refrigeration & Cold Storage Deals Near Me

Refrigeration is often the first equipment restaurants lease because it's expensive, essential, and prone to costly repairs. Here's what's available:

Reach-In Coolers and Freezers:

- 1-3 door configurations

- Lease payments: $150-$400/month

- Energy-efficient models available

- Maintenance often included

Prep Tables and Undercounter Units:

- Pizza prep tables

- Sandwich prep stations

- Undercounter refrigerators

- Lease payments: $100-$250/month

Walk-In Coolers and Freezers:

- Custom sizing available

- Installation included in lease

- Lease payments: $300-$800/month

- Remote refrigeration options

Why Lease Refrigeration:

- Compressors are expensive to repair

- Energy efficiency improvements save money

- Warranty coverage typically included

- Upgrade to newer models easily

High-Heat Cooking Essentials for Lease

Commercial Ranges:

- Gas and electric options

- 4-8 burner configurations

- Lease payments: $200-$500/month

- Heavy-duty construction for durability

Griddles and Flattops:

- 24"-72" cooking surfaces

- Gas and electric models

- Lease payments: $150-$400/month

- Ideal for breakfast and burger concepts

Deep Fryers:

- Single and double basket options

- Gas and electric configurations

- Lease payments: $100-$300/month

- High-efficiency models available

Convection Ovens:

- Half-size and full-size options

- Electric and gas models

- Lease payments: $200-$600/month

- Perfect for baking and roasting

Charbroilers:

- Radiant and lava rock options

- 12"-48" cooking widths

- Lease payments: $150-$400/month

- Essential for steakhouses and grills

Sanitation & Beverage Must-Haves

Commercial Dishwashers:

- Undercounter, door-type, and conveyor models

- Lease payments: $200-$800/month

- Maintenance contracts typically included

- High-temp and low-temp options

Ice Machines:

- 50-500 pounds daily production

- Cube, flake, and nugget ice types

- Lease payments: $100-$400/month

- Water filtration often included

Espresso Machines:

- Semi-automatic and super-automatic

- 1-4 group configurations

- Lease payments: $200-$1,000/month

- Training and maintenance included

Bar Equipment:

- Blenders and mixers

- Glass washers

- Beer dispensing systems

- Lease payments: $50-$300/month

Frequently Asked Questions about Leasing Restaurant Equipment Near Me

What happens at the end of the lease term?

When your lease term wraps up, you're not stuck with just one option. Most leasing companies want to keep you as a customer, so they make the transition pretty flexible.

Your three main choices are returning the equipment and walking away, purchasing it at the predetermined value, or upgrading to newer models with a fresh lease. The purchase price is usually either fair market value (determined by an appraiser) or a fixed amount that was set when you signed your original lease.

Many restaurant owners are surprised to learn about month-to-month extensions. If you're not ready to decide or need time to evaluate your business needs, most leasing companies will let you continue on a monthly basis. This gives you breathing room without pressure to make a quick decision.

The smart move? Start thinking about your end-of-lease options about six months before your term expires. This gives you time to explore all possibilities and negotiate the best deal for your situation.

Are maintenance and repairs included?

This is where lease restaurant equipment near me searches really pay off - local leasing companies often provide better service packages than national chains.

Full maintenance coverage varies by lease agreement, but many restaurant equipment leases include regular maintenance, manufacturer warranty protection, and even emergency service calls. The best part? You know exactly what you'll pay each month because repair costs are built into your lease payment.

Some leases cover preventive maintenance like regular cleaning and tune-ups, which actually extends equipment life and prevents costly breakdowns. Ice machines, dishwashers, and refrigeration units especially benefit from this type of coverage.

Here's the catch - always read the fine print about what's considered "normal wear and tear" versus damage. Most leases cover mechanical failures but not damage from misuse or accidents. Ask your leasing company for specific examples of what's covered and what isn't.

Emergency service availability can make or break your restaurant during busy periods. Look for leasing companies that offer 24/7 service or at least priority scheduling for their lease customers.

Can I upgrade equipment mid-lease?

Restaurant needs change, and good leasing companies understand this reality. Trade-up programs are becoming increasingly popular because they keep customers happy and equipment current.

Most leasing companies offer add-on leasing, which lets you add new equipment to your existing lease terms. This is particularly helpful when you're expanding your menu or increasing capacity. Instead of juggling multiple lease payments, everything gets rolled into one convenient monthly payment.

Early termination options exist, but they usually come with fees. However, if you're upgrading to a larger lease with the same company, many will waive or reduce these penalties. It's all about maintaining a good relationship with your leasing partner.

The key is discussing upgrade flexibility before you sign your initial lease. Some companies build upgrade rights directly into their agreements, while others handle it case-by-case. Restaurant owners who anticipate growth should prioritize leasing companies that offer flexible upgrade terms.

Pro tip: If you're considering an upgrade, time it strategically. Many leasing companies offer better deals at the end of their fiscal quarters when they're trying to meet sales targets.

Conclusion

Starting a restaurant is scary enough without worrying about how you'll pay for all that expensive kitchen equipment. That's exactly why lease restaurant equipment near me has become such a popular search - smart restaurant owners know there's a better way than emptying their bank accounts on day one.

Think about it: 80% of U.S. companies lease their equipment instead of buying it outright. These aren't struggling businesses making desperate moves - they're successful companies that understand cash flow management. When you preserve your working capital through leasing, you're keeping money available for the thousand little emergencies that pop up in restaurant life.

The math is pretty straightforward too. Instead of dropping $50,000 on a kitchen build-out, you can spread those costs over manageable monthly payments while taking advantage of Section 179 tax deductions. Whether you're working with a 550 FICO score as a startup or you're an established restaurant looking to upgrade, local leasing programs exist specifically for foodservice businesses like yours.

Here's what you're really getting when you lease:

You get predictable monthly expenses that make budgeting actually possible. Most lease agreements include maintenance and support, so you're not getting surprise repair bills when your ice machine decides to quit on the busiest night of the week. You get flexibility to upgrade as your business grows, because let's be honest - your needs will change. And you get tax advantages that actually improve your bottom line instead of just sounding good on paper.

At The Restaurant Warehouse, we've seen too many restaurant owners struggle because they tied up all their cash in equipment purchases. Our wholesale pricing approach eliminates high commissions and retail overhead, but we also understand that even wholesale prices can strain a tight budget. That's why we guide our customers toward the best leasing options for their specific situations.

Your dream kitchen doesn't have to wait for your bank account to catch up. The equipment you need is available today through local leasing programs designed specifically for restaurants. You can start cooking and start earning revenue while you pay for your equipment over time.

Ready to explore what's possible? Your next great meal is waiting to be cooked on equipment that fits your budget and your business plan.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment