Restaurant Startup Costs Calculator: Plan Your Budget

Why Most Restaurant Dreams Become Financial Nightmares

Passion for food is the spark, but a solid financial plan is what keeps the fire burning. The hard truth is that most restaurant failures don't happen because of bad recipes; they happen because of bad math. Many aspiring owners, driven by a dream, tragically underestimate what it truly costs to open their doors and survive that crucial first year. They often rely on gut feelings and ballpark figures, which is a recipe for disaster when dealing with razor-thin margins.

This is where a detailed restaurant startup costs calculator becomes non-negotiable. It’s not just a spreadsheet; it’s a reality check that transforms your dream into an actionable business plan. It forces you to look beyond the obvious expenses, like rent and a shiny new oven, and confront the hidden costs that can blindside even seasoned entrepreneurs.

The Hidden Costs That Derail Dreams

Through candid conversations I've had with owners who’ve weathered the storm, a clear pattern emerges. The financial nightmares aren’t caused by one single oversight but by a cascade of unexpected expenses. These often include:

- Permit and Licensing Delays: A two-week delay in your health department inspection can mean paying an extra month of rent on a space that isn't generating a single dollar of income.

- Unexpected Renovation Needs: That “minor” plumbing issue discovered during demolition can easily add $5,000 to $10,000 to your construction budget, eating into your cash reserves before you've even served a customer.

- Pre-Opening Payroll: You need to hire and train your key staff weeks before you open. This is a significant payroll expense with zero revenue to offset it.

- Initial Inventory Spoilage: Perfecting your menu before opening day often involves trial and error, leading to wasted food—a direct hit to your initial food budget.

From Gut Feeling to Data-Driven Decisions

Successful restaurateurs don't guess; they calculate. They use a comprehensive restaurant startup costs calculator to stress-test their concept. What if construction takes a month longer than planned? What if sales are 20% lower than projected for the first three months? A solid calculator allows you to model these scenarios and build a robust contingency fund to handle them.

To mitigate financial risks and prevent restaurant dreams from turning into nightmares, entrepreneurs should also explore strategies for maximizing startup grant funding, which can provide crucial capital without incurring debt. This proactive planning is essential in a rapidly expanding foodservice sector. The global restaurant market is projected to grow from $3.48 trillion in 2024 to an estimated $4.03 trillion in 2025, highlighting the immense opportunity for those who plan meticulously. You can learn more about the market's growth by exploring the latest global restaurant industry statistics.

Ultimately, the restaurants that thrive aren't always the ones with the most funding, but those with the most realistic financial projections.

The Real Cost Categories That Make or Break Your Budget

When you start dreaming about your new restaurant, it’s easy to focus on the exciting parts, like the monthly rent for that perfect location or that impressive six-burner range you’ve been eyeing. But if you want your budget to survive the real world, you have to look beyond the obvious. Your financial success truly depends on accounting for all the costs—especially the ones that tend to hide in plain sight. Let's dig into where your money will really go.

One-Time Capital Investments

These are the big, upfront purchases needed to get your space ready for business. They represent a huge slice of your initial cash outlay, and the numbers can be a real eye-opener. For instance, a complete kitchen equipment package can easily run between $100,000 and $300,000, depending on whether you buy new or used. Getting a detailed breakdown of these costs is essential for accurate financial planning, and you can find more information in this extensive guide on restaurant startup costs.

Your main capital investments will include things like:

- Construction and Renovation: Even a space that seems “move-in ready” often needs significant work. This could be anything from plumbing and electrical updates to cosmetic changes that bring your brand to life.

- Kitchen Equipment and Smallwares: This is a broad category covering everything from major appliances like walk-in coolers and commercial ovens down to every single plate, fork, and spatula. It all adds up quickly.

- Initial POS System: A modern point-of-sale (POS) system does much more than just process payments. The hardware for a basic setup can start around $600, but this figure can climb into the thousands for a more advanced, multi-terminal system.

Before we move on, let's put these numbers into perspective. Below is a table that breaks down the typical ranges you might encounter for various startup costs. This will help you see how different expenses stack up against each other.

| Cost Category | Low Range | High Range | Average Cost | Notes |

|---|---|---|---|---|

| Kitchen Equipment | $20,000 | $150,000 | $85,000 | Includes ovens, refrigerators, fryers, etc. Used equipment can lower this. |

| Construction/Renovation | $50,000 | $250,000 | $150,000 | Highly variable based on the initial condition of the space. |

| Licenses & Permits | $500 | $300,000 | $150,250 | A liquor license is often the most expensive and variable permit. |

| Initial Food Inventory | $5,000 | $25,000 | $15,000 | Varies based on menu size and concept. |

| POS System | $600 | $10,000 | $5,300 | Includes hardware, software, and installation. Monthly fees may apply. |

| Professional Fees | $2,000 | $20,000 | $11,000 | Costs for lawyers, accountants, architects, and consultants. |

| Pre-Opening Marketing | $1,000 | $30,000 | $15,500 | Grand opening events, social media campaigns, initial advertising. |

As you can see, the ranges are wide because every restaurant concept and location is different. The key takeaway is that you need to research the specific costs for your area and business type to create a realistic budget.

The Sneaky Pre-Opening and Soft Costs

These are the expenses that build up long before you ever serve your first customer, and they are notorious for derailing budgets. Underestimating them is a classic mistake that can put you in a tough spot before you even open your doors.

Think about all the money you'll spend on:

- Licenses and Permits: This isn't just about a business license. A liquor license alone can range from a few hundred dollars to an eye-watering $300,000 in some competitive markets.

- Professional Fees: You’ll need to pay your lawyer to review the lease, an accountant to set up your books properly, and potentially a designer or architect to plan your space.

- Initial Inventory and Staff Training: You have to fully stock your pantry, bar, and walk-in cooler for opening day. Plus, you’ll be paying your new staff for a few weeks of training, all while zero revenue is coming in.

While it's a different industry, the principles for identifying and implementing effective cost-saving strategies offer valuable lessons for any new business owner trying to manage a budget. Planning carefully for these "soft costs" is what gives you a vital financial buffer to handle unexpected expenses.

How Technology and Labor Costs Are Reshaping Restaurant Budgets

The days of running a restaurant with just a simple cash register and a handwritten schedule are long gone. Two powerful forces—technology and labor—are fundamentally changing how you need to plan your finances. Any modern restaurant startup costs calculator has to treat these as major expenses, not minor line items, because they drive both your initial investment and your ongoing profitability.

Budgeting for Your Digital Storefront

Your restaurant's success now relies heavily on its digital presence and how smoothly things run behind the scenes. This isn't just about having a website; it’s about creating a connected technology ecosystem. This “tech stack” has become a non-negotiable part of your startup budget.

The initial investment for hardware and software can range from $20,000 to $50,000, with ongoing monthly subscriptions typically falling between $300 and $1,500. These costs cover essential tools that customers now expect:

- Modern Point-of-Sale (POS) Systems: The command center for your restaurant, managing orders, payments, inventory, and sales data.

- Online Ordering Platforms: Whether integrated into your website or through third-party apps, this is your digital takeaway window.

- Delivery Service Integrations: Essential for reaching customers who prefer to dine at home.

- Reservation Software: Manages table turnover and provides valuable customer data.

Trying to cut corners here can be a critical mistake. For example, a slow or unreliable online ordering system will frustrate customers and send them straight to your competitors. A solid system is an investment that directly translates to revenue and customer satisfaction.

The New Reality of Staffing Costs

Alongside technology, labor costs have seen a dramatic increase, forcing a major shift in how restaurants budget for their team. A few years ago, a healthy labor cost was around 30% of revenue. Today, that number is climbing towards 36% or even higher in competitive markets. This significant jump is driven by rising minimum wages, a tougher hiring market, and the need to offer better benefits to attract and keep good people.

This shift makes accurate forecasting more important than ever. With the U.S. food service industry projected to reach $1 trillion in sales and add 200,000 jobs in 2025, the pressure on labor will only get more intense. A good restaurant startup costs calculator must reflect this new reality. You can get more details on these industry changes by reviewing the latest projections for restaurant employment.

Furthermore, high employee turnover can silently drain your budget. Understanding the hidden costs of employee turnover is key to minimizing these labor-related expenses and ensuring your financial stability for the long haul.

Finding Your Perfect Restaurant Model for Maximum Profitability

Deciding on your restaurant's business model is one of the most critical financial choices you'll make. The style of service you plan to offer—whether it's a classic sit-down experience or a nimble delivery-only operation—will directly shape your startup investment and your day-to-day operational costs. While a full-service restaurant might be the dream, its high overhead isn't the only way to build a successful food business.

Comparing Traditional vs. Alternative Models

The quintessential full-service restaurant, with its dedicated dining room, waitstaff, and broad menu, often requires a hefty initial investment. We're talking anywhere from $200,000 to $500,000, and sometimes even more. This budget covers expenses like a large commercial lease, significant renovations, front-of-house furniture, and higher labor costs. It’s a business model built around creating a complete customer experience from the moment someone walks through the door.

In contrast, alternative models are gaining serious popularity by offering a much lower barrier to entry. This is where a good restaurant startup costs calculator really proves its worth, as it helps you compare the potential returns of different concepts side-by-side. For instance:

- Food Trucks: These mobile kitchens offer incredible flexibility and drastically lower rent and utility costs. The focus shifts to a specialized, high-quality menu that can be served quickly to customers on the go.

- Ghost Kitchens (Delivery-Only): By getting rid of the dining room entirely, you slash major costs tied to rent, furniture, and front-of-house staff. The entire business is streamlined for one thing: preparing and sending out delicious food for delivery.

The Rise of Leaner Restaurant Startups

The industry is clearly shifting to favor these more agile, lean concepts. Modern startup cost calculators now reflect this trend, showing just how popular ghost kitchens and food trucks have become. For new entrepreneurs, they present a much smaller financial hurdle. In 2024 and 2025, founders using these models can get off the ground for as little as $50,000–$100,000. Some ghost kitchens can even launch for under $50,000 by leasing shared kitchen space and keeping initial equipment needs to a minimum. You can find out more about how alternative models are changing restaurant costs and see which approach best aligns with your budget.

Before we dive deeper, let's look at a side-by-side comparison of the startup costs for these different restaurant types. The table below breaks down the typical investment ranges and other key factors.

| Restaurant Type | Startup Range | Square Footage | Equipment Costs | Key Advantages |

|---|---|---|---|---|

| Food Truck | $50,000 - $175,000 | 100 - 400 | $15,000 - $75,000 | Mobility, low overhead, brand flexibility |

| Ghost Kitchen | $20,000 - $150,000 | 200 - 500 | $10,000 - $50,000 | Low rent, minimal staff, delivery-focused |

| Full-Service | $200,000 - $750,000+ | 2,000 - 6,000 | $75,000 - $200,000 | High-profit potential, full customer experience |

| Fast-Casual | $80,000 - $250,000 | 1,200 - 2,500 | $40,000 - $100,000 | Scalable, efficient, popular with consumers |

As you can see, the financial entry point for models like food trucks and ghost kitchens is significantly lower than for a traditional full-service spot, making them an attractive option for first-time owners.

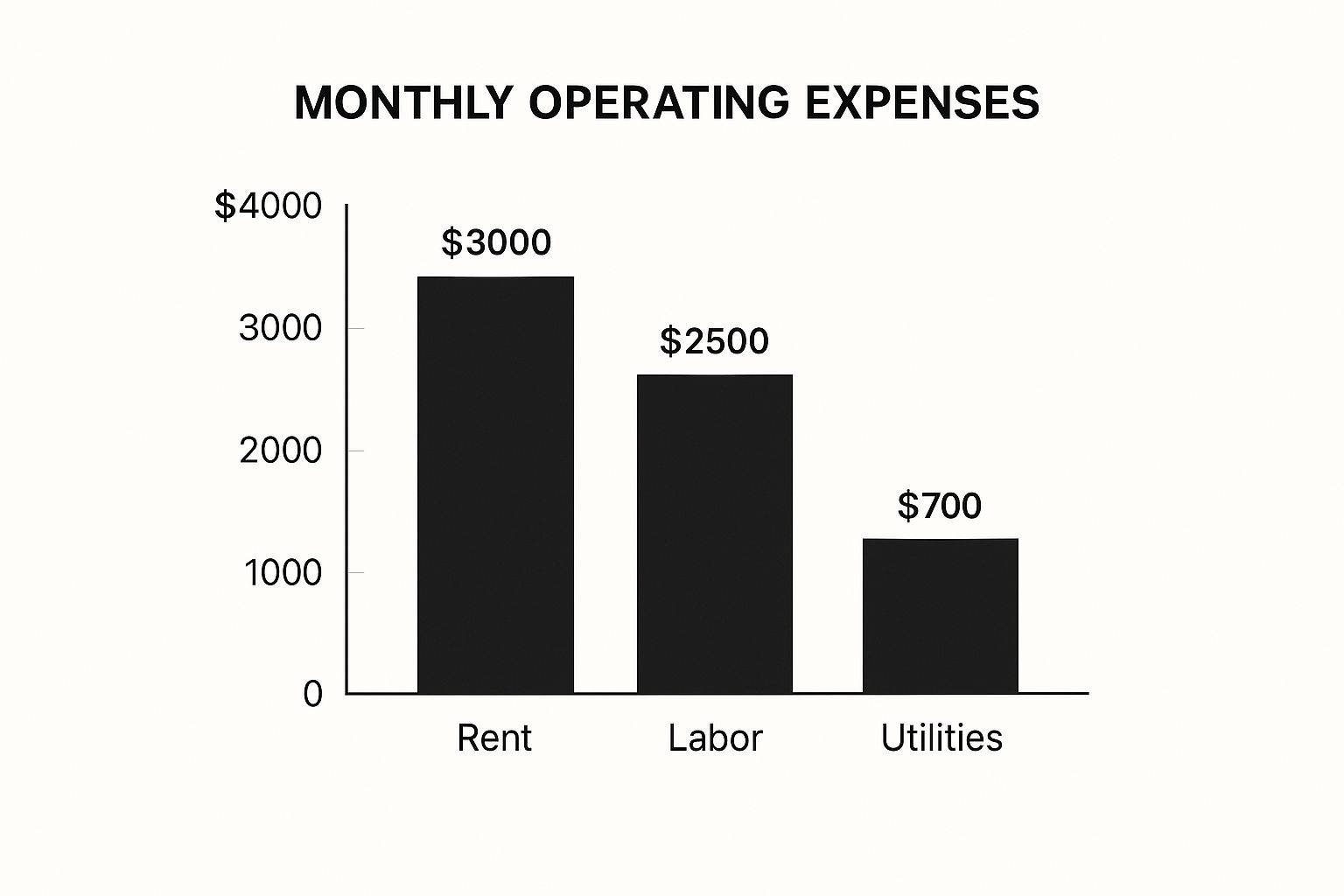

This infographic breaks down some of the major recurring monthly expenses that vary between models.

The chart makes it clear that rent and labor are often the two biggest operational costs. This is precisely why models that successfully reduce these expenses are becoming so appealing to new restaurant entrepreneurs.

Getting Accurate Results From Your Restaurant Startup Costs Calculator

Having a powerful tool is one thing; knowing how to get the most out of it is something else entirely. A restaurant startup costs calculator is only as accurate as the numbers you feed it. A common pitfall that can set you up for headaches later is relying on broad national averages for critical expenses like rent, utilities, and labor. Your restaurant's success will be determined by local market conditions, so that’s where your research needs to be laser-focused.

Grounding Your Numbers in Reality

To get projections you can actually count on, you need to put on your detective hat and investigate your local market. Generic data just won't do the job. You have to dig for real-world numbers specific to your chosen neighborhood.

Here’s how you can get numbers that reflect your reality:

- Local Rent Costs: Don't just glance at online listings. Pick up the phone and call commercial real estate agents. Ask them for the price per square foot on recent leases in your target area. This gives you a much more grounded figure than the advertised rates you see online.

- Utility Estimates: Get in touch with the local utility providers directly. They can often share historical usage data for businesses of a similar size in the area, giving you a solid baseline for what to expect for electricity, gas, and water costs.

- Labor Market Rates: Check out current job postings for restaurant positions in your city. What are your future competitors offering for line cooks, servers, and managers? This reveals the true market rate you'll need to offer to attract great talent, which is often higher than the mandated minimum wage.

Planning for the Unplannable

Let’s be honest: no restaurant launch goes exactly according to plan. That’s why experienced restaurateurs always build a financial safety net into their budgets. One of the most vital inputs for your restaurant startup costs calculator is a contingency fund. This isn't just "extra cash"; it's a carefully calculated buffer for those inevitable surprises. A solid rule of thumb is to set aside 15-20% of your total startup costs as a contingency line item. Trust me, you will absolutely use it for everything from unexpected construction delays to equipment that needs a more expensive installation than you first thought.

Beyond that, use your calculator to play out different scenarios. Don't just budget for the best-case outcome. Model what your finances look like if your grand opening is delayed by a month, or if your initial sales are 25% lower than you projected. This kind of stress-testing uncovers potential weak spots in your financial plan and prepares you mentally and financially for the challenges ahead.

These are the exact figures potential investors or lenders will want to see; it proves you’re a realist, not just a dreamer. This level of preparation is also essential when figuring out how to pay for major purchases. You can explore your options by checking out our guide on restaurant equipment financing to see how different payment structures might impact your cash flow.

The Costly Mistakes That Sink Even Well-Planned Restaurants

Even with the best restaurant startup costs calculator, some common but expensive mistakes can quietly sabotage your budget before you even unlock the doors. I've seen well-funded concepts run out of cash because they overlooked a few critical details. These aren't just minor miscalculations; they're budget-sinking errors that can add months to your timeline and thousands to your bottom line.

After having some honest talks with owners who have been through these challenges, we've pinpointed the most frequent financial traps that can catch even the most careful planners off guard.

Underestimating Bureaucracy and Pre-Opening Pressures

The gap between signing a lease and opening day is often where budgets begin to fall apart. There are two areas that consistently lead to major overspending:

- Permit and Licensing Delays: This is a huge one. Your calculator might account for the fees, but does it account for the time? A two-month delay waiting for a building permit or liquor license means you’re burning through cash on rent and insurance for a space that isn't making a dime.

- Forgotten Pre-Opening Marketing: You can have the perfect menu and a beautiful dining room, but if nobody knows you’re opening, you’ll be greeted by silence. A pre-launch marketing push—think social media ads, local PR, and a grand opening event—is an essential expense, not just a "nice-to-have." Forgetting to budget for it is a recipe for an empty restaurant.

Misjudging Your Financial Levers

How you pay for things is just as important as what you pay for. Equipment financing, for example, can have terms that dramatically affect your monthly cash flow. A slightly higher interest rate might not seem like much on paper, but it adds up quickly, squeezing your operational funds right when you need them most.

Spotting these potential issues in your financial projections is critical. For a complete look at everything you'll need to account for, our opening a restaurant checklist offers a thorough guide to keep you on track. Remember, flexibility in your financial plan is just as vital as the accuracy of your initial numbers.

Key Takeaways

Turning your passion for food into a real, profitable restaurant is a marathon, not a sprint. This guide is your practical roadmap, filled with real advice from owners who have made it through the sometimes-chaotic startup phase. It all begins with a solid financial plan, which is why a detailed restaurant startup costs calculator is one of the most important tools you'll use early on. Think of it less as a one-and-done calculation and more as a living dashboard for your new business.

Your Actionable Checklist for Success

To build a financial plan that actually works, you need to base your numbers on reality, not just national averages. Here’s how to move forward with confidence:

- Validate Local Costs: Don't guess. Take the time to research what things really cost in your specific city. This includes rent for the type of space you need, what you'll have to pay your staff, and the actual fees for local permits.

- Build a Contingency Buffer: Unforeseen costs aren't a possibility; they're a guarantee. Always add a 15-20% buffer to your total startup budget. This cushion will be a lifesaver when unexpected repairs or expenses pop up.

- Track Performance Relentlessly: Once your doors are open, make it a habit to regularly compare what you're actually spending against your initial budget. This practice helps you catch problems early and make adjustments before they spiral.

Staying on Budget and Optimizing for Profit

Staying on track financially requires being watchful and ready to adapt. Successful restaurant owners know which corners they can cut without ever sacrificing the quality of their food or the experience they provide to guests. For example, consider leasing big-ticket kitchen equipment instead of buying it all outright. This can be a smart move to protect your cash flow when you need it most.

When you're presenting your numbers to potential investors, this level of detail is exactly what they want to see. They need to know you've thoughtfully planned for both the best-case scenarios and the inevitable challenges.

Ultimately, your long-term success depends on building a resilient financial foundation. This isn't just about making it through your first year—it's about creating a business that has the strength to thrive for years to come.

Ready to build your restaurant on a solid financial footing? The Restaurant Warehouse offers everything from essential cooking equipment to flexible financing solutions that help you manage upfront costs and preserve your cash flow. Equip your dream kitchen affordably by exploring our extensive catalog at The Restaurant Warehouse.

About The Author

Sean Kearney

Sean Kearney used to work at Amazon.com and started The Restaurant Warehouse. He has more than 10 years of experience in restaurant equipment and supplies. He graduated from the University of Washington in 1993. He earned a BA in business and marketing. He also played linebacker for the Huskies football team. He helps restaurants find equipment at a fair price and offers financing options. You can connect with Sean on LinkedIn or Facebook.

Leave a comment